Calculate Call Option Profit Like a Pro

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Risks of Covered Calls: risks of covered calls explained

Discover the risks of covered calls and how to navigate gains limits, assignment pitfalls, and smarter income strategies to protect your portfolio.

Synthetic Covered Calls Explained A Guide to Smarter Income

Discover how synthetic covered calls can generate consistent income with less capital. This guide breaks down the strategy, risks, and real-world application.

To figure out your profit on a call option, it really comes down to a simple calculation. You just take the difference between the stock's final market price and your strike price, then subtract the premium you originally paid.

The core formula looks like this: (Stock Price at Expiration - Strike Price) – Premium Paid = Profit Per Share.

This is your starting point for seeing how a trade might pan out.

The Simple Math Behind Call Option Profits

Before we jump into more complex scenarios, it’s essential to get a solid grip on the basic math. Every single profit or loss calculation boils down to three core pieces that work together to determine your outcome.

Getting to Know the Core Variables

Understanding these three numbers is the first step to making accurate projections for any call option trade. Let’s break down what each one represents in the profit calculation formula.

| Variable | Description | Example Value |

|---|---|---|

| Strike Price | The fixed price where you have the right to buy the stock. It's the anchor of your trade. | $100 |

| Stock Price at Expiration | The stock's market price when the contract expires. This determines if your option has value. | $115 |

| Premium Paid | The upfront cost you paid for the option contract. This is the hurdle you need to clear to make a profit. | $5 per share |

As you can see, these variables are the essential components for calculating your potential profit or loss on a call option. Let's see how they interact.

Imagine you buy a call option with a $100 strike price and pay a $5 premium for each share. If the stock climbs to $115 by the time the option expires, the option's intrinsic value is now $15 per share ($115 - $100).

After you subtract the $5 premium you paid, your net profit is $10 per share. That’s a 200% return on your initial investment—a perfect example of the leverage that attracts traders to options.

Your profit really just boils down to whether the option's intrinsic value at expiration is greater than what you paid for it. If it is, you've got a winning trade on your hands.

This fundamental calculation is the bedrock for everything else. More advanced factors like volatility and time decay build on this simple math. To get a better handle on how an option’s price is determined, I highly recommend our guide on intrinsic vs extrinsic option value. Once you master this, you'll be much better prepared for the real world of options trading.

Finding Your Break-Even Point on Any Trade

Profit is the end goal, sure, but your break-even point is your trade's true North Star. It's the exact stock price where the tide turns—where you stop losing money and start making it. This simple number transforms a hopeful guess into a calculated risk.

The calculation itself is refreshingly straightforward, using the same numbers we’ve already been talking about. And remember, before you even think about placing a trade, understanding the importance of due diligence is the first step to properly researching the stock you're betting on.

The Break-Even Calculation

For a call option buyer, figuring out your break-even point is just a little addition. It's the price the stock has to hit by expiration just for you to get your initial investment back.

Break-Even Point = Strike Price + Premium Paid Per Share

Let’s run through a quick example. Imagine you've got your eye on XYZ Corp and decide to buy a call option with a $50 strike price, paying a $2.50 premium for each share.

Your break-even price is simply: $50 (Strike Price) + $2.50 (Premium) = $52.50.

This means XYZ Corp's stock needs to close at or above $52.50 on the day your option expires for your trade to be profitable. If it closes anywhere below that, you'll take a loss, but that loss is capped at the $2.50 premium you paid. Easy enough.

This single number is arguably one of the most important metrics in your trade. It defines your target and tells you precisely how far the market needs to move in your favor before you see a single dollar of profit.

Knowing this threshold forces you to get real with yourself. It makes you ask the most important question of all: "Do I genuinely believe this stock can not only hit but climb well past $52.50 before my option expires?" Answering that honestly is the key to sidestepping trades that have a low probability of ever paying off.

Mapping Profit and Loss with Real-World Scenarios

Alright, let's ditch the abstract formulas for a minute and see how these numbers actually behave in a real trade. To get a feel for calculating call option profit, we'll walk through a realistic scenario on a popular tech stock, exploring three ways it could play out.

Let’s imagine you're feeling bullish on a company we'll call "TechCorp" (TC). You decide to buy one call option contract with these specifics:

- Stock: TechCorp (TC)

- Strike Price: $150

- Premium Paid: $5 per share (that's $500 total for one contract of 100 shares)

- Break-Even Point: $155 (your $150 Strike + $5 Premium)

Now that we have our numbers, the stock's price at expiration is the only thing that will determine whether you make a profit or take a loss.

Outcome 1: The Trade Goes Your Way (Deep in the Money)

Let's start with the best-case scenario. A stellar earnings report comes out, and TechCorp's stock absolutely soars, hitting $170 per share at expiration.

Because the stock price ($170) is way above your break-even point ($155), this is a winning trade. The option's intrinsic value is now $20 per share ($170 stock price - $150 strike price). After you subtract the $5 premium you paid upfront, your net profit lands at $15 per share.

Your total profit comes out to $15/share x 100 shares = $1,500. That’s a massive 300% return on your initial $500 investment. Not bad at all.

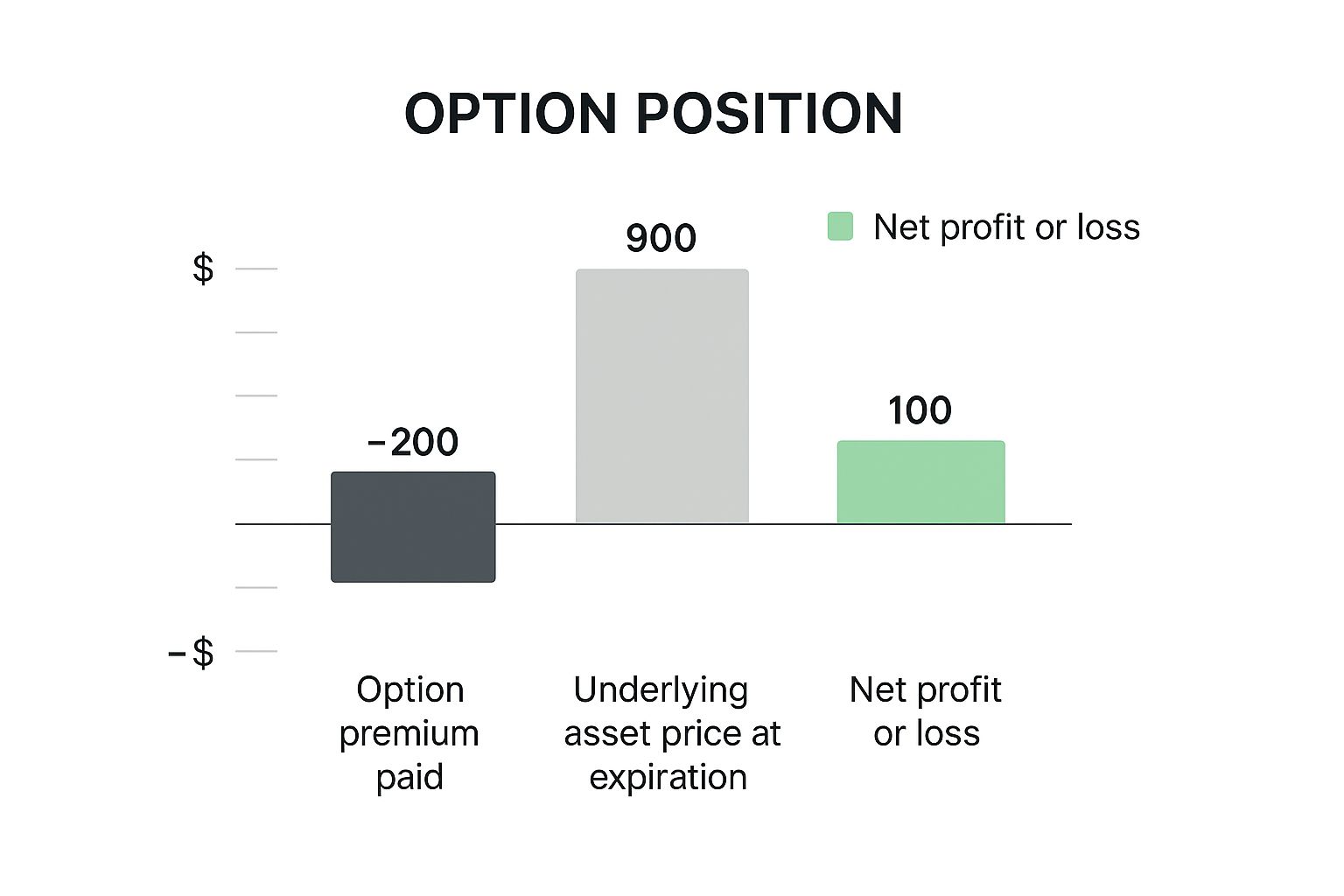

This image really helps visualize how the profit takes off once the stock price clears your break-even point.

As you can see, once the asset price moves past that threshold, your net profit can grow pretty quickly.

Outcome 2: The Trade Moves Against You (Total Loss)

Now, for a less fortunate turn of events. Imagine some unexpected negative market news hits, and TechCorp's stock falls instead. On expiration day, it closes at $140.

Since the stock price is below your $150 strike price, your option is now out-of-the-money. It expires worthless. There's no reason you'd exercise your right to buy the stock at $150 when you could just grab it on the open market for $140.

In this situation, your loss is limited to the premium you paid. Your total loss is exactly $500.

This is actually one of the key benefits of buying calls. Even though the stock moved against you, your downside was capped at the $500 you paid for the contract. You knew your maximum possible loss the second you entered the trade.

Profit/Loss Outcomes at Expiration

To bring it all together, this table shows how different stock prices at expiration directly impact your bottom line for this specific TechCorp trade.

| Scenario | Stock Price at Expiration | Profit/Loss per Share | Total P/L (1 Contract) |

|---|---|---|---|

| Stock Soars (In-the-Money) | $170 | +$15 | +$1,500 |

| Stock Dips (Out-of-the-Money) | $140 | -$5 | -$500 (Max Loss) |

| Stock at Break-Even | $155 | $0 | $0 |

This comparison makes it clear how the final stock price determines whether you have a big win, a complete (but limited) loss, or simply break even.

Of course, mapping profit and loss for a single trade is just one piece of the puzzle. It's also vital to fit this into the broader context of understanding overall investment risk for your entire portfolio.

How Market Volatility Impacts Your Bottom Line

That basic profit formula we just covered? It's a great starting point, but it leaves out a massive piece of the puzzle that pros obsess over: implied volatility (IV).

Think of IV as the market's "fear gauge" for a stock. It’s a measure of how much traders expect a stock’s price to swing, and it's baked directly into an option's premium.

When implied volatility is high, the market is bracing for big moves. That uncertainty inflates an option's extrinsic value, which means the premium you pay gets a whole lot more expensive. A higher premium pushes your break-even point further out, making it tougher to turn a profit even if you correctly predict the stock's direction.

The High IV Trap

Here’s a classic mistake I see new traders make all the time: buying a call option when its IV is through the roof.

You might be totally right about where the stock is headed, but that bloated premium acts like an anchor on your potential gains. You're basically paying extra for all the hype and uncertainty, and that cost can seriously eat into your returns.

On the flip side, low IV can signal a real opportunity. When the market is calm and premiums are cheap, your break-even point is much closer. This gives you more room to profit if the stock starts to climb. Learning how to calculate implied volatility is a game-changing skill for spotting these moments.

History shows just how much this matters. Look back at the 2008 financial crisis—the VIX, a broad measure of market volatility, spiked to a record high of 89.53. Call option premiums went absolutely wild, in some cases jumping over 100%. Anyone buying calls at that time paid a steep price, which drastically increased their break-even points and crushed their potential profit. For more on this, check out the historical options data on ivolatility.com.

The key takeaway here is simple but critical: The price of volatility is embedded in every option premium. If you ignore it, you’re only seeing half the picture. A high-IV environment demands a much bigger move from the stock just for you to break even.

Beyond the Basics: Time Decay and Price Sensitivity

Calculating your potential profit at expiration is a good start, but it's only half the story. The value of your call option is in constant motion, swinging up and down based on more than just the stock's price.

This is where a couple of key metrics, known to traders as "the Greeks," come into play. Understanding them is what separates guessing from making informed decisions, as they explain the why behind your option's daily value changes long before expiration day.

Your Option's Price Sensitivity (Delta)

First up is Delta (Δ). The easiest way to think about Delta is as a quick estimate: for every $1 the stock's price moves, how much will my option's premium change?

Let's say your call option has a Delta of 0.60. If the stock rallies by $1, you can expect your option's value to increase by about $0.60. On the flip side, if the stock drops by $1, your option will lose roughly $0.60 in value. It’s a handy shortcut for gauging how sensitive your option is to the stock’s performance.

The Inevitable Cost of Time (Theta)

The second Greek—and arguably the most critical for anyone buying options—is Theta (θ), also known as time decay. Theta tells you how much value your option premium is set to lose every single day as the clock ticks closer to expiration.

Time is the silent enemy of the option buyer. Every single day that passes, Theta nibbles away at your option's extrinsic value, making it harder to turn a profit.

This relentless decay is exactly why an option's price can drop even when the stock price doesn't move an inch. Grasping the powerful effect of time decay in options is crucial for picking the right expiration date and knowing when to get out of a trade.

Honestly, ignoring Theta is one of the fastest ways to watch a winning position turn sour.

Got Questions About Call Option Profits?

Even when you've got the basics down, a few practical questions always pop up when you're staring at your own trades. Let's tackle some of the most common ones traders ask.

Can I Lose More Than the Premium I Paid?

Nope. When you buy a call option, the absolute most you can lose is the premium you paid to get into the trade. That's it. Your potential profit might be unlimited, but your risk is locked in from day one.

This is one of the biggest draws for option buyers. You know your exact downside before you even hit the "buy" button, which makes managing risk a lot less stressful than with other ways of trading.

The limited risk is a huge reason why buying calls is so popular. Your loss is capped, but your upside isn't.

Do I Have to Wait Until Expiration to Take Profits?

Absolutely not. You can sell your call option to close out your position anytime before it expires. In fact, many traders prefer to sell early to either lock in a win or cut a loss.

Selling early is especially common to avoid the rapid time decay (known as Theta) that really kicks in during the last few weeks before an option expires. Your profit or loss is just the difference between what you sold the option for and what you originally paid.

How Do Dividends Affect My Calculation?

Dividends can throw a wrench in the works. When a stock goes "ex-dividend," its share price usually drops by the amount of the dividend. That sudden drop can hurt the value of your call option, sometimes enough to turn a winning trade into a loser overnight.

It's something you absolutely have to watch for, especially if your option expires near a company's ex-dividend date. It's one of those small details that can make a big difference. In fact, statistics show that winning rates for call option buyers can be as low as 30-40%, which really drives home how important it is to account for factors like dividends. For a deeper dive into historical data, you can learn about option profitability trends on cboe.com.

Ready to stop guessing and start making data-driven decisions? Strike Price provides real-time probability metrics to help you find the safest, highest-yield options strategies. Start your free trial at Strike Price and trade with confidence.