Beginner Options Trading Your Simple Starter Guide

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

Staring at complex stock charts can feel like a foreign language when you're just getting started. So let's forget the charts for a minute and simplify things.

Think of an options contract like putting a security deposit on a house you might want to buy. This deposit gives you the right—but not the obligation—to purchase that house later at a price you both agree on today.

What Is Options Trading A Simple Analogy

Let's stick with that real estate idea to make this concept click. Say you find a house you love, and it's listed for $300,000. You have a strong feeling its value is about to go up, but you're not quite ready to pull the trigger on a full purchase.

So, you go to the seller and offer them $3,000 for a special agreement. This deal, your "option," gives you the exclusive right to buy that house for $300,000 anytime within the next three months. The seller agrees and pockets your $3,000.

From here, only two things can happen.

Breaking Down the Core Concepts

First, the housing market could boom, and the home’s value skyrockets to $350,000. Your agreement is now pure gold. You can exercise your right to buy the house for the original $300,000, instantly locking in $50,000 in equity. That little $3,000 investment just paid off in a big way.

But what if the market slumps instead? If the house is now only worth $270,000, buying it for $300,000 would be a terrible deal. In this case, you simply walk away and let the agreement expire. You’re out your $3,000 deposit, but you just avoided a much bigger financial hit.

That simple transaction has all the core pieces of an options trade.

From Real Estate to the Stock Market

This idea translates perfectly to the stock market. You're just dealing with shares of Apple or Tesla instead of a house. The upfront cost is much smaller, and the timelines can be anything from a week to over a year.

To bring it all together, here’s a quick table connecting our analogy to the real trading terms you’ll need to know.

Core Options Trading Terms Explained

| Analogy Term | Official Trading Term | What It Means |

|---|---|---|

| The House | The Underlying Asset | The stock or ETF the option is based on (usually 100 shares). |

| The $300,000 Price | The Strike Price | The agreed-upon price at which you can buy or sell the stock. |

| The Three-Month Deadline | The Expiration Date | The date the options contract is no longer valid. |

| The $3,000 Deposit | The Premium | The non-refundable fee you pay for the right to buy or sell. |

This table is your cheat sheet. The premium is simply the price you pay for flexibility and control without having to own the asset outright.

If you want to dive deeper into the mechanics, you can explore our complete guide on how options trading works.

While this concept feels modern, the formalized market is younger than you might think. The Chicago Board Options Exchange (CBOE) was only established in 1973. It was the rise of online brokerages in the 90s that truly opened the doors for everyday investors. Understanding this foundation is the first real step from theory to practice.

Understanding Calls and Puts

Alright, now that we've covered the basics, let's meet the two main players in the options world: call options and put options. Every single strategy, from the simplest to the most complex, is built from these two contract types.

Think of them as straightforward directional bets on a stock. A call option is basically your vote of confidence that a stock's price will head up. A put option is your bet that it's going down. The real game, though, is understanding that for every option, there’s a buyer and a seller, and they both have very different goals.

The Dynamics of a Call Option

A call option gives the owner the right—but not the obligation—to buy a stock at a set price (the strike price) before a certain date. Let's look at this from both sides of the coin.

The Call Buyer (The Speculator)

Imagine a tech company, "Innovate Corp," is trading at $100 a share. You're convinced their new product is going to be a massive hit, sending the stock price skyward. You could buy 100 shares for $10,000, but that's a huge chunk of change to tie up.

Instead, you could buy one call option contract with a $105 strike price for a $200 premium. This contract gives you the right to buy 100 shares of Innovate Corp at $105 each, no matter how high the stock actually climbs. If the stock shoots up to $120, you can exercise your option, buy the shares for $105 each, and instantly be sitting on a nice profit. Your total risk was capped at the $200 you paid for the contract.

The Call Seller (The Income Generator)

Now, the person who sold you that call option has the exact opposite view. They're betting Innovate Corp will probably stay below $105 per share. By selling you the option, they pocket your $200 premium as immediate income.

Their goal is for the option to expire worthless. If the stock price never breaks above $105, you won't exercise your right to buy, and the seller simply keeps your $200. This is the core idea behind the covered call strategy we'll get into later, a favorite for beginner options trading.

The Dynamics of a Put Option

A put option works the other way around. It gives its owner the right, but not the obligation, to sell a stock at a set strike price before it expires.

Key Takeaway: Calls are about the right to buy (a bullish outlook). Puts are about the right to sell (a bearish outlook). Nailing this simple difference is the first step to making smarter trades.

The Put Buyer (The Protector or Bear)

Let's say you already own 100 shares of "Global Goods Inc.," which is trading at $50. You’re getting nervous about an upcoming earnings report and want to protect your investment from a potential nosedive.

You could buy a put option with a $45 strike price. This acts like an insurance policy. If the stock tanks to $30, your put option guarantees you the right to sell your shares for $45, saving you from a much bigger loss. On the flip side, a trader who doesn't even own the stock could buy a put just to bet on its price falling.

The Put Seller (The Stock Acquirer)

The put seller collects the premium from the buyer and, in exchange, agrees to buy the shares at the strike price if the buyer decides to sell. Why on earth would someone do this? Because they are often happy to buy the stock at that lower price.

For instance, a put seller might want to own Global Goods Inc. but thinks $50 is a bit steep. They can sell a put option with a $45 strike price. For them, there are two great potential outcomes:

- The stock stays above $45. The option expires, and they keep the premium as pure profit.

- The stock drops below $45. They get assigned to buy the shares at $45 (the price they wanted anyway), and they still get to keep the premium, which effectively lowers their purchase cost even more.

Your First Two Trading Strategies

Okay, you've got the basics of calls and puts down. Now it's time to put that theory into practice. For new traders, the key is to start with simple, low-risk strategies that make sense.

We're going to focus on two of the most trusted methods out there: the Covered Call and the Cash-Secured Put. These aren't about wild speculation. They're about generating steady income by taking on smart, calculated obligations.

The Covered Call: Get Paid From Stocks You Already Own

The covered call is the perfect starting point if you already own at least 100 shares of a stock you like for the long haul, but don't expect to shoot to the moon tomorrow. It’s a way to create an extra income stream from your existing portfolio.

Think of it like renting out a room in a house you own. You still own the house, but you're collecting rent. With a covered call, you sell someone the option to buy your shares, and the premium you collect is your "rent."

In exchange for that cash, you agree to sell your 100 shares at a set price (the strike price) if the stock climbs above that level. It's called "covered" because your promise to sell is backed up—or covered—by the shares you already hold.

Let's walk through an example.

- Your Position: You own 100 shares of "Stable Co.," currently trading at $48.

- Your Outlook: You figure the stock will probably trade flat or inch up a bit over the next month, but you doubt it'll blast past $50.

- The Trade: You sell one call option with a $50 strike price that expires in 30 days. For doing this, you instantly collect a $150 premium.

Once that trade is on, one of two things will likely happen.

- Stock Stays Below $50: If Stable Co. is trading at $49 when the option expires, it expires worthless. You keep the $150 premium, no strings attached, and you keep your 100 shares. Mission accomplished.

- Stock Rises Above $50: If the stock rallies to $52, the option is "in-the-money." You'll be assigned to sell your 100 shares for the agreed-upon $50 each. You still keep the $150 premium, but you miss out on any gains above $50.

The real risk here isn't losing your shirt—it's opportunity cost. You're capping your potential profit in exchange for guaranteed income right now.

The Cash-Secured Put: Get Paid to Buy a Stock Cheaper

The cash-secured put is another great income strategy, but it comes from a different angle. You use this when you want to own a stock but feel its current price is just a little too high. This strategy lets you either buy that stock at a discount or simply get paid while you wait.

The "cash-secured" part is non-negotiable. It means you have enough cash sitting in your account to buy 100 shares of the stock at the strike price if it comes to that. This is what makes it a safe beginner strategy—you’re never on the hook for more money than you have.

Crucial Insight: Selling a cash-secured put is a bullish to neutral move. You're basically saying, "I'm happy to buy this stock at the strike price, but if it stays above that, I'm just as happy to keep the premium."

Let's see it in action.

- Your Target: You want to buy "Growth Inc.," but at $95 a share, it feels a bit rich. You'd feel much better getting in at $90.

- The Trade: You sell one put option with a $90 strike price that expires in 45 days. For taking on this obligation, you collect a $200 premium. You also need to have $9,000 ($90 strike x 100 shares) set aside.

Again, two main outcomes at expiration.

- Stock Stays Above $90: If Growth Inc. is trading at $92 on expiration day, the put expires worthless. You keep the full $200 premium, and the $9,000 is freed up. You didn't get the stock, but you got paid to be patient.

- Stock Drops Below $90: If the stock falls to $88, you'll be assigned to buy 100 shares at the $90 strike, using your secured cash. Yes, the stock is trading lower, but your effective purchase price is actually $88 per share ($90 strike price minus the $2 per share premium you received). You got into the stock at a better price than you would have otherwise.

The main risk is the stock could plummet well below your strike price. You'd still have to buy it at $90, but since you were willing to own the company at that price anyway, it's a risk you've already accepted. That's why you should only use this strategy on companies you genuinely want to own.

To get really good at this, looking at how these strategies performed in the past is a game-changer. For anyone serious about building a solid approach, historical options data is an indispensable resource. Datasets going back to January 2010 let you see exactly how options on thousands of stocks reacted to different market conditions. You can explore options data to refine your strategy on FirstRateData.com and see for yourself.

How to Navigate a Trading Platform

This is where your strategy meets the market. Opening a trading platform for the first time can feel like stepping into an airplane cockpit—a dizzying sea of numbers, columns, and flashing buttons.

But just like a pilot, you only need to focus on a few key instruments to get started safely. We’ll break down the single most important screen in options trading: the option chain.

Think of the option chain as a menu of all available call and put options for a specific stock. It’s how you find and place a trade, and every platform has one. Typically, you'll see calls on the left and puts on the right, with a list of strike prices running right down the middle.

The recent explosion in beginner options trading has pushed platforms to become way more intuitive. In fact, options trading volumes soared past 10 billion contracts in 2022, and all that activity means it's easier for new traders to get in and out of positions smoothly. To see the full picture, you can read the research on options trading statistics on TheTradingAnalyst.com.

Decoding the Option Chain

When you pull up an option chain, you're hit with several columns of data. It looks intimidating, but for covered calls and cash-secured puts, you only need to care about a handful of them. Let's focus on the absolute must-knows.

- Strike Price: This is the anchor of your entire trade—the price at which you agree to buy or sell the stock.

- Bid and Ask: The Bid is the highest price a buyer will pay for an option, and the Ask is the lowest price a seller will accept. When you sell an option to collect premium, you’ll get a price at or very close to the bid.

- Last: This simply shows the price of the very last trade made for that specific contract.

- Volume: This number tells you how many contracts of that option have been traded today. High volume means lots of interest.

- Open Interest (OI): This is the total number of option contracts that are currently open. High open interest is a great sign for beginners because it signals a deep, liquid market, making it easy to enter and exit trades.

These data points are your navigation tools. They help you pick an option that’s popular and liquid enough to trade without any headaches. If you're looking for the right tools to make this even simpler, our guide on choosing an options trading platform can point you in the right direction.

Placing Your First Covered Call

Alright, let's walk through placing a covered call step-by-step using what we've just learned. The process is pretty much the same on any major brokerage platform.

Select Your Stock: You must already own at least 100 shares of the stock you want to use. Let's say you own 100 shares of XYZ Inc.

Navigate to the Option Chain: In your platform, type in the ticker (e.g., XYZ) and find the "Options" or "Chain" tab.

Choose an Expiration Date: Pick an expiration date that fits your income goals. Shorter-term options, around 30-45 days out, are popular for collecting premium on a regular basis.

Find a Strike Price: Look at the call side of the chain. Find a strike price above the current stock price that you’d be happy to sell your shares at. Check the Bid price to see the premium you'll get.

Create the Order: Click on the Bid price for the strike you chose. An order ticket will pop up. You’ll want to select "Sell to Open," enter the number of contracts (1 contract for your 100 shares), and make sure the order type is a "Limit" order at your desired price.

Review and Submit: Give it one last look—stock, strike, expiration, and premium. If it all looks correct, hit submit. The premium should land in your account almost instantly.

A Realistic Approach to Managing Risk

Successful options trading isn't about hitting home runs on every trade. It's about playing smart defense. Before anything else, a profitable trader is a disciplined risk manager. This means cutting through the hype and focusing on the real, tangible risks that come with the strategies you're using.

For those just starting out, the two strategies we’ve talked about—covered calls and cash-secured puts—come with defined, manageable risks. They are specifically designed to help you avoid the kind of catastrophic losses that can happen with more complex, speculative trades.

Getting a handle on these boundaries is the first step toward trading with real confidence.

The Real Risk of Covered Calls

When you sell a covered call, your main risk isn't a financial loss in the traditional sense. After all, you already own the stock. The real risk is opportunity cost—the painful feeling of missing out on a massive rally.

Imagine you sell a covered call on a stock at a $50 strike price. If that stock unexpectedly rockets to $70, you’re still obligated to sell your shares at $50. Yes, you made a profit, but you missed out on that extra $20 per share of upside.

The key to managing this is picking the right strike price. A strike further away from the current price will earn you less premium, but it gives the stock more room to run before your profit gets capped.

The Real Risk of Cash-Secured Puts

With cash-secured puts, the danger is a bit more direct: you might be forced to buy a stock that keeps falling. If you sell a put with a $90 strike and the stock plummets to $70, you still have to buy it at $90. You'll instantly own a stock that's underwater on paper.

This brings us to the golden rule of this strategy: only sell puts on high-quality companies you genuinely want to own at the strike price. If you wouldn’t be happy buying the stock at that price, don't sell a put on it. The premium you collect is nice, but it won’t save you from a bad investment decision.

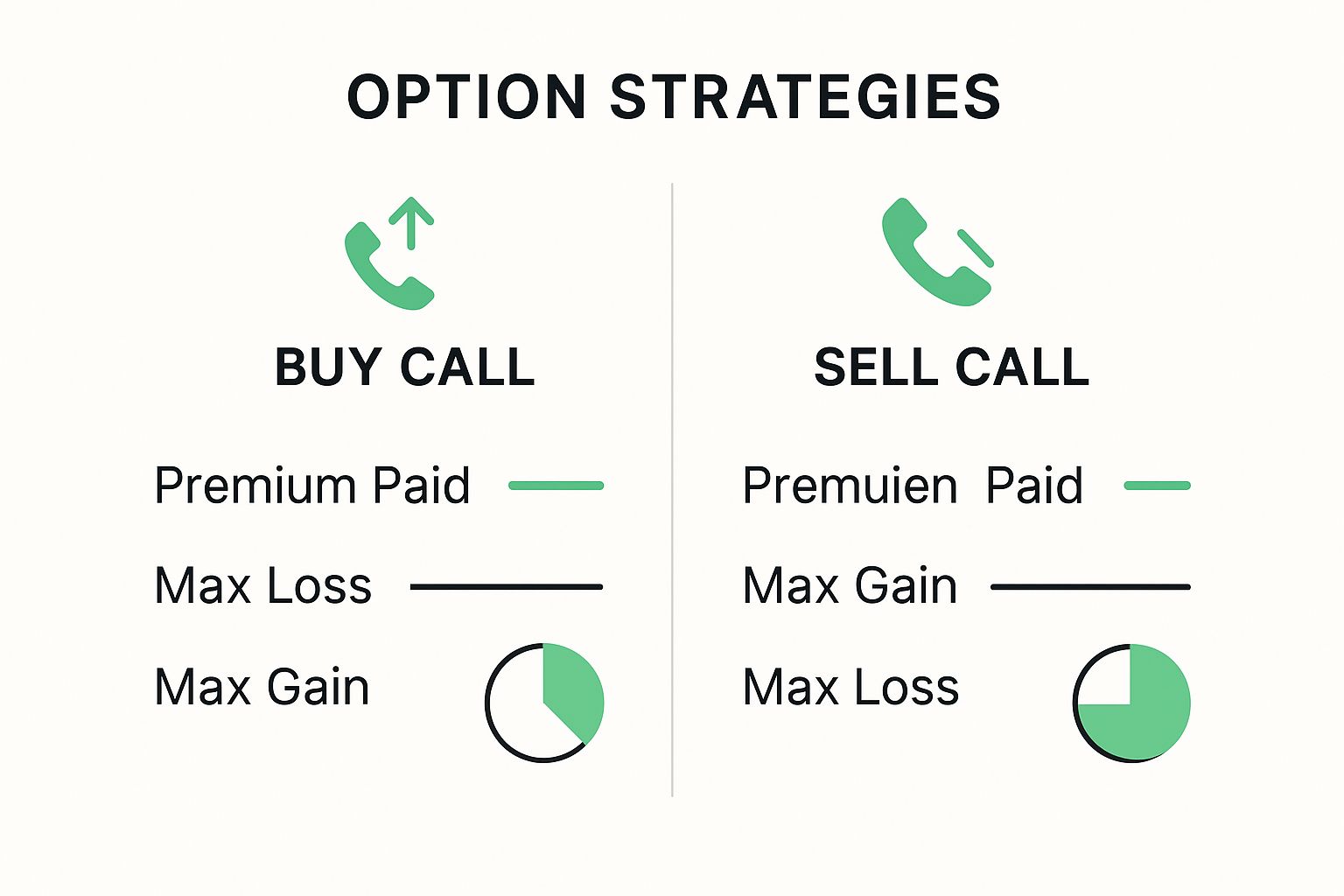

This infographic breaks down the core difference between buying a call and selling one—a fundamental concept for managing your risk.

As you can see, selling options limits your max gain to the premium you pocket, but it also defines your risk from the start. That's a core principle for any smart beginner's plan.

To make this clearer, let's compare these two foundational strategies side-by-side.

Risk and Reward for Beginner Strategies

| Strategy | Maximum Profit | Maximum Risk | Best Market Condition |

|---|---|---|---|

| Covered Call | Limited to the premium received + stock appreciation to the strike price. | The stock price falling to zero, minus the premium collected. | Neutral, slightly bullish, or sideways markets. |

| Cash-Secured Put | Limited to the premium received. | The strike price minus the premium received (if the stock goes to zero). | Neutral, slightly bearish, or sideways markets on a stock you want to own. |

This table highlights the trade-offs. Both strategies shine in stable markets and offer a way to generate income, but they do so by capping either your upside potential or agreeing to a potential purchase price.

Timeless Principles for Smart Trading

Beyond the specifics of each strategy, a couple of universal principles are non-negotiable if you want to protect your capital. Building these habits from day one will serve you for your entire trading journey.

Key Insight: Your goal isn't just to make winning trades. It's to ensure that no single losing trade can ever take you out of the game.

Here are two rules to live by:

Smart Position Sizing: Never go all-in. A common rule of thumb is to risk no more than 1-2% of your total account value on any single trade. This discipline ensures that even a string of bad luck won't wipe you out.

Have a Clear Exit Plan: Know how you'll get out before you get in. For a covered call, that might mean rolling the option to a later date. For a cash-secured put, it means being truly ready—financially and mentally—to own the stock. Never enter a trade just "hoping" it works out.

Mastering these concepts is what separates disciplined traders from gamblers. For a complete overview of protective strategies, our detailed guide offers deeper insights into options trading risk management. And if you're interested in the math behind modeling complex scenarios, this Monte Carlo simulation finance guide is a great place to start.

By treating risk management as your top priority, you build a sustainable foundation for long-term success.

Your Top Options Trading Questions, Answered

Once you get the hang of the strategies and start looking at a trading platform, a few practical questions always pop up. Let’s tackle the most common ones I hear from new traders. Getting these answers straight will build your confidence before you put any real money on the line.

How Much Money Do I Really Need to Start?

There isn't a magic number here. It’s less about a minimum deposit and more about what you need to execute a specific trade correctly.

For a cash-secured put, you have to have enough cash on hand to buy 100 shares at the strike price you choose. So, if you sell a put with a $50 strike, you’ll need $5,000 sitting in your account, ready to go. For a covered call, you must already own 100 shares of the stock.

The most important rule? Only start with money you are genuinely prepared to lose. All trading has risks. That said, most beginners find that a few thousand dollars is a solid starting point to learn these two strategies without feeling overexposed.

What Actually Happens When My Option Expires?

Expiration day is when the contract settles. The outcome is simple: it all depends on whether the option is "in-the-money" (ITM) or "out-of-the-money" (OTM) when the market closes.

Here’s the breakdown for the strategies we've discussed:

- Your Sold Covered Call: If the stock closes below your strike price (OTM), the contract is worthless. You keep 100% of the premium and your 100 shares. If it closes above the strike (ITM), your shares get sold at that strike price—and you still keep the premium.

- Your Sold Cash-Secured Put: If the stock closes above your strike price (OTM), the contract is worthless. You just keep the premium. If it closes below the strike (ITM), you’ll be assigned to buy 100 shares at the strike price, using the cash you set aside.

Notice a pattern? In both out-of-the-money scenarios, you achieve your goal perfectly: collecting income.

Can I Lose More Than I Invest?

This is a huge question, and the answer is precisely why covered calls and cash-secured puts are perfect for beginners. For these two strategies, the answer is no. You can't lose more than your defined risk.

With a covered call, your risk is the opportunity cost—what you miss out on if the stock price skyrockets past your strike. With a cash-secured put, your maximum risk is the cash you secured for the trade (minus the premium you already pocketed).

Heads Up: This safety net is not universal in the options world. Advanced strategies, like selling "naked" options, come with the risk of massive, even unlimited, losses. Stick to defined-risk strategies until you have plenty of experience under your belt.

What Are "The Greeks"?

Sooner or later, you'll hear traders talking about "the Greeks." Don't let the name intimidate you. They're just metrics that measure how an option's price reacts to things like stock price changes, time, and volatility.

For now, only two really matter: Delta and Theta.

- Delta: Think of this as a rough guide for how much an option's price will move for every $1 change in the stock's price. It also gives you a ballpark probability of the option finishing in-the-money.

- Theta: This measures "time decay"—the amount of value an option loses every single day as it gets closer to expiring.

As an option seller, Theta is your best friend. The value of the contract you sold literally melts away with time, which is exactly what you want to happen.

Ready to stop guessing and start making data-driven decisions? Strike Price provides real-time probability metrics for every trade, helping you balance safety and income. Get smart alerts and tailored strategies to maximize your premium earnings today. Learn more at https://strikeprice.app.