Understanding the Time Value of an Option in Trading

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

When you buy or sell an option, you're not just trading the right to buy or sell a stock. You're also trading time. The time value of an option is the part of its price—its premium—that's tied directly to the clock. It’s the extra cash traders will pay for the possibility that the option could become more valuable before it expires.

What Is the Time Value of an Option

Before you place any trade, you have to know what you’re paying for. Every option’s total price, or premium, is made of two distinct parts: intrinsic value and extrinsic value. Time value is just another name for an option's extrinsic value.

Think of it like buying a ticket to a championship game months in advance. The ticket has a face value (its intrinsic worth), but you’ll pay extra for the hope and potential of an exciting, game-changing outcome. That extra payment is the time value.

Deconstructing the Option Premium

An option's premium is pretty straightforward to break down. The formula is simple:

Option Premium = Intrinsic Value + Time Value (Extrinsic Value)

This means the time value is whatever is left over after you account for the option’s real, tangible worth at that moment. Let's look at each piece separately.

Intrinsic Value: This is the cold, hard cash value an option would have if you exercised it right now. For a call option, it's how much the stock price is above the strike price. For a put, it's how much the stock price is below the strike. If an option is "out-of-the-money," its intrinsic value is zero.

Time Value: This is the speculative part of the premium. It represents what the market thinks might happen before the contract expires. It’s the risk premium a seller collects for giving the buyer the right to buy or sell the stock at a fixed price for a specific period.

If you’re selling covered calls on your favorite stocks, a huge chunk of the premium you collect comes from time value. Buyers pay extra because there's still time for the stock to move in their favor. This time value predictably melts away every day—a process known as theta decay—which is music to an option seller's ears. To dig deeper, you can explore how historical option data provides key insights.

The Two Components at a Glance

To make this crystal clear, the table below breaks down an option's premium into its core components. Getting this relationship down is the foundation for analyzing any option trade.

Breaking Down an Option's Premium

| Component | What It Represents | When It Exists |

|---|---|---|

| Intrinsic Value | The option's real, tangible value if exercised now. | Only for In-the-Money (ITM) options. |

| Time Value | The extra amount paid for the potential of future profit. | Exists for all options until the moment of expiration. |

Essentially, intrinsic value is about what an option is worth today, while time value is all about its potential for tomorrow. As expiration gets closer, that potential fades, and so does the time value.

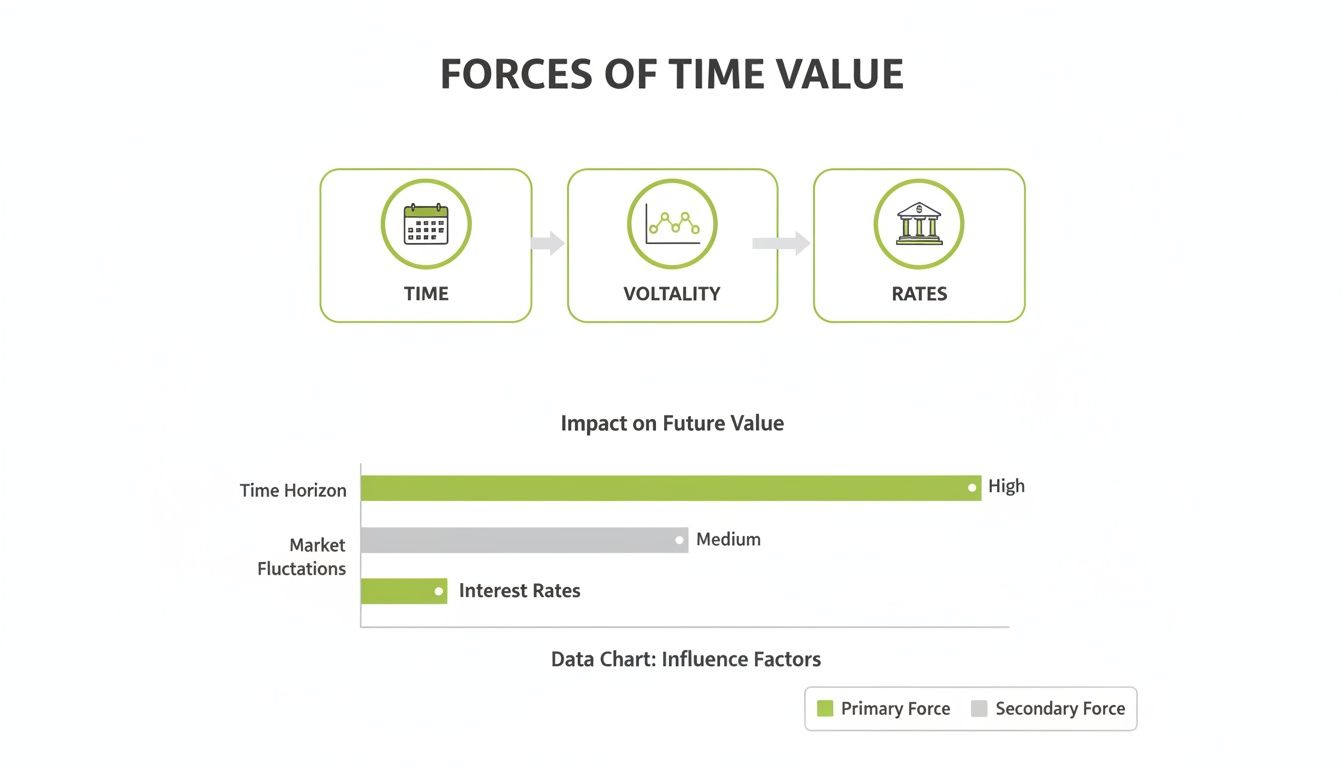

The Three Forces That Drive Time Value

So, we've established that time value is the speculative, hopeful part of an option's premium. But what actually fuels it? The time value of an option isn't some random number; it's pushed and pulled by a powerful trio of market forces.

Getting a feel for these concepts is non-negotiable if you're serious about selling options for income.

Think of time value like a balloon. Some forces inflate it, making it more valuable, while another is constantly letting the air out. The three big ones are:

- Time to Expiration: How much runway the option has left.

- Implied Volatility (IV): The market’s best guess on how much the stock will swing.

- Interest Rates: The boring, but still relevant, risk-free rate.

Let's break down each one so you can see exactly how they work together to shape the premium you're collecting or paying.

Time to Expiration and Theta Decay

Time is the most straightforward and predictable force in the mix. The more time an option has until it expires, the more chances the underlying stock has to make a big move. That uncertainty gives the option more potential, which pumps up its time value.

It's like having two lottery tickets. One is for tonight's drawing, and the other is for a drawing six months from now. That second ticket just feels more valuable, doesn't it? It holds more hope and potential, at least for a while.

But here’s the catch: that value is guaranteed to fade. Every single day that passes is one less day for the stock to move in your favor. This daily erosion of an option's premium is called theta decay.

Theta is the secret weapon for option sellers. It measures how much value an option loses each day just because time is passing. For anyone selling covered calls or secured puts, theta decay is the wind at your back, turning the clock into a source of income.

This decay isn't a straight line, either. It’s more like a melting ice cube—it melts slowly at first but starts to disappear much faster as it gets smaller. An option's time value works the same way, eroding slowly when it has months to go but absolutely collapsing in the last 30-45 days before expiration.

If you want to go deeper on how theta and other key metrics work, check out our detailed guide to the option trading greeks.

Implied Volatility: The Market's Anxiety Meter

While time is a steady headwind chipping away at an option's value, implied volatility (IV) is the sudden gust of wind that can inflate it in a hurry. IV is simply the market's forecast of a stock's likely price movement. It's not about what a stock has done, but what everyone thinks it might do.

You can think of IV as the market's "anxiety level" for a stock. When uncertainty is high, IV shoots up, and the time value of an option soars right along with it.

What causes this anxiety? A few usual suspects:

- Upcoming Earnings Reports: Nobody knows for sure what the numbers will be, leading to wide speculation.

- Major Product Launches: Will the new iPhone be a hit or a miss? That uncertainty drives IV.

- Pending FDA Decisions or Lawsuits: Big news can create a make-or-break outcome, boosting IV.

- Broad Market Fear: Events like a market crash send IV skyrocketing for almost everything.

For an option seller, high IV is a flashing green light. When you sell an option during a period of high IV, you collect a much bigger premium. The game plan is to collect that inflated premium, then sit back and profit as the uncertainty fades, IV drops back to normal, and good old theta decay gets to work.

Interest Rates: The Minor Influence

The third force, interest rates, usually has the smallest impact on an option's time value, especially for retail traders working with shorter-term contracts. Still, it’s baked into the pricing models, so it's good to know it's there.

The logic comes down to the opportunity cost of money. Buying a call option is a lot cheaper than buying 100 shares of the stock. The cash you didn't spend on the stock can be parked somewhere earning interest at the risk-free rate. Higher interest rates make this benefit a little more attractive, which slightly increases the value of calls and decreases the value of puts.

For most practical purposes, especially when you're selling covered calls or puts with just weeks or months to go, the daily wiggles in interest rates are nothing compared to the powerful effects of theta and IV.

How Theta Decay Gives Sellers an Advantage

For anyone selling covered calls or cash-secured puts, theta decay isn't just a background concept—it’s your most powerful ally. While option buyers need the stock to move in their favor, sellers have another way to win. They can profit simply from the relentless passage of time.

This daily erosion of an option's premium is the primary engine behind most income-focused option strategies. As a seller, you collect a premium upfront. Every day that passes, a small portion of that premium effectively moves from the buyer's pocket into yours as the time value of an option diminishes.

The Waterfall Effect of Time Decay

Crucially, theta decay isn't a slow, steady drip. A better way to think of it is like a waterfall. The decay starts slowly when an option has months left to live, but it accelerates dramatically as the expiration date gets closer. The time value erodes slowly at first, then seems to fall right off a cliff.

This acceleration is predictable and creates a strategic "sweet spot" for premium sellers. Both research and real-world trading experience show that this collapse in time value becomes most pronounced in the final 30 to 45 days of an option's life. Selling options inside this window often gives you the best balance of collecting a worthwhile premium while benefiting from its rapid decay.

By selling options in this 30-45 day window, you position yourself to capture the steepest part of the time decay curve. This turns the clock into your greatest asset and maximizes the rate at which the option's value evaporates in your favor.

To see this in action, the chart below illustrates the three core forces that shape an option's time value.

As you can see, while volatility and interest rates play a role, the steady march of time is the most predictable force chipping away at an option's premium.

Capitalizing on the Weekend Effect

One of the most interesting parts of theta decay is the "weekend effect." Even though the stock market closes on Friday afternoon, time keeps moving forward. Options with short expirations lose value not just for Saturday and Sunday but often for Friday as well, creating a three-day decay period over a single weekend.

This gives sellers a distinct edge. While buyers are helpless as their option's value melts away, sellers can watch this predictable decay work in their favor. Knowing how to use this is especially powerful if you're selling weekly contracts. To dig deeper, you can learn more about the strategic differences between weekly vs monthly options in our detailed guide.

When you're running strategies like covered calls and cash-secured puts, understanding how time value erodes over weekends and holidays can seriously boost your premium collection. While the stocks are static, theta decay is still hard at work. Historical data backs this up, showing SPY weekly options lost an average of 12% of their time value from Friday close to Monday open across 52 weeks in 2022. You can explore more option statistics like this at OptionCharts.io.

By understanding how to harness the predictable forces of theta, you transform time from a risk factor into a reliable source of potential income. It’s the closest thing an option seller has to a statistical advantage.

Calculating Time Value with Real-World Examples

Theory is great, but seeing how time value works with real numbers is where it really clicks. The good news? The math is surprisingly simple — just basic subtraction.

Let's start with the one formula you need to remember:

Time Value = Option Premium – Intrinsic Value

This little equation lets you look at any option premium and instantly separate its real, tangible value (intrinsic) from its speculative potential (time value). As an options seller, that distinction is everything.

To see this in action, let's walk through three different scenarios using a fictional stock, XYZ Inc., which is currently trading at exactly $100 per share.

Scenario 1: The In-the-Money (ITM) Call Option

An "in-the-money" option already has built-in value. If you could exercise it right now, you'd make a profit. Let’s see how that affects its premium.

- Stock Price: $100

- Option Type: $95 Strike Call

- Option Premium: $7.00 ($700 per contract)

First, we figure out its intrinsic value. Since the stock price ($100) is already above the strike price ($95), the option has immediate worth.

- Intrinsic Value Calculation: $100 (Stock Price) – $95 (Strike Price) = $5.00

Now, we just plug that into our formula to find the time value.

- Time Value Calculation: $7.00 (Premium) – $5.00 (Intrinsic Value) = $2.00

So, of the $7.00 premium, $5.00 is real, tangible value, and $2.00 is time value. A buyer is paying that extra $2.00 for the chance the stock might climb even higher before expiration.

Scenario 2: The At-the-Money (ATM) Call Option

"At-the-money" options have a strike price that’s right on top of the current stock price. These contracts are all about potential because there’s maximum uncertainty about where the stock will go next.

- Stock Price: $100

- Option Type: $100 Strike Call

- Option Premium: $4.00 ($400 per contract)

Let's check the intrinsic value. The stock price and strike price are identical, so there's no immediate profit to be had from exercising it.

- Intrinsic Value Calculation: $100 (Stock Price) – $100 (Strike Price) = $0.00

This makes the time value calculation incredibly easy.

- Time Value Calculation: $4.00 (Premium) – $0.00 (Intrinsic Value) = $4.00

The entire $4.00 premium is pure time value. Traders are paying for one thing: the possibility that the stock will move above $100 before the contract expires.

Scenario 3: The Out-of-the-Money (OTM) Put Option

"Out-of-the-money" options have zero intrinsic value. They are pure bets on which way the stock will move in the future.

- Stock Price: $100

- Option Type: $90 Strike Put

- Option Premium: $1.50 ($150 per contract)

For a put option to have intrinsic value, the stock price needs to be below the strike price. In this case, at $100, the stock is way above the $90 strike.

- Intrinsic Value Calculation: Since the stock price is above the strike, the intrinsic value is $0.00.

Just like our ATM example, the time value is simply the premium itself.

- Time Value Calculation: $1.50 (Premium) – $0.00 (Intrinsic Value) = $1.50

The buyer of this OTM put is paying $1.50 entirely for the hope that XYZ's stock price will tank below $90 before the clock runs out. This is why OTM options are often seen as pure plays on volatility and time.

To make this even clearer, the table below breaks down these examples side-by-side.

Time Value Calculation Examples (Stock Price at $100)

| Option Type | Example Strike Price | Option Premium | Intrinsic Value Calculation | Time Value Calculation |

|---|---|---|---|---|

| In-the-Money Call | $95 Strike Call | $7.00 | $100 Stock – $95 Strike = $5.00 | $7.00 Premium – $5.00 Intrinsic = $2.00 |

| At-the-Money Call | $100 Strike Call | $4.00 | $100 Stock – $100 Strike = $0.00 | $4.00 Premium – $0.00 Intrinsic = $4.00 |

| Out-of-the-Money Put | $90 Strike Put | $1.50 | Stock price > Strike price = $0.00 | $1.50 Premium – $0.00 Intrinsic = $1.50 |

Understanding how to break a premium down into these two parts is a core skill for any trader. It’s fundamental to the valuation of options and helps you instantly spot which contracts offer the risk and reward you're looking for.

Once you get the hang of it, you'll be able to glance at an option chain and see not just the prices, but the story they're telling about risk, time, and potential.

How to Use Time Value in Your Trading Strategy

Knowing the theory behind time value is one thing. Turning it into a real, repeatable income strategy is where the magic happens. For traders who sell covered calls and cash-secured puts, this isn't just an abstract concept—it’s the entire business model. When you sell an option, you are literally selling time.

Your goal is simple: collect a premium that’s packed with time value, then sit back and let theta decay do its job. If all goes to plan, that value erodes down to zero by expiration, and the cash you collected upfront is now pure profit.

This mindset flips the script on trading. Instead of speculating on where a stock is headed, you're often just betting on where it won't go. All the while, time is relentlessly on your side, working to your benefit.

Finding the Sweet Spot for Selling Time

One of the biggest decisions an option seller makes is picking the right expiration date. Sell an option that’s too far out, and you might get a nice big premium, but its time value decays at a snail's pace. On the other hand, a contract expiring in a few days offers lightning-fast decay, but the premium is tiny and it’s hyper-sensitive to any little price swing (that's gamma risk for you).

This brings us to the strategic sweet spot: selling options with 30 to 45 days until expiration.

This specific window is a favorite among seasoned traders for two big reasons:

- Meaningful Premium: There's enough time left on the clock to collect a premium that makes the trade worth your while.

- Accelerated Theta Decay: You’re positioned right on the steepest part of the time decay curve, where the option’s value is melting away fastest.

Selling in this window gives you the best of both worlds. You get a respectable chunk of cash upfront and immediately start benefiting from the “waterfall” effect of theta decay, maximizing the rate at which that premium evaporates into your account.

By focusing on the 30-45 day window, you're not just selling time—you're selling time when it's decaying at its fastest possible rate. This tactical choice is a cornerstone of consistent premium generation for covered call and secured put sellers.

The concept of an asset losing value over time is universal in finance. It’s not just for stocks; understanding it is also crucial for things like strategies for trading derivatives like Kalshi contracts, which also have time-sensitive values.

Using Probabilities to Pick Your Strikes

Once you’ve locked in your timeframe, the next move is picking a strike price. This is where so many new traders stumble. They see a big, juicy premium and can't resist, but a high premium is usually a warning sign of high risk—a much greater chance of the option finishing in-the-money and getting you assigned.

The key to long-term success is to stop thinking like a gambler and start thinking like an insurance company. Use probabilities to stack the odds in your favor. Your goal is to sell contracts that have a high statistical chance of expiring worthless, letting you pocket the entire premium without a fuss.

This is where a data-driven platform like Strike Price becomes indispensable. Instead of guessing, you get a clear, real-time probability of each strike price finishing out-of-the-money (OTM).

Let's look at two ways to approach a stock trading at $100:

- Approach A (The Greedy Way): You sell a call option with a $102 strike. The premium is great, but the probability of the stock closing above $102 might be 40%. You're taking on a huge risk of having your shares called away.

- Approach B (The Smart Way): You sell a call option with a $108 strike. The premium is smaller, but the platform shows an 85% probability of the stock closing below $108. You collect less cash, but you've just massively boosted your odds of a successful, stress-free trade.

Do this hundreds of times, and the probability-driven approach will build a far more reliable and consistent income stream. It’s about hitting lots of singles and doubles, not swinging for the fences and striking out. By systematically selling the time value of an option on contracts that are statistically likely to expire worthless, you turn time and math into your greatest allies. This is how abstract concepts become a concrete plan for generating real income.

Turning Time into Your Greatest Trading Asset

When you put all the pieces together, the time value of an option is simply the part of its premium that decays away. For anyone selling premium, this decay is exactly where the profit comes from. Its speed is dictated by three main things: time left until expiration, implied volatility, and where your strike price sits relative to the stock price.

If you're selling covered calls or secured puts, time isn't the enemy—it’s your most reliable partner. It works for you every single day, relentlessly chipping away at the value of the option you sold. Once you truly get this, you can move away from just guessing and start building a real, data-driven strategy.

The core mindset shift is to stop seeing options as just a bet on a stock's direction and start viewing them as a way to sell time itself. Your goal is to let this intangible asset decay to zero.

This approach turns trading into a process, almost like harvesting a crop that predictably ripens over time. Beyond just understanding the time value of a specific option, it's also smart to think about how different time horizons fit your overall trading style. You can learn more about the best time frames for swing trading to see how timing impacts different approaches.

Ultimately, mastering time value gives you a much more consistent way to pull income from the market. It literally turns the clock into one of your most valuable strategic tools.

Got Questions? We've Got Answers

Getting a feel for time value can be tricky at first. It’s one of those concepts that clicks into place with a bit of practice. Let's tackle some of the most common questions traders have, so you can start using these ideas with more confidence.

Which Options Have the Most Time Value?

Easy one: at-the-money (ATM) options almost always have the most time value. Why? Because there’s the greatest amount of uncertainty about where they'll end up. The market isn't sure if they'll finish in-the-money or out-of-the-money, and that uncertainty is what you're getting paid for.

On the flip side, deep in-the-money (ITM) options have very little time value since their price is almost entirely made of real, intrinsic value. And far out-of-the-money (OTM) options? They also have almost no time value because the odds of them becoming profitable are just so slim.

Can an Option Ever Have Zero Time Value?

Yep. An option has exactly zero time value at the moment of expiration. It’s the finish line.

At that point, its entire worth boils down to its intrinsic value. An in-the-money option will be worth the difference between the stock and strike price, while an out-of-the-money option expires completely worthless.

For an option seller, this is the entire point of the game. You collect a premium that's full of time value and wait for that value to bleed out to zero, letting you pocket the cash you received upfront.

Why Do Traders Talk About the 30-45 Day "Sweet Spot"?

You'll hear this a lot, and for good reason. The timeframe of 30-45 days to expiration is widely seen as the sweet spot for selling premium. It's the perfect balance between collecting a decent upfront premium and catching the fastest part of the theta decay curve.

Inside that 45-day window, time value really starts to melt away at an accelerated pace.

Options with more than 45 days left on the clock decay much more slowly. And while those with fewer than 30 days decay like crazy, they offer smaller premiums and are dangerously sensitive to big price swings — something traders call gamma risk.

How Does Volatility Affect an Option's Time Value?

Higher implied volatility (IV) pumps up an option's time value. Think of it like this: when the market expects a big move in a stock (like around an earnings report), buyers are willing to pay more for the chance to cash in on that swing. That "chance" is time value, and it gets inflated.

As a seller, this is a huge strategic advantage. Selling options when IV is high means you collect a fatter premium. You can then profit as that inflated value disappears, especially if the stock calms down and volatility returns to normal.

Ready to stop guessing and start making data-driven decisions? Strike Price provides the real-time probability metrics you need to sell options with confidence. Start your free trial and turn time into your greatest asset.