A Practical Guide to Sell a Call and Sell a Put for Weekly Income

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering the Break Even Price for Options Trading

Unlock options trading success by mastering the break even price. Learn to calculate and use this key metric for covered calls and puts to protect capital.

What Is Option Vega and How It Shapes Your Trades

Discover what is option vega and how it measures sensitivity to volatility. Learn to use vega to improve your covered call and secured put strategies.

What Is A Strike Price And How Does It Drive Profit?

What is a strike price? Learn how this single number determines an option's value, profit potential, and risk in our complete guide to options trading.

When you sell a call or sell a put, you’re not just trading—you’re generating income. By selling a covered call, you agree to sell 100 shares of a stock you already own at a specific price, pocketing an instant premium. Or, you can sell a cash-secured put, where you agree to buy 100 shares at a target price, and you get paid a premium for that promise.

The Foundation of Selling Calls and Puts for Income

Welcome to the world of strategic options selling. Forget speculative bets and lottery tickets. This is about turning your portfolio into a reliable income stream.

The two cornerstone strategies you'll master are the covered call and the cash-secured put. Think of them as two sides of the same coin. Both strategies pay you—the seller—a cash premium upfront in exchange for taking on an obligation.

Getting these mechanics down is the first step. If you need a refresher on the absolute basics, check out our guide on how options trading works before diving deeper here.

The Covered Call Explained

The covered call is a fantastic starting point for anyone who already owns stocks. If you’re holding at least 100 shares of a company, you can sell one call option contract against those shares.

The moment you do this, you collect an immediate cash premium. In return, you’ve agreed to sell your 100 shares at a predetermined price (the strike price) if the stock climbs above it by the expiration date.

Investors love this strategy for two big reasons:

- Income Generation: If the stock stays below your strike price, the premium is pure profit. You keep your shares and the cash.

- Strategic Exit: It's a way to set a target selling price for your shares while getting paid to wait for the stock to hit it.

The Cash-Secured Put Demystified

The cash-secured put flips the script. Instead of starting with shares you own, you start with shares you want to own—but only at a price you find attractive, which is usually lower than where it's trading now.

Here’s how it works: you sell a put option and set aside enough cash to buy 100 shares at your chosen strike price. Just for making this commitment, you get paid a premium right away.

If the stock drops below your strike, you might get "assigned," meaning you'll use your secured cash to buy the shares at a discount to their old price. If the stock stays above your strike, the option expires worthless, and you just keep the premium, free and clear.

Key Insight: The beauty of a cash-secured put is that you get paid while waiting to buy a stock you already wanted. It’s a win-win: either you keep the premium, or you acquire a quality asset at your target price.

To make the comparison crystal clear, here’s a quick breakdown of how these two strategies stack up.

Covered Call vs. Cash-Secured Put At a Glance

This table breaks down the key differences and requirements for the two primary options selling strategies, helping you decide which is right for your goals.

| Attribute | Covered Call | Cash-Secured Put |

|---|---|---|

| Prerequisite | Own at least 100 shares of the stock | Have enough cash to buy 100 shares |

| Your Obligation | To sell your 100 shares at the strike price | To buy 100 shares at the strike price |

| Ideal Market View | Neutral to slightly bullish | Neutral to slightly bearish |

| Goal | Generate income or exit a position | Generate income or acquire a stock |

Understanding these distinctions helps you pick the right tool for the job based on your portfolio and market outlook.

Why These Strategies Are Synthetically Equivalent

Now, here’s where things get really interesting. A covered call and a cash-secured put are what traders call synthetically equivalent. This is just a fancy way of saying they have nearly identical risk-and-reward profiles.

A covered call on stock XYZ at a $50 strike has the same profit-and-loss potential as a short put on XYZ at the same $50 strike.

This isn't just a fun fact; it's a powerful advantage. It means you can choose the strategy that’s most efficient. For instance, research often shows that for major S&P 500 stocks, out-of-the-money puts have more trading volume and liquidity than calls. This can translate to better pricing and tighter spreads.

By understanding this relationship, you can tap into deeper liquidity pools and simply pick the option offering the best premium for a given level of risk. This foundational knowledge is what separates guessing from making smart, data-driven decisions.

Choosing the Right Stocks and Strike Prices with Data

Success when you sell calls and puts isn't about luck or gut feelings; it's about making deliberate, data-driven choices. The quality of the underlying stock and the specific strike price you pick are the two most critical factors that determine your probability of success.

The foundation of any solid options selling strategy is the underlying asset itself. Not all stocks are created equal for this purpose. Before you can even think about premiums and strike prices, you have to evaluate investment opportunities to make smarter, more informed choices.

Selecting the Right Underlying Stocks

Your goal is to find stable, predictable companies. High-flying, volatile meme stocks might offer juicy premiums, but they also carry an immense amount of risk and can move against you in an instant. Instead, focus on blue-chip stocks or well-established ETFs.

Here's what to look for:

- Sufficient Liquidity: The options chain should have high open interest and trading volume. This ensures you can enter and exit trades easily without getting stuck with wide bid-ask spreads that eat into your profits.

- Price Stability: Look for stocks that tend to trade in a predictable range or have a history of steady, manageable growth. Erratic price swings make it nearly impossible to pick a safe strike price.

- Long-Term Viability: You should be comfortable owning the underlying stock. This is absolutely crucial for cash-secured puts, where assignment means you'll be buying 100 shares. If you wouldn't want to hold the stock long-term, you shouldn't be selling a put on it.

A disciplined approach to stock selection filters out unnecessary risk from the start. For more specific ideas, check out our guide on the best stocks for put selling, which covers these criteria in much greater detail.

Using Delta to Pick Your Strike Price

Once you have a quality stock, the next step is choosing a strike price that aligns with your risk tolerance. This is where many traders start guessing, but there's a much better way: using probability metrics. The most powerful and accessible metric for this is Delta.

Delta is often described as an option's sensitivity to the stock price, but for an options seller, it has a more practical meaning:

Delta is a rough approximation of the probability that an option will expire in-the-money (ITM).

This simple interpretation is a game-changer. A call option with a 30 Delta (or 0.30) has roughly a 30% chance of expiring ITM. For you, the seller, that means you have a 70% chance that the option expires worthless and you keep the full premium. This is the probability-based approach that turns options selling into a consistent strategy.

A common starting point for many sellers is to target a Delta between 16 and 30.

- A 16 Delta strike offers a high probability of success (around 84%) but will yield a smaller premium.

- A 30 Delta strike provides a lower probability of success (around 70%) but a more substantial premium.

Your personal risk tolerance dictates where you fall on this spectrum. More conservative sellers might stick closer to 16 Delta, while those comfortable with more risk might venture toward 30 or even 40 Delta for higher income.

Platforms like Strike Price remove the guesswork by displaying the real-time probability of success for every single strike price, letting you see the risk-reward tradeoff instantly.

Balancing Safety and Yield with Data

Data confirms that this probabilistic approach works. Covered calls and cash-secured puts can offer high-probability income, with success rates often exceeding 50-80% per trade when managed with discipline. For instance, in a bullish market, a Delta target of 30-50 can give you a great balance of premium and safety.

Smart traders also use open interest filters—like avoiding strikes with fewer than 8 contracts—to ensure good liquidity. By grounding your decisions in probability, you move from gambling to strategic investing. You can quantify your risk on every trade, align it with your goals, and build a more reliable income stream over the long term.

Executing and Managing Your Trades Like a Pro

Placing the trade is just the starting line. The real skill in consistently generating options income comes from what you do after the position is open. Proper trade management is what separates experienced sellers from those who get burned by surprise market moves.

Think of this as your playbook for execution and management. We'll walk through the mechanics of placing the order, then dive into the proactive strategies that protect your capital and lock in profits.

Placing the Order Correctly

When you’re ready to sell a call and a put, you’ll use a “Sell to Open” order. This tells your broker you’re starting a new short options position. Always, and I mean always, use a limit order.

A limit order lets you set the minimum credit you’re willing to accept for the trade. This is your safety net against getting a bad price, especially when the market is moving fast or on options with a wide bid-ask spread. A market order, on the other hand, just executes at whatever the current price is, which could be way lower than you wanted.

The Power of Proactive Profit-Taking

Once the trade is live and the cash is in your account, it's easy to just set it and forget it, hoping for a worthless expiration. This is a rookie mistake. A much smarter approach is to have a clear exit plan before you even click "submit."

Many of the most successful options sellers I know live by a simple but powerful rule:

Close the position once you have captured 50% to 80% of the maximum premium.

Let's say you sell an option for a $1.00 credit ($100 per contract). Your profit target is to buy it back when its price falls to $0.50 or less. Why leave that extra potential profit on the table? It’s all about risk management. The last 20-50% of an option's premium decay is often where the most danger lies—a sharp move against you can wipe out your gains in an instant.

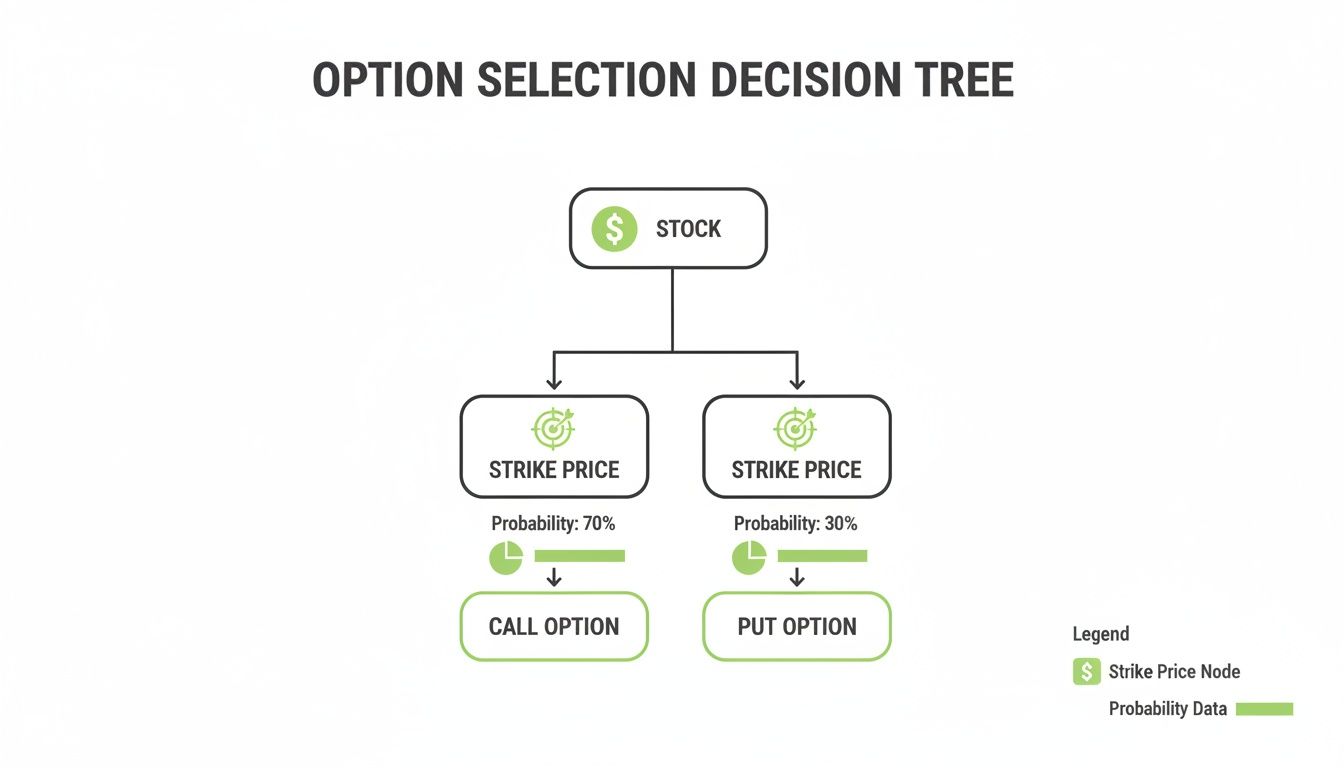

This decision tree helps visualize how to use stock data and probability metrics to guide your entry.

By taking profits early, you dramatically reduce the time your capital is at risk. More importantly, it frees you up to find the next high-probability trade.

Defensive Tactics When a Trade Moves Against You

Not every trade is going to be a home run right out of the gate. Long-term success is built on knowing how to handle positions that get challenged. Instead of panicking and closing for a loss, you can often adjust the trade to buy yourself more time and a better shot at turning it into a winner.

The go-to defensive move is rolling the position. This is a two-part order:

- Buying to Close your current short option.

- Selling to Open a new option on the same stock, but with a later expiration date.

When you roll, you can also adjust the strike price. If a put is being tested, you might roll down and out—to a lower strike and a later date. For a challenged call, you'd roll up and out. The objective is always to collect a net credit from the roll, which adds to your total premium collected and improves your break-even point. We cover this essential technique from top to bottom in our complete guide on rolling over options.

Using Technology for Smarter Management

Trying to manually track dozens of open positions, profit targets, and assignment odds is a recipe for disaster. It’s overwhelming, and that’s when mistakes happen. This is where technology becomes your best friend.

This table gives you a quick-reference guide for how to react when a trade is working or when it's moving against your position.

Trade Management Scenarios and Actions

| Scenario | Recommended Action | Rationale |

|---|---|---|

| Trade is profitable (50%+ max gain) | Buy to Close the position. | Locks in the majority of the profit while reducing the time your capital is exposed to market risk. |

| Trade is moving against you (challenged) | Roll the position to a later expiration. | Buys more time for the trade to work out and allows you to collect an additional credit, improving your break-even point. |

| Trade is near expiration and profitable | Let it expire worthless or Buy to Close for a few cents. | Letting it expire captures 100% profit, but closing it for pennies frees up capital sooner and removes any last-minute risk. |

Having a clear plan for each scenario is what separates proactive, profitable traders from reactive ones.

The Strike Price dashboard brings all your open positions into one clean view, showing your real-time P/L and the current probability of assignment for every contract you hold. No more spreadsheets, no more manual math.

Better yet, you can set up smart alerts. Get a notification the moment a trade hits your 50% profit target, or if a position's assignment risk suddenly spikes. This empowers you to manage your portfolio from anywhere, making data-driven decisions so you never miss a chance to lock in a gain or defend a position.

Automating Your Income Strategy with Strike Price

Managing trades by hand works, but it demands constant screen time. What if you could just set your income goals and let technology find the best trades that fit your rules? This isn't science fiction—it's about automating your options strategy to take emotion out of the equation and enforce discipline.

When you bring data-driven tools into the mix, you shift from reacting to the market to proactively building a consistent income machine. It’s all about creating a systematic, repeatable process every time you sell a call and sell a put.

Set Your Goals with Target Mode

The foundation of any good automated approach is defining what success actually looks like for you. Instead of just hunting for trades, you can set clear, measurable goals. This is exactly what Target Mode inside the Strike Price platform was built for.

You just have to answer two simple questions:

- How much income do you want to bring in each week or month?

- What’s your minimum probability of success?

For instance, maybe you set a goal to earn $500 in weekly premium with at least an 80% probability of success on every trade. Once you plug those numbers in, the system scans thousands of covered call and cash-secured put opportunities in real-time.

It filters out all the noise, leaving you with a curated list of high-probability trades that perfectly match your risk tolerance and income targets. It turns the manual hunt into an automated discovery process.

Get Notified with Smart Alerts

The market doesn’t wait. Opportunities pop up and vanish in minutes. An automated system acts like your own personal trading assistant, making sure you never miss a solid setup or a critical red flag.

This is where smart alerts are so crucial. You can set up notifications that trigger on specific events:

- High-Reward Opportunities: Get an instant ping when a trade matching your Target Mode criteria appears.

- Risk Profile Changes: Receive a warning if the probability of assignment on one of your positions suddenly jumps, giving you a chance to manage it.

- Profit-Taking Signals: Get an alert when a trade hits your profit target (like 50% of max premium), telling you it’s time to consider locking in your gains.

By turning market data into instant, actionable alerts, you can manage your portfolio with confidence. You know you have a system watching your back, which is the key to building a consistent, data-driven strategy over the long run.

The screenshot below gives you a look at a typical Strike Price dashboard. It consolidates your positions, probabilities, and income into one clear, real-time view.

This kind of central hub immediately shows you which trades are safe, which are at risk, and where your income is coming from. It turns a mountain of complex data into simple, actionable insights.

Seamless Broker Integration

Finding the right trade is only half the job—execution is everything. Modern platforms like Strike Price are designed to integrate directly with major brokerages, which streamlines the whole process from discovery to order placement.

When an alert flags a trade that fits your strategy, you can review the details and place the order with your broker in just a few clicks. That seamless workflow gets rid of the friction of jumping between different apps and manually typing in order details, which cuts down on costly mistakes.

Ultimately, automation isn't about replacing your judgment. It's about enhancing it. It handles the tedious, data-heavy work of scanning the market and monitoring positions so you can focus on strategy. By applying a consistent, data-backed approach every single time you sell a call and sell a put, you build a more resilient and profitable income stream.

Understanding Assignment and Long-Term Performance

For a lot of new options sellers, the word "assignment" sounds like you failed. It’s the moment the market moves against you, and you're forced to make good on your contract.

But that’s the wrong way to think about it. Assignment isn't a failure; it’s a planned, strategic outcome.

When you sell calls and puts, you're doing more than just collecting a check. You are defining the exact terms under which you’re willing to transact in the future. Shifting your mindset to see assignment as a core part of the strategy is the key to long-term success.

Demystifying the Assignment Process

Let’s get one thing straight: getting assigned is simply the fulfillment of the contract you sold. It's a neutral event, not an automatic loss.

It breaks down into two simple scenarios:

- Covered Call Assignment: If the stock price climbs above your strike price, you might get assigned. This just means you sell your 100 shares at that predetermined price. The premium you collected is yours to keep, and the cash from the sale lands in your account.

- Cash-Secured Put Assignment: If the stock price drops below your strike price, assignment means you buy 100 shares at that strike. You use the cash you already set aside for the purchase, and you still keep the premium you were paid.

In both cases, there are no surprises. You knew the deal from the very beginning.

Reframing Assignment as a Strategic Win

The most consistently profitable options sellers don’t fear assignment—they see it as one of two desirable outcomes. When you place a trade, you are making a clear statement to the market.

With a covered call, you're saying, "I am perfectly happy to sell my shares at this specific price." If assignment happens, you've successfully sold your stock at a target price you already decided on, all while pocketing a premium for your patience.

With a cash-secured put, you're saying, "I would love to own this stock, but only if I can get it at a discount." If you get assigned, you just bought a quality company you wanted for cheaper than it was trading before—and you got paid to wait for the opportunity.

Key Takeaway: Assignment is not a loss. It's the execution of your plan. You either generate pure income when options expire worthless, or you transact on a stock at a price you already deemed attractive. Both are wins.

This approach strips the emotion out of the process and replaces it with a disciplined, business-like execution of your investment plan.

Long-Term Performance: The Data Backs It Up

Thinking long-term is everything. The goal isn’t to win a single trade; it’s to build a resilient, income-generating machine over many years. This is where strategies like selling puts really shine, often outperforming traditional buy-and-hold investing.

In fact, remarkable research analyzing data from 1990 to 2023 showed that consistently selling cash-secured puts on the S&P 500 delivered superior returns. The study found that a strategy of selling puts with a 2.5% out-of-the-money strike achieved the highest geometric annual return of 8.7%. This didn't just beat the S&P 500's buy-and-hold return; it also had the best Sharpe ratio, meaning it delivered better performance for the amount of risk taken.

This data drives home a critical point: selling options isn't just about the premium from one trade. It’s about a systematic process that generates consistent cash flow and manages risk effectively over the long haul.

Of course, beyond managing the risks of assignment, investors should always be diligent in protecting against securities fraud. By combining a sound strategy with vigilance, you build a much stronger foundation for your portfolio. When you sell a call and sell a put with this bigger picture in mind, you stop reacting to short-term market noise and start compounding your returns for years to come.

Your Questions, Answered

Even with the best game plan, you’re bound to have questions when you first start selling calls and puts. Let's tackle some of the most common ones I hear from traders so you can move forward with confidence.

What Happens if My Option Expires In-The-Money?

If your short option expires in-the-money (ITM), you should expect to be assigned. That’s the name of the game.

For a short call, this means you’ll sell your 100 shares of the stock at the strike price. For a short put, you'll be buying 100 shares at the strike price, using the cash you already set aside.

Think of this as a strategic outcome, not a failure. You either sold your stock at a price you were happy with or bought a great company at a discount you chose.

Can I Be Assigned Before the Expiration Date?

Yes, early assignment is possible, but it’s pretty rare for most options, especially those sold out-of-the-money. It happens when the option buyer decides to exercise their right to the shares before the contract officially expires.

So, when does it happen? Usually for a couple of specific reasons:

- Deep In-The-Money Options: If an option is so far ITM that there’s very little time value left, the holder might exercise it to lock in their position.

- Upcoming Dividends: This is a big one. A call option holder might exercise their contract early to get their hands on the shares before an ex-dividend date so they can collect the payout.

While it can happen, it’s not something that should keep you up at night if you're primarily selling OTM contracts.

What’s the Difference Between a Naked Call and a Covered Call?

The difference boils down to one word: risk. A covered call is "covered" because you own the 100 shares you need to deliver if the contract gets assigned. Your risk is capped—it’s just the opportunity cost of the stock soaring way past your strike price.

A naked call, however, is sold when you don't own the underlying shares. This is a completely different beast and an extremely high-risk strategy. If the stock price shoots to the moon, your potential losses are theoretically infinite because you'd have to go buy the shares on the open market at that sky-high price.

Because of this, most retail investors should stick exclusively to covered calls.

Important Note: Selling naked calls is an advanced, high-risk strategy not suitable for most investors. It often requires a high-level options trading approval from your broker and exposes you to uncapped potential losses.

Do I Really Need 100 Shares to Sell a Call?

Yes, absolutely. To run a true covered call strategy, you must own at least 100 shares of the stock for every single call contract you sell. One standard options contract is always tied to 100 shares. That ownership is what "covers" your position.

If you sell a call without the shares, it’s no longer a covered call—it becomes a naked call, which carries that massive, undefined risk we just talked about.

How Much Money Do I Need to Start Selling Puts?

When you sell a cash-secured put, you need to have enough cash in your brokerage account to buy 100 shares of the stock at your chosen strike price. The broker will "secure" or set aside these funds to make sure you can make good on your promise.

The math is simple:

Capital Required = (Strike Price x 100)

So, if you want to sell one put contract on a stock with a $45 strike price, you’ll need to have $4,500 ($45 x 100) in cash sitting in your account, ready to go. The premium you collect can slightly offset this, but your broker will require the full amount to be secured to place the trade.

Ready to stop guessing and start making data-driven decisions? With Strike Price, you can set your income goals, define your risk tolerance, and get a curated list of the best covered call and cash-secured put opportunities delivered to you in real-time. Join thousands of investors who are building consistent income streams.