Options greeks explained: Delta, Gamma, Theta, Vega

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

The options greeks are simply a set of risk measurements. They tell you how sensitive an option’s price is to changes in the underlying stock, the passage of time, and shifts in market volatility.

Think of them as your car’s dashboard when you're driving. Delta is your speedometer, Gamma is the accelerator, Theta is the fuel gauge, and Vega is like a sensor for changing road conditions.

Decoding Your Options Dashboard

Welcome to the driver's seat. Our goal here is to pull back the curtain on these critical numbers, treating them less like complex theory and more like the real-time gauges you need to make smarter trading decisions. If you're just getting started and want a primer on the basics before jumping into options, learning how to start investing for beginners is a great first step.

The greeks give you a complete, 360-degree view of an option’s risk and potential reward. They answer the real-world questions every options seller has to ask.

How will my position react if the stock pops $1? How much cash will time decay put in my pocket each day? Is my trade going to get hammered by a spike in market fear? By the end of this guide, you’ll be able to answer these questions with confidence.

The Core Metrics on Your Dashboard

The dashboard analogy isn't just a gimmick; it’s a powerful way to intuitively grasp what each Greek does. Instead of trying to memorize formulas, you can visualize how each gauge contributes to the bigger picture of your trade. We’ll focus on the four greeks that have the most direct impact on your day-to-day trading:

- Delta: Your speedometer, showing how much an option's price will move for every $1 change in the stock.

- Gamma: Your accelerator, measuring how quickly that price sensitivity (Delta) will speed up or slow down.

- Theta: Your fuel gauge, representing the steady, predictable burn of an option's value as time passes.

- Vega: Your road condition sensor, gauging how sensitive your option is to changes in overall market volatility.

To help you get the big picture right away, here's a quick summary table that puts it all together.

The Options Greeks Dashboard At a Glance

| Greek | What It Measures | Dashboard Analogy |

|---|---|---|

| Delta | Rate of change in option price per $1 stock move | Speedometer |

| Gamma | Rate of change in Delta | Accelerator |

| Theta | Rate of price decay over time | Fuel Gauge |

| Vega | Sensitivity to changes in volatility | Road Condition Sensor |

| Rho | Sensitivity to changes in interest rates | Tire Pressure Gauge (Important, but checked less often) |

This table provides a simple, at-a-glance reference for what each Greek is telling you about your position.

We will also briefly touch on Rho, which measures sensitivity to interest rates. While it’s far less critical for most retail traders, it completes the dashboard.

The real power of the greeks isn't in looking at them as individual numbers. It's in seeing them as an interconnected system. Together, they give you a dynamic assessment of risk, turning speculative guesses into strategic, probability-driven decisions.

This guide will break down each Greek with clear examples and show you how to apply them to covered calls and secured puts. You'll learn how to read these metrics to manage risk, maximize your income, and keep your trades aligned with your goals.

Let's start the engine and take a closer look at our first gauge: Delta.

Delta: Your Speedometer for Price and Probability

When you first dive into the world of options greeks, Delta is your starting point. It’s the single most important metric on your dashboard, and for good reason. Delta pulls double duty, giving you two critical pieces of information at a glance.

First, it’s your speedometer. Delta tells you exactly how much an option’s price will move for every $1 change in the underlying stock. Second, it’s a surprisingly accurate probability gauge, giving you a quick estimate of the chances your option will expire in-the-money (ITM). This dual personality is what makes Delta so foundational for any options seller.

How Delta Measures Price Sensitivity

Let’s start with Delta’s most direct job: measuring how sensitive an option is to the stock’s price. For call options, Delta ranges from 0.00 to 1.00. For puts, it runs from 0.00 to -1.00. A positive Delta means the option moves with the stock; a negative Delta means it moves against it.

Say you sell a covered call with a Delta of 0.30. This means for every $1 the stock price goes up, the option you sold will lose about $0.30 in value (a good thing for you, the seller). If the stock drops by $1, your short call gains $0.30 in value, eating into your premium.

It’s a straightforward way to quantify your immediate risk. A high Delta means your option is very reactive and acts a lot like the stock itself. A low Delta means it’s less sensitive to small price swings. You can dive deeper into this relationship in our complete guide to delta in option trading.

How Delta Gauges Probability

This is where Delta becomes a game-changer for income traders. That same 0.30 Delta on your covered call also gives you a rough estimate of the probability of assignment. It’s telling you there’s about a 30% chance the stock will close above your strike price when the contract expires.

By simply looking at Delta, you can instantly see the market's implied probability of your shares being called away. It turns a gut feeling into a data-driven decision.

This is indispensable for option sellers. It’s why platforms like Strike Price are built around tracking Delta in real-time—it helps you balance the income you want with the assignment risk you’re willing to take. Historical data from major exchanges shows that sellers who stick to secured puts with Deltas under 0.30 often see assignment rates below 15%, which is a powerful edge for generating consistent income.

Putting Delta to Work: Real-World Scenarios

Theory is great, but applying it is what matters. Here’s how you’d use Delta to make decisions with two of the most common income strategies.

Covered Call Scenario: You own 100 shares of XYZ, which is trading at $50. You’re considering selling a call with a $55 strike price and see it has a Delta of 0.25. Right away, you know two things: the option premium will move about $0.25 for every $1 XYZ moves, and there's roughly a 25% chance of your shares being called away. If your goal is to keep the shares while earning income, that low probability makes it a solid choice.

Secured Put Scenario: You want to buy 100 shares of ABC, now trading at $100, but you'd be happier getting it for $95. You can sell a put with a $95 strike price that has a Delta of -0.35. This Delta tells you there's about a 35% chance the stock will drop below $95, forcing you to buy the shares at your target price. If you’re truly ready to own the stock at $95, this trade aligns perfectly with your plan.

Gamma: The Accelerator of Your Position

If Delta is your option's speedometer, then Gamma is the gas pedal. It tells you how fast your Delta is going to change. Think of it this way: Delta shows you the speed of your option's price right now, but Gamma shows you how quickly that speed will ramp up or slow down for every $1 the stock moves.

This is a huge piece of the puzzle as we get the options greeks explained. A low Gamma means your Delta is steady and predictable. High Gamma, on the other hand, means your position’s risk can change on a dime—and sometimes frighteningly fast.

Why Gamma Matters for Option Sellers

For those of us selling covered calls and secured puts, Gamma is the Greek that keeps us on our toes. It’s the number one indicator of instability. A position with high Gamma is like a twitchy sports car; the slightest touch on the gas and you're suddenly rocketing forward.

This sensitivity gets dialed up to eleven under two specific conditions:

- When an option is at-the-money (ATM), where the strike price is kissing the stock's current price.

- When an option is getting close to expiration, especially inside that final 30-day window.

When those two things happen together, Gamma can go through the roof. This is where a small, otherwise meaningless move in the stock can make an option's Delta explode, radically changing your risk and your odds of assignment. This is what traders call "Gamma risk."

Gamma is the force that can turn a seemingly "safe," low-Delta position into a high-risk trade demanding your immediate attention. Ignoring it is one of the quickest ways to get into trouble as an option seller.

Understanding this acceleration is what proactive risk management is all about. It’s your early warning system, telling you which positions need a closer eye and which are likely to behave themselves.

A Real-World Gamma Squeeze Scenario

Let’s walk through a real-life example to see how this plays out. Imagine you sold a covered call on a stock that’s trading at $98. Your strike is $100, and with three weeks left, the option has a nice, calm Delta of 0.20. That implies a comfortable 20% chance of your shares getting called away.

A week later, the stock has rallied to $99.50, putting it right at-the-money. Because you're now closer to expiration and the strike, Gamma has surged. Suddenly, the stock ticks up just $1 more, hitting $100.50.

Thanks to that high Gamma, your Delta doesn't just nudge up a little—it jumps. That single dollar move could cause your option's Delta to leap from 0.20 all the way to 0.70.

So what just happened?

- Probability Shift: Your chance of assignment just went from a comfortable 20% to a very real 70%.

- Price Sensitivity: Your position is now way more sensitive to the stock's price. For every extra dollar the stock climbs, your short call will lose $0.70, quickly eating away at the premium you collected.

That’s Gamma in action. It’s the accelerator that took your slow-moving trade and shoved it into the fast lane. By keeping an eye on Gamma, especially on positions nearing their expiration date, you can see these shifts coming and avoid getting caught by surprise. It’s how you stay in control.

Theta: Profiting From the Power of Time

Time is the one constant in the market, and Theta is the Greek that measures its relentless march on an option's value. It's often called the option seller's best friend for a simple reason: Theta quantifies how much an option's price is expected to decrease each day, holding everything else constant.

For income traders, this isn't a bug—it's a feature. It's one of the main ways we get paid.

The classic way to think about Theta is the "melting ice cube" analogy. Every option has extrinsic value, which is the part of its price based on time and implied volatility. Imagine this extrinsic value is a block of ice. Every single day, a little piece of that ice melts away, shrinking the cube.

As an option seller, you’re basically selling that ice cube to someone else. As it melts, its value drops, and that lost value flows right back to you as profit. This process, called time decay, is automatic and predictable, which makes Theta such a powerful ally. It’s a core concept, and you can dive deeper in our full guide on option time decay.

How to Read and Apply Theta

Theta is almost always shown as a negative number. If an option has a Theta of -0.05, it’s expected to lose $0.05 of its value every day. And since one options contract represents 100 shares, you just multiply that by 100 to see the real-world impact.

A Theta of -0.05 means your short option position will gain about $5 in value each calendar day (0.05 x 100 shares), just because time passed. This decay happens seven days a week, including weekends and holidays when the market is closed.

This daily erosion is the engine that drives income strategies like covered calls and secured puts. You collect a premium upfront, and Theta gets to work in the background, decaying that premium so you can hopefully keep all of it by expiration.

The Acceleration of Time Decay

Here’s the thing about Theta: its effect isn't a straight line. It’s more like a snowball rolling downhill—it picks up speed. The rate of time decay accelerates dramatically as an option gets closer to its expiration date.

An option with 90 days left might lose value at a snail's pace. But one with just 20 days remaining will see its value evaporate much, much faster.

This creates a "sweet spot" for option sellers, usually in the last 30 to 45 days of a contract's life. During this window, Theta decay is at its most aggressive, offering the best potential return for the time your capital is tied up.

- Long-Dated Options (90+ days): Theta decay is slow. You’re collecting premium, but it takes a long time for the decay to kick in.

- The Sweet Spot (30-45 days): This is where Theta really starts to work for you, providing a powerful tailwind for sellers.

- Final Week (<7 days): Decay is lightning-fast, but this period also comes with the highest Gamma risk, making your positions extremely sensitive to price swings.

Theta in Action: A Covered Call Example

Let’s make this real. Imagine you own 100 shares of XYZ stock and you sell a covered call that expires in 40 days. The premium you collect has a Theta of -0.08.

What does this mean for you? Your position is set to earn roughly $8 per day from time decay alone. As long as the stock price hangs around your strike, time is actively working to make your trade profitable. Every morning you wake up, that short option is worth a little bit less than it was the day before, bringing you one step closer to keeping the entire premium.

By understanding and harnessing Theta, you turn time from a passive backdrop into an active profit center for your portfolio. It’s the key to turning the simple passage of days into a consistent stream of income.

Vega: Your Gauge for Market Volatility

While time decay (Theta) is a slow, predictable force, Vega is all about the sudden storms of market emotion. It measures how much an option's price will change for every 1% jump or drop in implied volatility (IV).

Think of Vega as the "fear gauge" for your option contract.

Implied volatility is simply the market's collective guess on how much a stock's price will swing around in the future. High IV means traders are bracing for big, uncertain moves. Low IV suggests things are expected to stay calm. As an option seller, high IV is your friend.

The best way to think about this is to compare selling options to selling insurance.

Selling an option when implied volatility is high is like selling hurricane insurance right as a storm is brewing offshore. The perceived risk is through the roof, so the premiums you can collect are way higher. You get paid more for stepping in when everyone else is nervous.

This is a massive edge for sellers. You can collect that "expensive" premium when fear is high, and then profit as that fear eventually fades and volatility returns to normal. This drop in IV is often called a "volatility crush."

How to Read and Use Vega

Vega is shown as a positive number that tells you how many dollars an option's premium will change for each percentage point change in IV.

For instance, if a call option has a Vega of 0.12, its price will pop up by $12 (0.12 x 100 shares) if implied volatility climbs by 1%.

On the flip side, if IV drops by 1%, that same option's value will fall by $12. For an option seller, that $12 drop is pure profit. This dynamic is a huge part of selling premium effectively. If you really want to dig into this, our detailed guide on what is vega in options breaks it down with more examples.

The best moments to sell premium almost always pop up during periods of high market stress, like:

- Right before a company's earnings report.

- Leading up to a big economic announcement from the Fed.

- During a market-wide sell-off or correction.

In these situations, IV spikes, inflating option premiums and letting you collect more cash for the same amount of risk.

A Quick Word on Rho

To give you the complete picture, we have to mention Rho. This is a lesser-known Greek that measures how sensitive an option is to changes in interest rates.

So, why don't most traders talk about it?

- It's a Slow Mover: Interest rates change maybe a few times a year, while stock prices and volatility move every single second.

- The Impact is Tiny: Rho's effect is really only noticeable on very long-term options (like LEAPs, which expire a year or more out). For the typical 30-45 day contracts most income traders use, its impact is often so small it’s not even worth tracking.

For call options, Rho is positive—their value gets a tiny bump when interest rates go up. For puts, Rho is negative. While it's good to know it exists, your day-to-day focus should stay locked on Delta, Gamma, Theta, and Vega. They're the ones that will make or break your trades.

Using the Greeks: A Practical Pre-Trade Checklist

Knowing what each Greek measures is the first step. But the real skill is using them together to make smarter, more consistent trading decisions.

To pull it all together, let's walk through a simple pre-trade checklist. This isn't about memorizing formulas; it's about asking the right questions before you put your money on the line. By running through this quick mental check, you turn the Greeks from abstract theory into a practical tool for managing risk and generating income.

Your Four-Point Greek Inspection

Before you sell any covered call or secured put, pause for a moment and walk through these four questions. This quick inspection makes sure you've looked at the trade from every critical angle—probability, stability, time, and volatility.

Check the Delta (Your Probability Gauge)

- The Question: What's the rough probability of this option expiring in-the-money?

- Why It Matters: Delta gives you an instant read on your assignment risk. A 0.20 Delta on a covered call means there's roughly a 20% chance your shares will be called away. Does that fit your goal for the stock? If you want to keep your shares, a lower Delta is your friend. If you'd be happy to sell at the strike price, a higher Delta might be worth the extra premium.

Inspect the Gamma (Your Stability Sensor)

- The Question: Is Gamma high? Am I setting myself up for a bumpy ride?

- Why It Matters: High Gamma means your Delta—and therefore your assignment risk—can swing wildly with even small moves in the stock price. You'll usually see this with at-the-money options that are close to expiring. A quick look at Gamma tells you if this is a "set it and forget it" trade or one you need to watch like a hawk.

Analyze the Theta (Your Profit Engine)

- The Question: How much premium am I earning each day just from time passing?

- Why It Matters: As an options seller, Theta is your best friend. It’s your primary source of profit. An option with a Theta of -0.07 is quietly putting $7 into your account every single day, assuming nothing else changes. Is that daily decay worth the risk you're taking (as measured by Delta)? If Theta is too low, you might not be getting paid enough for your trouble.

Evaluate the Vega (Your Volatility Paycheck)

- The Question: Am I getting paid well enough for taking on volatility risk?

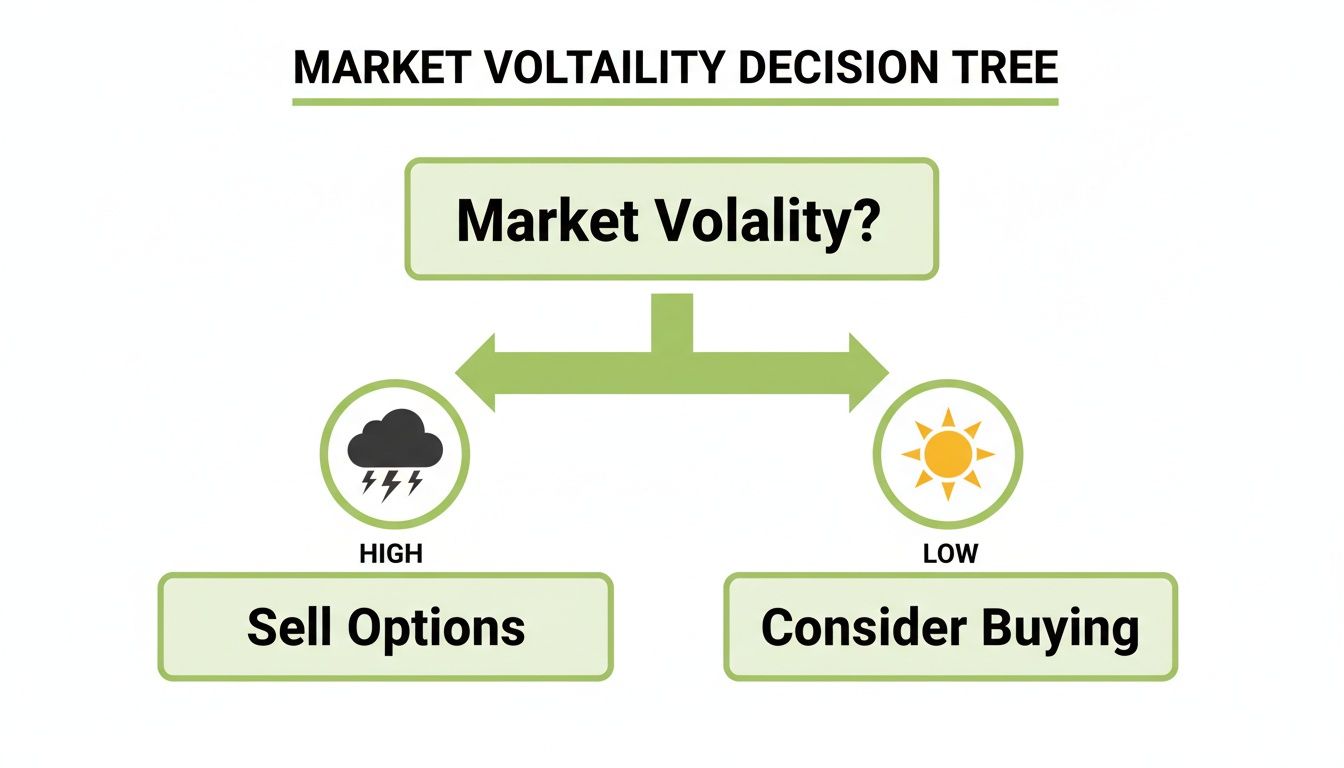

- Why It Matters: Vega shows you how sensitive the option's price is to changes in market fear or uncertainty. Selling options when implied volatility (IV) is high is like selling insurance right before a hurricane—you collect a much bigger premium. This simple decision tree shows the general rule of thumb.

The big idea here is to match your strategy to what the market is giving you. High volatility is generally a seller's market, while low volatility can be better for buyers.

Bringing It All Together

Running through these questions helps you move beyond just picking strike prices. You start building a strategic, risk-aware approach to generating income. To make it even more concrete, here's a summary table that turns the four-point inspection into a repeatable checklist.

| Options Seller's Pre-Trade Greek Checklist | ||

|---|---|---|

| Greek | Key Question for Seller | Ideal Scenario for Income |

| Delta | What is my assignment risk? | Low Delta (< 0.30) if you want to keep the underlying asset. |

| Gamma | How stable will my Delta be? | Low Gamma, especially for longer-dated options. High Gamma requires active monitoring. |

| Theta | Am I getting paid enough for my time? | High Theta. You want time decay to work aggressively in your favor. |

| Vega | Is volatility on my side? | High Vega when selling during periods of high implied volatility (IV). |

By consistently applying this checklist, each trade becomes a deliberate choice, not just a guess. You're stacking the odds in your favor by ensuring the risk, reward, and market conditions align with your goals.

This structured process is the core philosophy behind tools like Strike Price, which are built to present these metrics clearly. When you can see the Greeks on a clean dashboard, you can run through this mental checklist in seconds, comparing multiple strikes to find the best balance of risk and reward for you.

Common Questions About Options Greeks

Even when the theory makes sense, the real world always throws a few curveballs. Let's tackle some of the most common questions that pop up when traders start putting the Greeks to work in their own accounts.

Which Greek Is Most Important for an Options Seller?

Great question. While all the Greeks are tangled together, if you’re selling options for income, Theta and Delta are your two co-pilots. Think of them as your primary profit engine and your main risk gauge.

Theta is why you’re in the trade—it’s the steady, predictable decay of the option's premium that drops cash into your account day after day. On the flip side, Delta is your quick-and-dirty risk meter, giving you a rough idea of your odds of assignment.

A winning strategy is all about finding the sweet spot between the two. You need enough Theta to make the trade worth your time, but a Delta that lines up with your personal comfort zone for risk. Get that balance right, and you're getting paid fairly for the risk you’re taking on.

How Do Greeks Change Near an Option's Expiration?

This is where things get interesting. The behavior of the Greeks changes drastically as an option runs out of time, and it's a critical concept to grasp.

As expiration gets closer, time decay (Theta) speeds up dramatically, especially in the last 30 days. For sellers, this is fantastic news. But there's a catch: Gamma also spikes for at-the-money options, making their Delta hyper-sensitive to even tiny moves in the stock. At the same time, Vega shrinks because there's simply less time left for future volatility to matter.

Understanding this dynamic is the key to managing your trades in those final weeks. It helps you see big shifts in risk coming before they hit you by surprise.

Can I Succeed Without Understanding the Greeks?

Look, it's possible to get lucky for a little while. But trading options without understanding the Greeks is like trying to fly a plane by just guessing which buttons to push. You might get off the ground, but you have no idea where you're going or how to land safely.

The Greeks give you the data you need to make consistent, informed decisions instead of just gambling.

They help you measure your risk, see why an option is priced the way it is, and predict how your position will react when the market moves. Learning to read them is what separates pure speculation from building a repeatable, strategic plan for generating income.

Ready to stop guessing and start making data-driven decisions? Strike Price provides real-time probability metrics and smart alerts to help you find the best covered call and secured put opportunities. Turn risk into reward and start trading with confidence.