poor man's covered calls: Boost income with less capital

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

A poor man’s covered call (PMCC) is a slick, capital-efficient way to mimic a traditional covered call without needing the cash to buy 100 shares of stock. Instead of owning the stock, you buy a long-term, in-the-money call option—often called a LEAP—and then sell shorter-term calls against it to generate income.

This approach massively reduces your upfront cost while giving you similar exposure to the stock's price movements.

Understanding the Poor Man’s Covered Call

At its heart, the poor man's covered call is a clever workaround for traders who want to earn income on expensive stocks but don't have the capital to buy 100 shares outright. Think of it like this: instead of buying an entire apartment building (owning 100 shares), you secure a long-term lease on a single unit (buying a LEAP option) and then sublet it month-to-month (selling short-term calls) to create a steady cash flow.

This strategy packs a powerful one-two punch of reduced capital and leveraged returns. While a standard covered call can tie up a huge chunk of your portfolio, a PMCC achieves a similar goal for a fraction of the cost. You’re simply swapping expensive stock ownership for a much cheaper, long-dated call option that behaves almost exactly like the stock itself. You can learn more about how the classic strategy works in our guide to what covered call options are.

How the Strategy Reduces Capital Outlay

The biggest draw of the PMCC is its capital efficiency. You buy one long-term, deep in-the-money (ITM) call option and then sell a shorter-term, out-of-the-money (OTM) call against it. For example, buying 100 shares of a pricey stock might set you back $10,000. A PMCC on that same stock could require an initial investment of just $2,300, representing a 77% capital reduction.

This setup lets you generate income from selling premiums while holding a "synthetic" stock position that costs way less. For another great breakdown, check out this guide to the cost-effective options strategy at Framework Investing.

A PMCC is essentially a diagonal debit spread, but it's structured to feel and act like a covered call. Your long LEAP acts as the "stock," and your short call acts as the "cover," bringing in that sweet premium income.

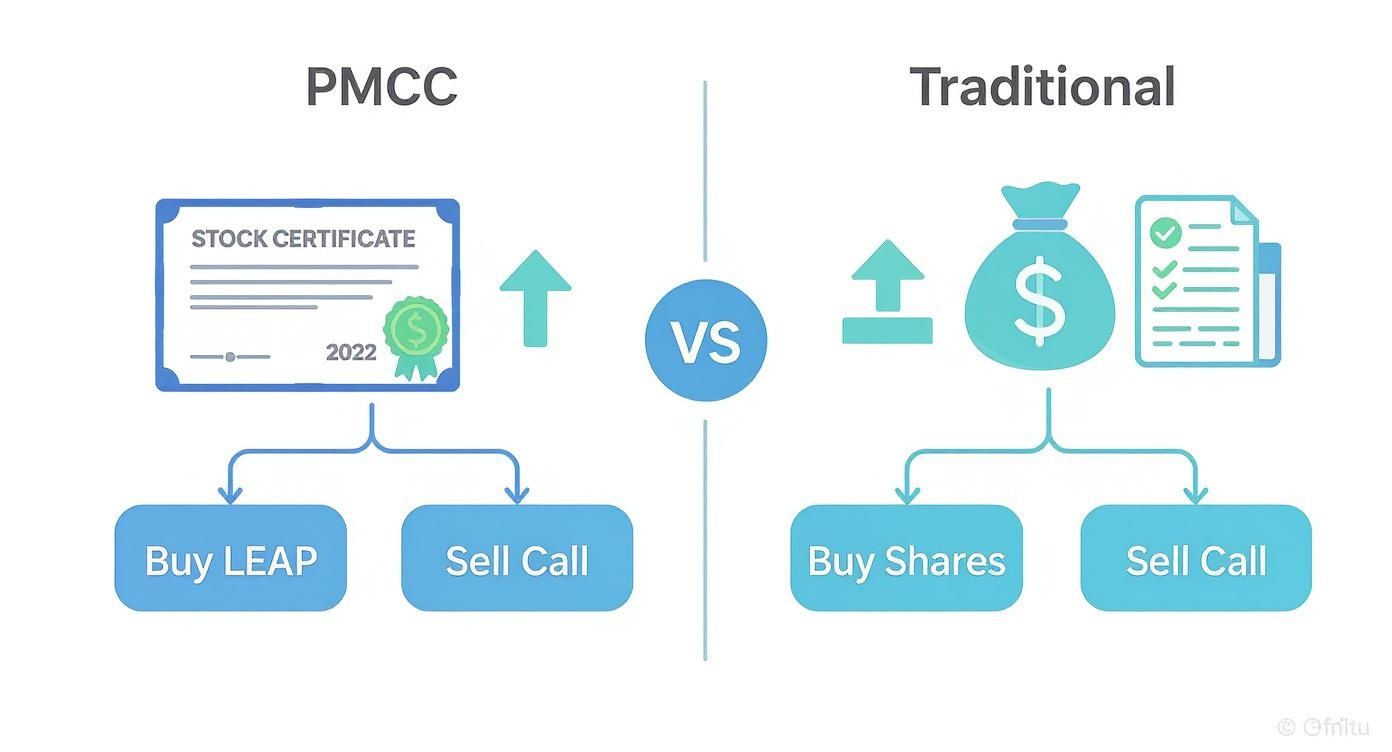

To really see the difference, let’s put the PMCC and its traditional counterpart side-by-side.

PMCC vs Traditional Covered Call At a Glance

Here’s a quick comparison of the core components, costs, and risks associated with each strategy. This table should help you see why a trader might choose one over the other based on their capital, risk tolerance, and goals.

| Attribute | Poor Man's Covered Call (PMCC) | Traditional Covered Call |

|---|---|---|

| Initial Capital | Low. Requires buying one long-term call option. | High. Requires buying 100 shares of stock. |

| Leverage | High. Potential for higher ROI due to lower cost. | Low. Returns are based on the full stock value. |

| Max Risk | Limited. Capped at the net debit paid for the options. | Substantial. The entire value of the stock, less premium. |

| Dividends | No. You do not receive dividends from the stock. | Yes. You own the shares and collect any dividends. |

As you can see, the PMCC is a game-changer for traders who want the income benefits of a covered call without the hefty price tag of owning shares. While you do give up dividends, the dramatically lower cost and higher potential ROI often make it a compelling choice.

How to Set Up Your First PMCC Trade

Alright, let's roll up our sleeves and walk through setting up a poor man's covered call. It's a two-step dance: first, you buy a long-term option to act like you own the stock. Then, you sell a short-term option against it to start generating some cash flow.

We’ll break it down with a clear example to take this from an abstract idea to a concrete trading plan you can actually use.

Step 1: Buy the Long-Term LEAPS Call

The entire PMCC strategy is built on one thing: your long-term call option. This is often a LEAPS (Long-Term Equity Anticipation Security), and it's your substitute for owning 100 shares of stock, but for way less cash upfront.

The goal here is to pick an option that moves almost exactly like the stock itself. To nail this, you need to focus on two things:

Expiration Date: Look for an option that expires at least 9 months from now. Honestly, over a year is even better. This gives your trade plenty of breathing room and minimizes the daily bleed from time decay (theta), letting your bullish view on the stock play out.

Strike Price: You want a deep in-the-money (ITM) strike. A solid rule of thumb is to find one with a Delta of 0.80 or higher. A high Delta means the option's price will track the stock's price very closely, which is exactly what we want to mimic ownership.

For instance, if a stock is trading at $150, you might buy a call with a $120 strike that expires in 12 months. That option will have a nice, high Delta and serve as the perfect foundation for the income side of the trade.

Step 2: Sell the Short-Term Call

Okay, you've got your stock substitute in place. Now it's time to make some money. You'll do this by selling a call option with a much closer expiration date against your LEAPS. This is the "covered" part of the strategy.

The whole point here is to collect a premium on an option that has a high probability of expiring worthless. Here’s what you’re looking for:

Expiration Date: An expiration that’s 30 to 45 days away is the sweet spot. This is where time decay really starts to accelerate, which works in your favor as the seller.

Strike Price: Pick a strike that’s out-of-the-money (OTM), meaning it's above the current stock price. A common approach is to choose a strike with a Delta around 0.30 or less. This gives you a statistical edge, suggesting there’s roughly a 70% chance the option will expire worthless.

Back to our example: with the stock at $150, you could sell a call with a $160 strike that expires in 35 days. The cash you collect from that sale is your income for the month.

This visual really drives home the difference between a capital-heavy traditional covered call and the leaner PMCC.

The key takeaway? Both strategies let you sell short-term calls for income, but the PMCC gets you there with a fraction of the capital by swapping out expensive shares for a cheaper LEAPS option.

A Full PMCC Trade Example

Let's put real numbers to this. Imagine XYZ stock is trading at $200 a share.

Part 1: Buying the LEAPS Call

- Action: You buy one call option expiring in 365 days with a $160 strike price (deep ITM).

- Delta: It has a Delta of 0.85, so it will track the stock’s moves closely.

- Cost: The premium is $50.00 per share, making your total cost $5,000 ($50.00 x 100 shares).

Part 2: Selling the Short Call

- Action: You immediately turn around and sell one call option expiring in 40 days with a $210 strike price (OTM).

- Premium Collected: You get paid $2.50 per share, bringing in a credit of $250 ($2.50 x 100 shares).

You've just set up a PMCC. Your initial out-of-pocket cost, or net debit, is what you paid for the LEAPS minus what you collected from selling the short call.

Net Debit Calculation:

$5,000 (Cost of Long Call) - $250 (Premium from Short Call) = $4,750

Your absolute maximum risk on this trade is locked in at that $4,750 net debit. That’s a huge difference compared to the $20,000 you would’ve needed to buy 100 shares of XYZ for a traditional covered call. This capital efficiency is why so many traders love this strategy for getting income from pricey stocks.

Knowing the mechanics is step one, but being able to read an options chain is just as important. To get comfortable picking the right strikes and expirations, check out our guide on how to read option chains. It’ll help you spot the perfect contracts for both legs of your PMCC.

Weighing the Rewards and Risks of a PMCC

The poor man’s covered call is a powerful way to generate income without tying up a ton of capital. But just like any trading strategy, it’s not all upside. You have to know the good, the bad, and what to watch out for before you even think about placing a trade.

The Big Rewards of the PMCC

The number one reason traders love the PMCC is its incredible capital efficiency. Forget needing tens of thousands of dollars to buy 100 shares of a big-name stock. You can control a similar position for a tiny fraction of that cost by using a long-term LEAPS call option instead.

This opens the door to trading blue-chip and popular growth stocks for those of us who don't have massive accounts.

That efficiency leads directly to the potential for a much higher return on investment (ROI). Think about it: your initial cash outlay is way lower than buying stock, so any income you generate from selling short calls represents a bigger slice of your investment.

A $250 premium on a $20,000 stock position is a 1.25% return. But that same $250 on a $4,750 PMCC is a sweet 5.2% return. It's the same income, but your return is over 4x higher.

On top of that, the PMCC is a defined-risk strategy. Your maximum possible loss is capped right at the net debit you paid to open the position. You know your absolute worst-case scenario from day one, which is a peace of mind that owning stock outright just can't offer.

With a PMCC, your risk is limited to the net amount you paid for the options spread. In volatile markets, knowing exactly how much you stand to lose provides a level of security that simply owning stock can't match.

The Real Risks to Manage

For all its perks, the PMCC has some very real risks you need to manage carefully. The biggest one is theta, or time decay, silently working against your long LEAPS call.

While your LEAP decays much slower than the short-term option you're selling, it is still losing a tiny bit of value every single day. If the underlying stock just treads water for months, that slow bleed from theta can start to eat away at your position.

To really get a handle on how time decay and other forces impact your options, you need to understand the basics. Our detailed guide on the options trading Greeks breaks down concepts like theta and delta.

Another huge risk is early assignment on your short call. If the stock price shoots up and your short call goes deep in-the-money, the option holder might exercise their right to buy the shares from you. Since you don't actually own the shares, your broker creates a short stock position in your account that you have to cover. It can get messy and expensive to fix.

Finally, you have to be ready for gap risk. While your maximum loss is defined, a sudden, nasty drop in the stock’s price can do a lot of damage fast. If a stock gaps down overnight on bad earnings or terrible news, the value of your LEAPS call can get crushed, potentially wiping out a big chunk of your investment before you can even react. This isn't a set-it-and-forget-it strategy; it needs more attention than just buying and holding stock.

How to Find the Best Stocks and Options for a PMCC

A great PMCC trade doesn’t start with clicking the “buy” button. It starts with careful selection. Think of it this way: even the most brilliant strategy will fall flat if you apply it to a low-quality stock. Finding the right underlying company and the right options contracts is the real foundation for a profitable position.

Your ideal candidate is a stock you have a stable, long-term bullish outlook on. You aren’t hunting for a meme stock or a highly speculative play. Instead, you're looking for established companies with a solid history of steady growth. This long-term conviction is crucial because your LEAP option is a multi-month, sometimes year-long, commitment.

Beyond the company's story, liquidity is non-negotiable. Always look for stocks with high trading volume and options chains with tight bid-ask spreads. Thinly traded options can make getting in and out of your PMCC incredibly expensive, eating into your profits before you even get started.

Choosing the Right Stock

When you're scanning for PMCC candidates, you're trying to find a perfect blend of stability, liquidity, and just enough volatility to make selling those short calls worthwhile.

Here’s what to look for in a stock:

- Long-Term Bullish Outlook: You should fundamentally believe the stock will gradually climb in value over the next year or more. This is an investment, not a short-term gamble.

- High Liquidity: The stock and its options must be actively traded. Look for daily stock volume in the millions and open interest on the options in the thousands.

- Moderate Implied Volatility (IV): You want enough IV to generate decent premiums from your short calls, but not so much that the stock is prone to wild, unpredictable swings that could blow up your trade.

A great place to start is with well-established, blue-chip companies or leaders in stable growth sectors. These names often provide the perfect mix of predictability and healthy option premiums needed for a successful PMCC.

Selecting the Perfect Options

Once you’ve landed on a promising stock, the next step is picking the two options contracts that will form your PMCC. This is a balancing act, and getting the parameters right is what makes the strategy click.

The capital efficiency here is the main attraction. The upfront cost of buying the long-term, in-the-money call option can be just 20-30% of the cost of buying 100 shares outright. From there, you generate income by repeatedly selling short-term, out-of-the-money calls. Depending on volatility, these short calls can historically yield an annualized return of 5-10% on the capital you’ve invested. You can learn more about the PMCC's structure and returns on optionsamurai.com.

The Long LEAP Call: The Stock Substitute

Your long call is the engine of the trade. It’s designed to mimic owning 100 shares without the massive capital outlay.

- Expiration: Go far out in time—at least nine months to a year, if not more. This pushes time decay (theta) way out, minimizing its negative impact on your position.

- Delta: Target a Delta of at least 0.80. A high Delta ensures your option's price moves almost dollar-for-dollar with the stock, giving you the stock-like behavior you need.

The Short Call: The Income Generator

This is your cash flow machine. You’ll sell a new one every month or so to generate consistent income.

- Expiration: Stick to expirations that are 30 to 45 days out. This is the sweet spot where time decay works most aggressively in your favor as an option seller.

- Delta: Aim for a Delta of 0.30 or less. A lower Delta means there's a lower probability of the stock price hitting your strike, which increases the odds that the option expires worthless and you keep the full premium.

By combining a high-Delta, long-dated call with a low-Delta, short-dated call, you create a synthetic covered call position. The long call provides the upside exposure, while the short call consistently generates income, all for a fraction of the capital required to own the stock.

PMCC Options Selection Checklist

Finding the right combination of options is part art, part science. This checklist breaks down the ideal parameters for both the long LEAP you're buying and the short call you're selling.

| Parameter | Long LEAP Call (The 'Stock') | Short Call (The 'Income Generator') |

|---|---|---|

| Expiration | At least 9+ months out (preferably > 1 year) | 30-45 days out |

| Delta | 0.80 or higher (deep in-the-money) | 0.30 or lower (out-of-the-money) |

| Goal | Mimic stock ownership, capture upside | Generate monthly income, expire worthless |

| Theta (Time Decay) | Minimize its negative effect | Maximize its positive effect (for you as a seller) |

| Bid-Ask Spread | As tight as possible for good entry/exit price | As tight as possible to maximize premium captured |

Sticking to these guidelines helps you build a PMCC position that's set up for success from day one, balancing long-term growth potential with consistent, short-term income.

Managing Your PMCC Trade Like a Pro

Unlike just buying and holding a stock, a poor man's covered call is an active strategy. It needs your attention. Once you’re in a PMCC, the market is going to do what it does, and you need a solid game plan for whatever comes next.

Knowing how to react when the stock grinds sideways, rallies hard, or takes a nosedive is what separates consistent income from frustrating losses. Let’s walk through the three most common situations and how to handle them.

Scenario 1: The Stock Moves Sideways or Stays Flat

This is exactly what you want to see. It’s the best-case scenario for a PMCC trader. If the stock price hangs out below your short call's strike price, your job is easy: do nothing.

Your entire goal was for that short call to bleed value from time decay (theta), and that’s precisely what's happening. As expiration gets closer, the option gets cheaper and cheaper until it expires worthless.

When it does, you pocket the entire premium you collected. Pure profit. The best part? Your long LEAP call is still sitting there, ready for another round. You can immediately sell a new short call for the next 30-45 day cycle and collect more income. Rinse and repeat.

Scenario 2: The Stock Rallies and Challenges Your Short Call

A big rally is great for your LEAP's value, but it definitely puts your short call under pressure. If the stock price blasts past your short strike, you risk getting assigned, which could stick you with an unwanted and complicated short stock position.

The professional move here is to roll the position. This is a single order that does two things at once:

- Buy to Close your current short call, taking it off the board.

- Sell to Open a new short call with a higher strike price and a later expiration date.

Rolling up and out lets you collect another credit, gives your trade more breathing room, and keeps you out of assignment trouble. You're basically locking in a bit of profit while resetting the trade to keep the income engine running.

For example, if the stock hits $215 and your short call is at $210, you could roll it out to a $220 strike expiring the following month. This simple adjustment keeps your PMCC strategy alive and working for you.

Scenario 3: The Stock Price Drops Significantly

This is the toughest spot for a PMCC. If the stock takes a serious dive, the value of your long LEAP call is going to drop, too—potentially more than the premium you collected. Now you have a decision to make, and it all comes down to your long-term outlook for the stock.

If you think the drop is just a blip and your bullish view hasn't changed, you might decide to hang on. You could even roll your short call down to a lower strike to collect more premium, helping to offset some of the paper loss on your LEAP.

But if the drop changes your mind about the stock or it smashes through a stop-loss you set, the most disciplined move is to close the entire position. That means selling your LEAP call and buying back your short call to salvage whatever value is left. Protecting your capital is always priority number one.

Common Questions About Poor Man's Covered Calls

As you dig into the poor man’s covered call, a few questions always seem to pop up. This strategy has more moving parts than a standard covered call, so it’s smart to get clear on the details before putting real money on the line.

We’ve pulled together the most common questions traders have about the PMCC. Getting these answered should help you build the confidence you need to place that first trade.

What Happens if I Get Assigned on My Short Call Option?

This is easily the biggest worry for anyone starting with PMCCs, and for good reason. If the short call you sold moves deep in-the-money, the buyer can exercise it. That means you’re on the hook to sell 100 shares of a stock you don’t actually own.

When that happens, your broker will likely create a short stock position in your account to fulfill the assignment. To fix this, you’ll then have to exercise your long LEAP call to buy 100 shares, which are immediately used to close out that short position. The whole process collapses your PMCC trade, forcing you to lock in whatever profit or loss exists at that moment.

The best defense against assignment is a good offense. It's almost always better to proactively manage your short call—roll it up to a higher strike and out to a later date—before it gets too deep in-the-money. This keeps your strategy alive and avoids the headache of assignment.

How Are Poor Man's Covered Calls Taxed?

The tax side of a PMCC can get a bit more complicated than a traditional covered call. It's crucial to know how your profits and losses are treated, because it isn't always straightforward.

Generally, the premium you collect from selling the short-term calls is taxed as a short-term capital gain. The profit or loss on your long LEAP call, however, depends on how long you hold it. If you keep it for more than a year, any gains are typically treated as long-term capital gains, which usually come with a much nicer tax rate.

But there's a catch. The IRS might view your PMCC as a "straddle" under special tax rules, which can change everything. Since tax laws are notoriously complex and everyone's situation is different, it's always a good idea to chat with a qualified tax professional. They can give you advice that fits your specific financial picture.

Can I Use a PMCC on Any Stock?

Technically, you can set up a PMCC on any stock with options, but it's definitely not a good idea. This strategy lives and dies by smart stock selection. You want to run this play only on stocks you're fundamentally bullish on for the long haul.

Here are a few things to look for:

- High Liquidity: The stock's options, especially the far-dated LEAPS, need to have plenty of trading volume and tight bid-ask spreads. This makes sure you can get in and out of the trade at a fair price without getting killed by slippage.

- Long-Term Bullish Outlook: Your LEAP is a long-term bet. Only use stocks you believe are headed up (or at least stable) over the next year or more.

- Avoid High Volatility: Stay away from the meme stocks and highly speculative names. A sudden, sharp drop could completely wipe out the value of your LEAP, creating losses that the short call premium can't even begin to cover.

Stick to stable, blue-chip companies or established growth stocks. It’s a much safer and more reliable path for a PMCC.

Why Are the Deltas Different for the Long and Short Calls?

The intentional difference in the Delta values of your two options is the very engine that powers the PMCC. Each is chosen for a completely different job to create a specific risk-reward profile.

Your long LEAP call needs a high Delta—think 0.80 or higher. A high Delta means the option acts a lot like the underlying stock. For every $1 the stock moves, your option's value will move by about $0.80. This is how you get that stock-like upside you’re looking for.

On the other hand, your short call needs a low Delta, usually 0.30 or less. A low Delta means there's a low probability the option will expire in-the-money. The whole goal for this leg of the trade is for it to expire worthless, letting you pocket the entire premium as income. This delta mismatch is what allows you to generate income while mimicking a long stock position for a fraction of the cost.

Ready to stop guessing and start making data-driven decisions with your covered calls? Strike Price gives you the real-time probability metrics you need to balance safety and premium like a pro. Use our Target Mode to set your income goals and let our analytics find the best opportunities for you, complete with alerts that warn you of rising risk.