Sell Covered Calls for Income Your Definitive Guide

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

What Is Risk Adjusted Return? A Practical Guide

What is risk adjusted return? This guide explains how to measure it with the Sharpe Ratio, how to interpret the numbers, and why it's key to smarter investing.

Selling covered calls for income is a straightforward way to get paid from stocks you already own. Think of it like renting out a spare room in your house—you're still the owner, but you're collecting a little extra cash by letting someone else use the space for a while.

The goal is to generate a consistent cash flow, known as a premium, turning your long-term investments into a more active income source.

Why Sell Covered Calls for Consistent Income

Imagine your stock portfolio paying you on a regular basis. That’s the big idea behind selling covered calls for income. Instead of just letting your shares sit there, waiting for the price to go up, you can actively put them to work generating a secondary stream of cash.

This isn't about wild, high-risk speculation. It's a calculated method for boosting your overall returns by trading a little bit of potential upside for immediate cash in your pocket. You get paid the premium upfront, no matter what the stock does next.

Monetizing Your Existing Assets

One of the best parts of this strategy is that it works with what you already have. You’re not chasing some new, complicated financial product; you're just making your existing shares work harder for you.

Every premium you collect chips away at the net cost of your original stock purchase.

For instance, say you bought 100 shares of a stock at $50 per share. If you sell a covered call and collect a $2 premium ($200 total), your effective cost basis for those shares just dropped to $48. Do that a few times, and you can seriously reduce the risk on your initial investment.

The core principle is transforming a passive holding into an active income generator. By consistently collecting premiums, you create a more predictable return profile, smoothing out some of the market's natural volatility.

Understanding the Risk and Reward

So, what's the catch? The main "risk" with a covered call is opportunity cost. If the stock price blasts off and soars way past your strike price, your shares will get sold. You'll miss out on any gains above that strike price.

But that’s a trade-off you make consciously. You’re capping your potential home run for the certainty of getting paid right now.

This approach really shines in a few specific market situations:

- Sideways Markets: When a stock is just bouncing around in a range, you can sell calls over and over, collecting premium without much risk of your shares being called away.

- Slightly Bullish Markets: You can set a strike price just above where the stock is trading now. This lets you collect a nice premium while still giving you room to capture some of the stock's appreciation.

- Income-Focused Portfolios: If your priority is generating cash flow rather than chasing maximum growth, this strategy is a perfect fit.

Ultimately, selling covered calls lets you set your own terms for a potential sale while getting paid to wait. It’s a proactive way to manage your portfolio that lines up perfectly with a broader strategy of using options trading for income. Before we get into the nitty-gritty, understanding this fundamental balance is the most important first step.

Building Your Foundation for Covered Call Success

Before you even think about placing a trade, you need to get the groundwork right. There's one rule for anyone looking to sell covered calls for income that trumps all others, and it's deceptively simple: only use this strategy on stocks you’d be happy to own for the long haul.

This isn't a get-rich-quick scheme. Think of it as a way to boost the returns on solid companies you already believe in. Your goal is to collect premium on quality stocks, not to gamble on some speculative name hoping for a quick buck.

This mindset is your safety net. If the stock price drops, you're left holding a company you wanted in your portfolio anyway.

Selecting the Right Kind of Stocks

So, what kind of stocks are we talking about? The best candidates are usually well-established, blue-chip companies. They tend to have more predictable price movements and, just as importantly, a liquid options market. Liquidity—measured by trading volume and open interest—is your best friend here, ensuring you can get in and out of trades easily and at fair prices.

As you build your watchlist, keep an eye out for these traits:

- Stability and Strong Fundamentals: Look for businesses with a track record of consistent earnings, a healthy balance sheet, and a real competitive edge.

- Moderate Volatility: Super high volatility might mean fatter premiums, but it also brings a ton of risk. A moderately volatile stock is the sweet spot, offering decent income without giving you whiplash.

- High Options Trading Volume: Lots of trading activity means a tighter bid-ask spread. That translates directly to lower transaction costs for you over time.

A solid grasp of fundamental analysis is non-negotiable for filtering out the weak players and homing in on companies built to last.

Setting Up Your Brokerage Account

Once you have a few good companies in mind, you'll need to make sure your brokerage account is actually set up for options trading. You can't just dive in and start selling calls without getting the green light first.

Most brokers have different options trading "levels," and selling covered calls usually requires a basic level of approval, often called Level 1 or Level 2 permission. The application is typically straightforward, asking about your investing experience and how comfortable you are with risk. Your broker just wants to make sure you know what you're getting into.

The approval process isn't just a formality; it's a safeguard. It ensures that investors understand the obligations that come with selling options, which is a crucial step in responsible trading.

The "Covered" in Covered Calls

The final, and most critical, piece of the foundation is understanding what makes the call "covered." This entire strategy hinges on one simple prerequisite: you have to own the shares first.

For every single call option contract you sell, you must own at least 100 shares of the underlying stock. This is the golden rule. One standard options contract always represents 100 shares.

Owning the shares is what "covers" your position. If the stock rips higher and flies past your strike price, the buyer can exercise their option. When that happens, your broker simply delivers the 100 shares you already own to them. This completely eliminates the terrifying, unlimited risk of selling a "naked" call, where you'd be forced to buy shares on the open market at a sky-high price to make good on the contract.

This 100-share requirement is the bedrock of the strategy's risk management. It's the core principle that makes this a viable income tool for everyday investors.

Choosing the Right Strike Price and Expiration Date

Alright, this is where the rubber meets the road. Picking the right strike price and expiration date is the single most important decision you'll make in any covered call trade. It's what separates guessing from a repeatable, income-focused strategy.

These two choices directly control how much you get paid and the odds of your shares getting sold. Let's move past the theory and get into a practical framework for reading an options chain and making a smart, data-driven decision.

The best tool for this job? Delta. Think of it as a quick-and-dirty probability gauge for an option ending up in-the-money. A call with a 0.30 Delta has, roughly, a 30% chance of the stock finishing above that strike price by expiration. Simple as that.

Decoding Delta for Smarter Strike Selection

If you think of Delta as your probability compass, it becomes much easier to navigate the options chain.

Want to keep your shares and just collect a check? You’ll want to sell a call with a low Delta, something in the 0.20 to 0.30 range. This gives you a high—70% to 80%—chance the option expires worthless, letting you pocket the premium and keep your stock for the next round.

On the flip side, maybe you're perfectly fine selling your shares at a certain price and want to collect the biggest premium possible. In that case, you'd pick a strike closer to the current stock price, which naturally has a higher Delta. You get more cash upfront, but the odds of your shares getting called away go up significantly.

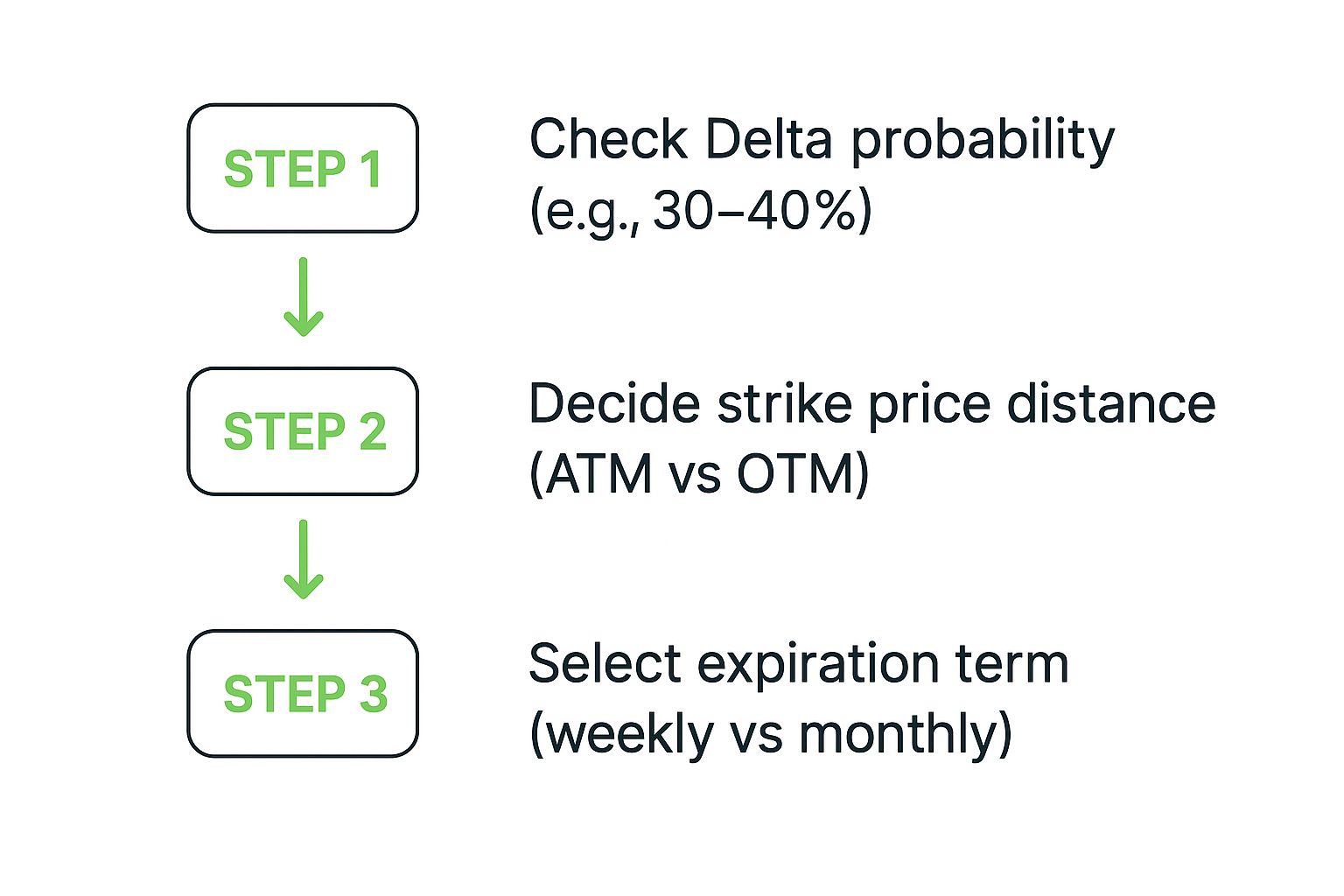

This flow is pretty straightforward once you get the hang of it.

It all starts with deciding on the probability you're comfortable with.

Strike Price The Income Versus Safety Trade-Off

Your choice of strike price is a direct trade-off: more income now versus more safety (a lower chance of assignment). Getting this balance right is everything.

Out-of-the-Money (OTM) Calls: These have a strike price above where the stock is currently trading. The premiums are smaller, but the probability of the option expiring worthless is much higher. This is the go-to for conservative investors who want to generate consistent income while holding onto their shares.

At-the-Money (ATM) Calls: Here, the strike price is right around the current stock price. These options offer the most time value, meaning they pay the highest premiums. The catch? You have roughly a 50/50 shot of having your shares assigned, making it a riskier play if your main goal is to keep the stock.

For a deeper look at these dynamics, check out our full guide on how to choose the best option strike price.

The bottom line is this: Are you prioritizing immediate cash flow, or is long-term ownership of the stock more important? Your answer will point you directly to the right type of strike price.

It's tempting to always chase the biggest premiums, but be careful. Research on S&P 500 covered call strategies from 1999 to 2023 showed that being too aggressive often led to underperformance. Capping your upside can sometimes cost you more than the premium you collect, which is a critical lesson to remember.

To help you decide, here's a quick look at the trade-offs involved when selecting a strike price.

Strike Price Selection Trade-Offs

| Strike Price Type | Premium Income | Probability of Assignment | Upside Potential | Best For |

|---|---|---|---|---|

| In-the-Money | Highest | Very High | Capped at Strike | Investors ready to sell their shares for maximum income. |

| At-the-Money | High | ~50% | Limited | Maximizing immediate income with a neutral outlook. |

| Out-of-the-Money | Lower | Low | Preserved up to Strike | Investors who want to keep their shares and earn steady income. |

This table lays out the core dilemma. OTM calls are your conservative income play, while ITM and ATM options are for those willing to part with their shares for a bigger upfront payment.

Expiration Date: Choosing Your Time Horizon

Just like with strike prices, your expiration date involves a trade-off—this time between premium size and how often you get paid.

Weekly Options (Short-Term)

Selling weeklies lets you generate income far more often, potentially 52 times a year instead of just 12. While each premium is smaller, the compounding effect can lead to higher annualized returns. The downside? It requires more hands-on management, and you'll rack up more in transaction costs.

Monthly Options (Longer-Term)

Monthlies offer bigger upfront premiums and require less babysitting. They also give the stock more time to move around, which is a double-edged sword. You have a larger buffer if the stock dips, but also more time for it to rally past your strike and get called away.

There’s no single "best" answer here. A beginner might feel more comfortable starting with monthlies to get a feel for the process. A more active trader might prefer the rapid compounding of weeklies. The right choice is the one that fits your income goals, your risk tolerance, and how much time you want to spend in your brokerage account.

Putting Your Covered Call Into Action

Alright, you’ve done the homework. You’ve picked your stock, pinpointed the perfect strike price, and have an expiration date in mind. Now it's time to make it happen. This is where the rubber meets the road and you officially sell a covered call for income.

Executing the trade itself is pretty simple. On your brokerage platform, you’ll place a “Sell to Open” order. This tells your broker you’re creating a new short call position against the 100 shares you already own. The interface will look a lot like a standard option chain, but you'll be selling instead of buying.

For a deeper dive into making sense of this screen, our guide on how to read option chains is a fantastic starting point.

Once the order fills, that premium—your income—hits your account almost instantly. You've just been paid. Now the real work begins: managing the position until expiration.

The Three Ways Your Trade Can End

As expiration day gets closer, your trade will resolve in one of three ways. Knowing what to do in each scenario is what separates the pros from the amateurs. You never want to be caught flat-footed.

Outcome 1: The Stock Finishes Below the Strike Price

This is usually the best-case scenario for an income-focused investor. If the stock price is below your strike when the contract expires, the option simply expires worthless.

- You keep 100% of the premium you collected.

- You keep all 100 of your shares.

- You’re now free to sell another call and repeat the process.

This is the income-generating engine in action. You can immediately turn around and sell a new call for the next cycle, keeping the cash flow going.

Outcome 2: The Stock Finishes Above the Strike Price

If the stock closes above your strike price, the option is now "in-the-money." The buyer will almost certainly exercise their right to buy your shares at that price. This is known as assignment.

Don’t panic. Your broker handles everything automatically. They will sell 100 of your shares at the strike price. You still keep the full premium, and you've also locked in a capital gain on your stock up to that point. It's a profitable outcome, but it does mean you no longer own the shares.

Key Takeaway: Getting assigned isn't a loss. It’s a built-in exit strategy. You sold your stock at a price you were happy with and collected a premium on top of it.

Outcome 3: The Stock Is Trading Near the Strike Price

This is where things get interesting. If the stock is hovering right around your strike price as expiration nears, you have a decision to make. You can let assignment happen, or you can choose to roll the position.

Rolling is a core technique for long-term covered call writers. It’s a two-part move you execute at the same time:

- Buy to Close your current short call.

- Sell to Open a new call with a later expiration date.

The Strategic Art of Rolling Your Position

So, why would you roll a trade? The main reason is to avoid having your shares called away, especially if you think the stock still has more upside. Rolling lets you collect a new premium while kicking the can down the road.

For instance, say your stock is trading just a hair above your strike with a week to go. You could roll the option to the following month and maybe even up to a higher strike price. This move often results in a net credit (more cash in your pocket) and gives the stock more room to climb before you have to worry about assignment again.

This kind of active management is what gives you an edge over a passive, set-it-and-forget-it approach. By adjusting your trades, you can better balance income generation with the potential for future stock gains. While a realistic return for a solid covered call strategy often falls in the 10-20% annual range, hitting those numbers depends on your ability to adapt.

Common Pitfalls and How to Avoid Them

Success with covered calls often comes down to the mistakes you don't make. While the strategy itself feels straightforward, there are a handful of psychological traps and tricky situations that can trip up even seasoned investors. If you can learn to sidestep these, you’re well on your way to building a consistent income stream.

Resisting Temptation Around Big News

One of the most common mistakes I see is selling calls right before a company's earnings announcement. The premiums look amazing—they’re often swollen with what the pros call implied volatility (IV). But that high IV isn't a gift; it's a warning flare. The market is pricing in a massive price swing, and you're essentially placing a bet on which direction it'll go.

If there's a positive surprise, the stock could blow right past your strike price, and you'll miss out on a huge rally. If the news is bad, the stock could tank, leaving you with a paper loss that makes the premium you collected feel like pocket change. It's a gamble, not an income strategy.

The Mental Game: FOMO and Getting Called Away

Beyond the numbers, the mental side of trading is where the real work is. Perhaps the toughest hurdle is the fear of missing out (FOMO). It’s that gut-punch feeling when a stock you owned gets called away at $55, and then you have to watch it soar to $75 over the next few weeks. Ouch.

That experience can poison your future trades. You might start setting strike prices way too high just to avoid it happening again, but then you're only collecting tiny premiums that barely make the trade worthwhile.

Here's the mental shift you need to make: getting your shares called away isn't a failure. It's the successful completion of the trade. You locked in a profit at a price you agreed to and got paid a premium for doing it.

Stick to your plan. Remember why you’re doing this. You're building an income stream, not swinging for the fences on a growth stock. Every premium is a win.

Don't Chase a Dangerously High Yield

Another trap is "chasing yield" by selling calls on speculative, low-quality stocks. You might see some struggling company offering a 5% premium for a one-month contract and think you've hit the jackpot. What you've really found is a minefield.

Those huge premiums exist for a reason: the stock is incredibly risky and could collapse. Selling a call offers very little protection if the share price gets cut in half. The small premium you earned won't be much comfort when you're stuck holding the bag on a failing company.

This brings us to the golden rule: only sell covered calls on stocks you'd be happy to own for the long term.

The performance of covered call strategies can be tricky and often depends on the market. Historically, they've shown mixed results, especially when the market is flat. One analysis of an S&P 500 covered call strategy found it underperformed two-thirds of the time, though it did have moments of success during shorter, one-year flat cycles. This just goes to show the real risk of capping your upside for income. You can learn more about how covered call strategies perform in different markets to dig into the data yourself.

Always Have a "What If" Plan for a Downturn

Finally, a critical error is only worrying about the upside. Many investors focus so much on avoiding assignment that they forget to plan for what happens if the stock price drops. What’s your move if your $100 stock falls to $80?

- Are you going to keep selling calls at lower strike prices to chip away at your cost basis?

- Will you just hold on and wait for things to recover?

- Do you have a stop-loss price in mind where you’ll just cut your losses and move on?

Decide on your "what if" plan before you ever place the trade. Having a clear exit strategy for both good and bad scenarios is what separates disciplined investors from everyone else.

Got Questions About Covered Calls? We've Got Answers

Once you start selling covered calls, you're bound to run into a few questions. It’s totally normal. Getting comfortable with the strategy means facing these common uncertainties head-on, so let’s clear them up right now.

What Happens If My Shares Get Called Away Early?

Early assignment is when the option buyer decides to exercise their right to buy your shares before the expiration date. It's not an everyday thing for most options, but it definitely happens.

When it does, your broker handles it automatically. They'll sell 100 of your shares at the strike price you agreed to. The main reason this happens is usually tied to an upcoming ex-dividend date. If your call is deep in-the-money, the buyer might exercise it just to snag that dividend payment for themselves.

The good news? You still keep the entire premium you were paid upfront. The trade just closes out a little sooner than you planned.

Can I Actually Lose Money Selling Covered Calls?

Yes, you can, but it’s critical to understand how. The option trade itself is profitable—you collect the premium, and that cash is yours to keep. The real risk comes from the 100 shares of stock you own.

If the stock price takes a nosedive, the loss on your shares can easily wipe out the small premium you collected. Think of the premium as a small discount on your stock's cost basis, not a shield against a market downturn.

Crucial Insight: This is why you should only sell covered calls on quality stocks you wouldn't mind holding for the long haul. The risk you're managing is stock risk, not option risk.

How Do Taxes Work on Covered Call Premiums?

Taxes are a big piece of the puzzle, and how your premium is taxed really depends on what happens at expiration.

- If the option expires worthless: The premium you collected is almost always taxed as a short-term capital gain, no matter how long you've owned the stock.

- If your shares get assigned (sold): The premium gets added to the sale price of your stock. This new, higher sale price is then used to figure out your capital gain or loss on the shares themselves.

Whether that gain is short-term or long-term depends on your original holding period for the stock. Tax rules can get tricky, so it's always a good idea to chat with a qualified tax pro about your personal situation.

What’s the Best Type of Market for This Strategy?

Covered calls aren't an all-weather strategy; they really shine in certain market conditions. Knowing when they work best helps you set the right expectations.

This strategy tends to thrive in:

- Stable or Sideways Markets: When a stock is just bouncing around in a predictable range, you can often sell calls and collect premium over and over without much risk of assignment.

- Slightly Bullish Markets: A slow, steady climb is also great. You get to generate income from the premiums while still capturing some of the stock's appreciation.

The toughest environments? A roaring bull market where your shares constantly get called away (and you miss out on bigger gains) or a sharp bear market where your stock losses dwarf the premium income.

Stop guessing and start making data-driven decisions. Strike Price gives you the real-time probability data you need to balance safety and yield, turning your portfolio into a consistent income engine. See how our smart alerts and strategy tools can help you sell covered calls with confidence. Start your free trial at https://strikeprice.app.