The Definition of Covered Call Explained

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Synthetic Covered Call: A Clear Guide to the synthetic covered call

Understand the synthetic covered call: how it works, key benefits, risk controls, and practical examples.

Define Covered Calls A Guide to Generating Consistent Income

Define covered calls with this practical guide. Learn to generate consistent income from your stocks, manage risk, and apply proven strategies for success.

A Trader's Guide to the Iron Condor Options Strategy

Discover the iron condor options strategy. This guide explains how to generate consistent income from range-bound stocks with real-world examples and tactics.

A covered call is one of the most popular ways to generate a little extra income from stocks you already own. At its core, you own at least 100 shares of a stock and sell someone else the right to buy those shares from you at a set price, within a specific timeframe. For selling that right, you get paid an upfront fee, called a premium.

What Exactly Is a Covered Call

The easiest way to think about it is like being a landlord for your stocks. You own the asset—your shares—and you're essentially renting them out by selling a call option. That premium you collect is like a rent check, giving you a steady drip of income whether the stock’s value inches up or down.

It's important to get this part straight: you're not actually selling your shares. You're selling a contract, a call option, that gives another investor the right (but not the requirement) to buy your shares at a price you both agree on beforehand.

This is why it's called "covered"—your promise to sell the shares is backed, or covered, by the fact that you already own them. This is a foundational concept in the world of options trading. You can learn more about the basics of how options work if you need a quick refresher.

The Core Components

So, what are the moving parts of this strategy? To really get a handle on covered calls, you need to understand the four key pieces that make up every trade. Each one shapes the structure of the deal and what the potential outcome could be.

Before we break down the components, let's look at a quick summary table.

Covered Call At A Glance

| Component | Role In The Strategy |

|---|---|

| Underlying Stock | The shares you own (at least 100 per contract). This is the "covered" part. |

| Call Option | The contract you sell, giving the buyer the right to purchase your shares. |

| Strike Price | The agreed-upon price at which you'll sell your shares if the buyer exercises the option. |

| Expiration Date | The date the contract becomes void. After this, the buyer's right to purchase your shares is gone. |

Each of these pieces—the stock, the option, the strike price, and the expiration date—work together to define the trade. Getting comfortable with these terms is the first step toward using this strategy effectively.

The real power of a covered call is its ability to turn a stagnant stock holding into an income-producing asset. The premium you receive acts as a small, consistent return, lowering your overall cost basis and providing a buffer against minor price drops.

How a Covered Call Works in Practice

Let’s get down to the brass tacks. How do you actually put a covered call to work?

Before you can do anything, you need two things: at least 100 shares of a stock and a brokerage account that's approved for options trading. If you’ve got those, you’re ready to go.

The process itself is surprisingly simple. You sell a call option contract that is "covered" by the shares you already own. The moment you do this, the option's premium gets dropped right into your account.

That cash is yours to keep, no matter what happens next. You’re essentially getting paid today for agreeing to potentially sell your shares at a higher price in the future. It’s a straightforward way to create an instant income stream from stocks you already have in your portfolio.

Making the Key Decisions

Success here isn't about luck; it's about making a few smart decisions upfront. You're not just throwing darts at an option chain. You're making calculated choices that align with your goals for the stock.

Here’s what you need to decide:

- Which Stock to Use? You’ll want to pick a solid, stable stock in your portfolio—one you don't think is about to blast off to the moon.

- What Strike Price? This is the price you agree to sell your shares for. A higher strike price is safer (less chance of being sold) but pays a smaller premium. A strike price closer to the current stock price brings in more cash but also increases the odds of your shares being called away.

- Which Expiration Date? Shorter-term options, like weeklys or monthlys, let you generate income more often but require you to be more hands-on. Longer-term options pay a bigger premium upfront but lock you in for a longer period.

This strategy shines in markets that are flat or slowly grinding upwards, where your stock isn't likely to scream past your chosen strike price. The premiums you collect can cushion your portfolio against small dips in the stock's price and seriously boost your returns, especially when other income sources are weak.

Understanding the Trade Mechanics

Let's walk through a quick example. Imagine you own 100 shares of XYZ Corp., which is trading at $50 a share. You feel pretty confident it's not going to move much over the next month.

So, you decide to sell one call option with a $55 strike price that expires in 30 days. For making this agreement, a buyer pays you a premium of $1.50 per share. That comes out to $150 ($1.50 x 100 shares), which lands in your account immediately.

Just like that, you've generated income from your shares while you continue to hold them. The trade-off? You've agreed to cap your potential gains at $55 per share until the option expires.

This practical, intuitive approach is why so many investors dip their toes into the options world with covered calls. For a much deeper dive into the nuts and bolts, check out our complete guide on selling covered calls for income. Now, let’s look at what can happen once the trade is on.

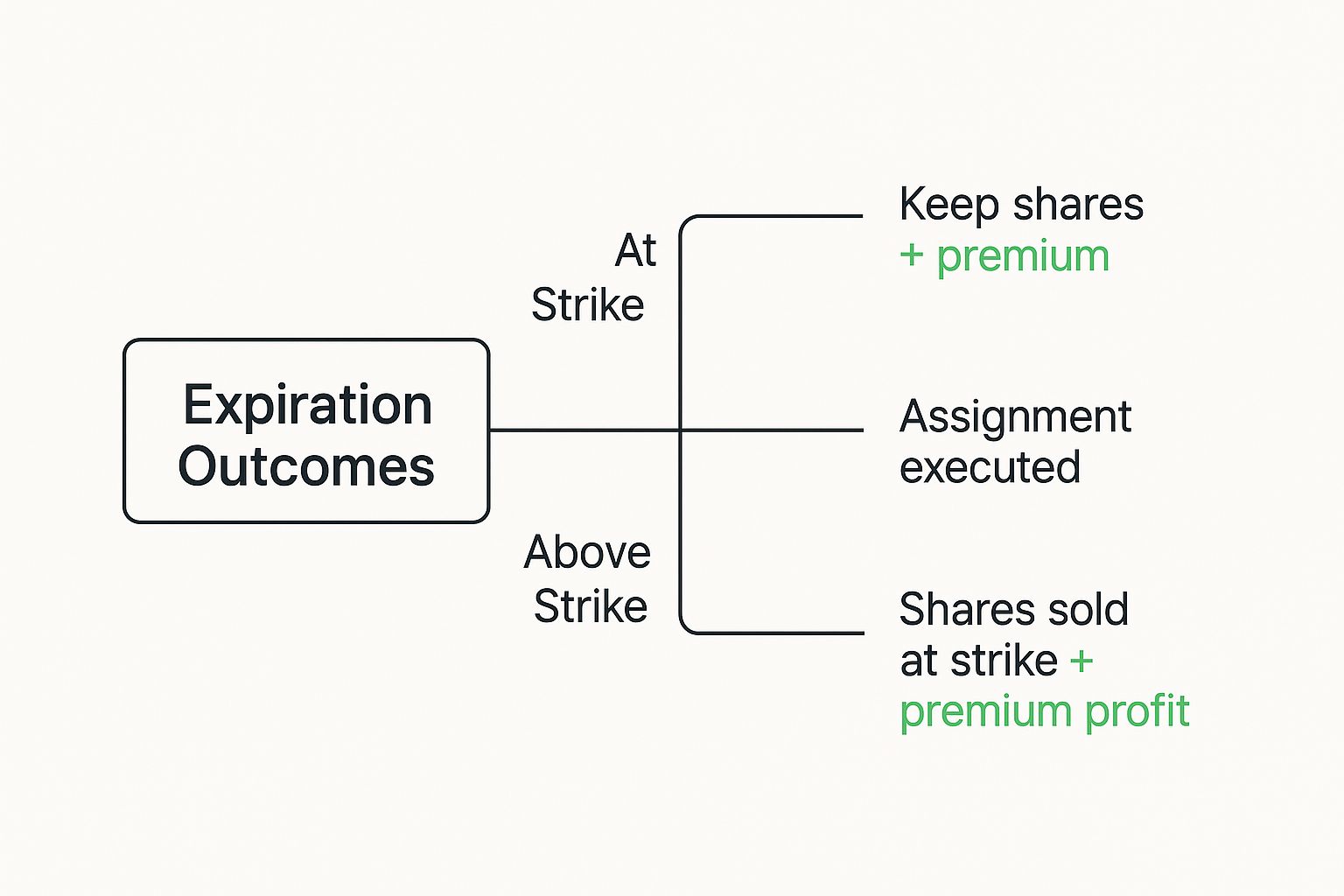

The Three Ways Your Covered Call Can End

Once you've sold a covered call, the trade is in motion. By the time the expiration date rolls around, it will resolve in one of three ways. It all comes down to a simple question: where is the stock price relative to the strike price you picked?

Getting a handle on each scenario is the key to managing your expectations and understanding the real risks and rewards of this strategy.

As you can see, two of the three paths lead to you pocketing the premium and keeping your shares, which is exactly what most income-focused traders are hoping for.

Outcome 1: The Stock Price Stays Below the Strike Price

For many, this is the best-case scenario. If the stock’s price is trading below your strike price when the option expires, that option becomes worthless. The buyer has zero incentive to buy your shares for more than they cost on the open market.

So, what happens? You keep the entire premium you collected upfront, and you also keep all 100 of your shares. You're now free to write another covered call for the next month, repeating the income cycle. It's a perfect strategy for a stock that's moving sideways or even down a little.

This is the ideal ending for most investors: you make money from a stock you wanted to own anyway. That premium you collected effectively lowers your cost basis and boosts your total return, all without having to sell a thing.

Outcome 2: The Stock Price Goes Above the Strike Price

Now, if the stock price closes above your strike price, things get interesting. The buyer will almost certainly exercise their right to buy your shares at that agreed-upon price. In options lingo, this is called assignment.

Your broker handles everything automatically, selling your 100 shares to the option buyer at the strike price. Your total profit is a combination of the premium you already received plus any capital gains between your original purchase price and the strike. You'll miss out on any upside above the strike, but you still walk away with a profitable, predictable trade.

Outcome 3: The Stock Price Lands Exactly at the Strike Price

This is the rarest of the three outcomes, but it can happen. If the stock price is sitting exactly at the strike price at expiration, the buyer may or may not exercise the option.

In most situations, though, assignment will likely still occur, and your shares will be sold. The profit math works out the same as in Outcome 2.

Why Bother With Covered Calls?

Let's cut to the chase: the number one reason investors get into covered calls is for the income. The premium you collect for selling that call option is an instant cash payment—think of it as a synthetic dividend you get for owning stocks you already have.

It’s a fantastic way to put your portfolio to work, squeezing extra yield out of your holdings. This strategy lets you get paid while you wait, turning even stagnant stocks into assets that generate a steady cash flow.

A Built-In Cushion for Your Investments

Another huge plus is risk reduction. When you collect that option premium, you’re effectively lowering the cost basis of your stock. It's like getting an instant rebate on your original purchase price.

This premium gives you a real, tangible buffer if the stock price dips. If the shares drop a little, the income you’ve already pocketed helps offset that paper loss, giving your position a bit of a cushion.

The dual advantage of consistent income and downside cushioning is why covered calls are so popular. They can provide equity-like returns with lower volatility and smaller drawdowns, making them an attractive option for risk management.

History backs this up. Covered call strategies consistently show lower volatility than just holding the stocks outright. One study found that over nearly a decade, global covered calls delivered an average annualized return of 6.6% with volatility of 14.8%. In contrast, the underlying indexes returned 7.2% but with a much rougher ride at 21.2% volatility. You can dig into more insights about covered call performance if you're curious.

Turning a Flat Market Into a Payday

Finally, covered calls are your best friend when the market is just... stuck. While buy-and-hold investors are watching their portfolios go nowhere during periods of stagnation, covered call writers can keep collecting those premiums month after month.

This strategy turns a boring, sideways market into a reliable source of profit. You can literally make money even when your stocks aren't going up.

Understanding the Key Risks Involved

As appealing as generating extra income sounds, every smart investor knows there’s no free lunch. The covered call strategy is no different, and its main risk is something you need to be comfortable with from the start: capped upside potential.

When you agree to sell your shares at a set strike price, you're also agreeing to wave goodbye to any gains if the stock absolutely skyrockets past that price. It’s the core trade-off.

Let’s say you own 100 shares of a stock you bought at $50. You sell a covered call with a $55 strike price. Then, the company announces a game-changing breakthrough, and the stock rips to $75. Your shares? They’re getting sold at $55. You definitely made a profit, but you also left an extra $2,000 in potential gains on the table.

Once that trade is active, you’re obligated to sell at the strike. There’s no changing your mind to hold on for bigger profits.

The Downside Isn't Fully Covered

Here’s another reality check: the premium you collect only offers a tiny cushion if the stock takes a nosedive.

If your $50 stock tumbles to $30, that $150 premium you collected doesn’t do much to soften a $2,000 paper loss. The "covered" part of the name simply means you already own the shares—it doesn't mean you're protected from a serious drop.

The core trade-off is clear: you are exchanging the potential for unlimited upside gains for a small, known premium. This makes stock selection crucial—the strategy works best on stocks you don't expect to be highly volatile.

Managing these risks all comes down to careful planning and being genuinely okay with selling your shares at the price you choose. For a deeper dive into protecting your portfolio, our guide on options trading risk management lays out some valuable strategies.

Ultimately, smart risk management is what separates consistent income from unexpected, painful losses.

Got Questions About Covered Calls?

Diving into a new strategy always kicks up a few questions. To help clear things up, let's walk through some of the most common things investors ask when they first start looking at covered calls.

What Happens When My Shares Get Called Away?

If your stock closes above the strike price when the option expires, your shares will probably be "called away" or assigned.

Don't worry, this is an automatic process. Your broker sells your 100 shares to the option's buyer at the strike price you agreed to. You get to keep the premium you collected upfront and the cash from the sale, locking in a predictable profit.

Can I Get Out of a Covered Call Early?

Absolutely. You don't have to wait for the option to expire.

You can close your position anytime by buying back the same option you sold. This is called a "buy to close" order. If the option's price has dropped since you sold it, you can buy it back for less and pocket the difference, freeing up your shares right away.

This is a super important risk management move. If the stock starts climbing fast and you decide you don't want to sell your shares after all, you can buy back the call. You'll likely take a small loss on the option itself, but it gets you off the hook.

What Kinds of Stocks Work Best for This?

The sweet spot for covered calls is usually stable, blue-chip stocks you wouldn't mind holding onto for the long haul anyway. Think of companies that tend to trade sideways or grow slowly and steadily.

High-flying, volatile growth stocks are often a bad fit. A sudden price spike could force you to sell your shares and miss out on some massive gains.

Is This a Good Strategy for Beginners?

Many traders consider covered calls one of the best ways to get started with options.

Its risk profile is much more conservative than other strategies because your obligation to sell is "covered" by the shares you already own. It’s a fantastic, hands-on way to learn about strike prices, premiums, and expirations while actually generating some income.

Ready to stop guessing and start making data-driven decisions? Strike Price gives you the real-time probability metrics you need to balance safety and premium yield on every trade. Turn your portfolio into a consistent income engine by visiting https://strikeprice.app to see how.