How to Learn Options Trading From the Ground Up

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

What Is Risk Adjusted Return? A Practical Guide

What is risk adjusted return? This guide explains how to measure it with the Sharpe Ratio, how to interpret the numbers, and why it's key to smarter investing.

Learning how to trade options isn't about finding some secret formula. It’s a step-by-step process that starts with the absolute basics, moves into practice, and then slowly introduces simple strategies. The goal is to build a solid foundation around calls, puts, strike prices, and risk management before you ever put real money on the line.

Building Your Core Options Knowledge

Before you even think about placing a trade, you need to get the fundamentals down cold. Options can seem complicated with all the jargon, but everything boils down to a few key ideas. At its core, an option is just a contract giving the buyer the right, but not the obligation, to buy or sell something at a set price by a certain date.

Think of it like putting a deposit on a house you want to buy. You pay a small fee (the premium) to lock in a purchase price (the strike price) for a set amount of time. If the house's value skyrockets, your right to buy it at that lower, locked-in price becomes incredibly valuable. If the value goes down, you just walk away, losing only your initial deposit—not the entire value of the house.

This simple analogy introduces the three pillars of every single options contract:

- The Strike Price: This is the locked-in price where the asset can be bought or sold. It's the anchor for your entire trade.

- The Expiration Date: Every option has a shelf life. After this date passes, the contract is worthless. Time is a critical, and constantly decaying, asset.

- The Premium: This is what you pay for the contract itself. The buyer pays it to the seller, and for the buyer, it represents the absolute most they can lose.

Calls and Puts: The Two Sides of the Coin

The entire options market is built on just two types of contracts: calls and puts. Understanding what they do is non-negotiable.

A call option gives you the right to buy an asset at the strike price. You'd typically buy a call when you're bullish and think the price of the underlying stock is going to head higher.

On the flip side, a put option gives you the right to sell an asset at the strike price. Buying a put is a common move when you're bearish and expect the asset's price to drop.

Of course, for every buyer, there's a seller (often called a "writer") who collects that premium. Sellers take on the obligation to make good on the contract if the buyer decides to exercise their right. You can dive deeper into the mechanics of how this all fits together in our guide on how options trading works.

Here's a quick way to keep the four basic roles straight:

Core Options Roles At a Glance

| Action | Option Type | Market Outlook | Your Goal |

|---|---|---|---|

| Buy | Call | Bullish 📈 | Profit from a price increase |

| Buy | Put | Bearish 📉 | Profit from a price decrease |

| Sell | Call | Bearish/Neutral 📉 | Collect premium; stock stays below strike |

| Sell | Put | Bullish/Neutral 📈 | Collect premium; stock stays above strike |

This table simplifies the starting point for any trade. Your action and option type directly reflect what you think the market will do next.

Learning to Read the Market's "Menu"

A huge part of your learning curve is getting comfortable with the data. A critical skill is learning to read an options chain, which is basically a big table listing all the available contracts for a stock. It shows you every strike price, expiration date, and premium available. Learning How To Read Options Chain is an essential next step on your journey.

Key Takeaway: Don't rush this part. Your first goal is to get an intuitive feel for how strike prices, expiration dates, and premiums all work together. This foundational knowledge is what separates smart decisions from pure gambling. Your understanding of these mechanics is the best risk management tool you'll ever have.

Understanding the Language of the Greeks

If you’ve spent any time looking at options, you've probably run into the "Greeks." They might sound like something out of a math textbook, but don't let the name fool you. These are your essential risk-management tools, telling you exactly how your option's price is expected to react to the market's every move.

Learning the Greeks is what separates casual bets from calculated, strategic trading.

Think of it this way: an option's price is constantly being pulled in different directions. The stock price changes, time ticks by, and overall market volatility shifts. The Greeks are what let you measure the force of each of those pulls individually.

Delta: The Speed of Your Option

Delta is the first, and arguably most important, Greek you need to know. It tells you how much an option's price should move for every $1 change in the underlying stock. In short, it’s the "speed" of your option.

A call option with a Delta of 0.40, for example, is expected to gain $0.40 in value for every $1 the stock goes up. If the stock drops by $1, that same option will lose about $0.40. Delta is your direct link between the stock's performance and your option's P&L.

Pro Tip: Traders often use Delta as a quick-and-dirty estimate for the probability of an option expiring in-the-money. A Delta of 0.30 roughly translates to a 30% chance of the option finishing in-the-money.

Theta: The Cost of Time

Meet Theta, the silent portfolio killer for option buyers. It measures the impact of time decay, showing you how much value an option loses every single day as it gets closer to expiration.

This decay is relentless. It happens even if the stock price doesn't budge an inch.

Theta is always a negative number. An option with a Theta of -0.05 will lose about $0.05 of its value each day, purely from the passage of time. This effect picks up speed dramatically as the expiration date nears, which is why holding short-dated options can be so risky.

Want to see how all these metrics work together? Check out our complete guide explaining what option Greeks are.

Vega: Volatility's Influence

Vega tells you how much an option’s price will change for every 1% shift in the stock's implied volatility. Volatility is just a fancy word for how much the market expects a stock to move. More expected movement means higher volatility, and higher volatility means more expensive options.

If your option has a Vega of 0.10, its price will climb by $0.10 for every 1% jump in implied volatility. This is why options get so pricey right before a company's earnings report—the market is bracing for a big move, so implied volatility (and Vega's impact) is through the roof.

After the news is out, that uncertainty vanishes. Volatility collapses, and option prices often crater along with it.

A Practical Example of the Greeks in Action

Let's put this all together with a hypothetical trade. Imagine XYZ stock is trading at $100.

- You buy one $105 call option that expires in 30 days.

- The premium you pay is $2.00 ($200 per contract).

- The option's initial Greeks are: Delta: 0.40, Theta: -0.04, Vega: 0.12.

Fast forward one week. The stock has rallied to $103.

Your option is now more valuable, and its Delta will have increased (maybe to 0.55), making it even more sensitive to future stock price moves. But at the same time, seven days of Theta decay have quietly shaved some value off the premium.

This is the multi-dimensional game of options trading. Your position is a living thing, constantly reacting to price, time, and volatility. By keeping an eye on the Greeks, you can anticipate how your trades will behave, manage your risk, and ultimately make much smarter decisions.

Applying Your Knowledge with Paper Trading

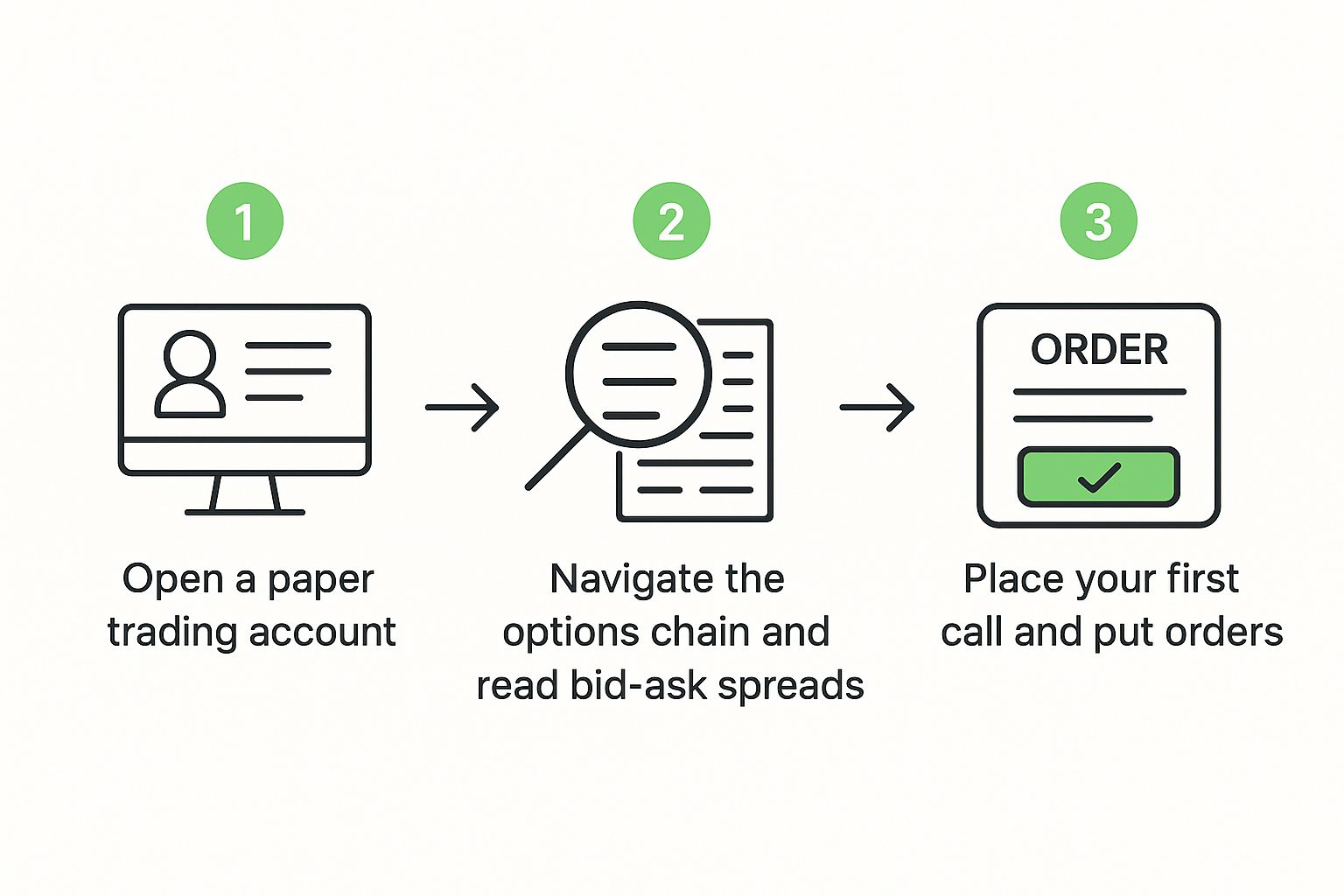

You’ve got the theory down—calls, puts, the Greeks. Now it’s time to actually do something with that knowledge. This is where paper trading comes in. Think of it as your personal, risk-free training ground for the real market.

It's the flight simulator for traders. No pilot ever learns to fly with a planeload of real passengers on their first day. They spend hours in a simulator, building muscle memory and making mistakes where the consequences are zero. Paper trading gives you that exact same safe environment.

Choosing Your Platform and Getting Set Up

Almost every major brokerage offers a paper trading account, sometimes called a "virtual" or "practice" account. Big names like Interactive Brokers, TD Ameritrade's thinkorswim, and E*TRADE all provide robust simulators that look and feel just like their live trading platforms.

Getting started is usually simple. You'll create a simulated portfolio and get a chunk of virtual cash to play with—often $100,000 or more. This lets you practice without the stomach-churning stress of risking your own money.

Here's a peek at what a paper trading interface looks like, using Interactive Brokers as an example.

As you can see, it's a clean interface where you can access market data and place trades just like you would in a live account. The trick is to treat this virtual money as if it were real. That's how you build good habits from day one.

Making Your First Practice Trades

Once you're in, the first goal is simple: get comfortable with the mechanics of placing an order. This means learning to navigate an options chain, understanding bid-ask spreads, and actually executing a trade.

To do that, you need to know what you're looking at. The options chain is the heart of it all.

How to Read an Options Chain

The options chain can look intimidating at first, but it's just a table of data. Breaking it down makes it much easier to understand and use for placing your first paper trades.

| Column Name | What It Means for You | Why It Matters for Your Trade |

|---|---|---|

| Strike Price | The price where you can buy (call) or sell (put) the stock. | This is the core of your bet. Is the stock likely to move past this price? |

| Expiration Date | The date your option contract becomes void. | This determines how much time your trade has to work out. More time costs more premium. |

| Bid | The highest price a buyer is currently willing to pay for the option. | This is roughly the price you'll get if you sell an option. |

| Ask | The lowest price a seller is currently willing to accept for the option. | This is roughly the price you'll pay if you buy an option. |

| Last Price | The price at which the last trade for that option occurred. | It gives you a recent reference point, but the Bid/Ask is more current. |

| Volume | The number of contracts traded for that option today. | High volume means more traders are active, which usually leads to tighter bid-ask spreads. |

| Open Interest | The total number of open contracts that have not been settled. | High open interest indicates a liquid market for that specific option. |

By getting familiar with these columns, you'll be able to quickly find the contract you want and understand the key variables at play before you click "buy" or "sell."

Let's walk through placing a couple of fundamental trade types.

Placing a Bullish Call Order

Let's imagine you're bullish on a well-known tech company, we'll call it "Innovate Corp" (ticker: INOV), currently trading at $150 per share. You think the stock might climb over the next month.

- Find the Options Chain: First, pull up the INOV stock quote in your platform and open its options chain.

- Pick an Expiration: Choose an expiration date about 30-45 days out. This gives your trade enough time to work without time decay (Theta) eating your lunch right away.

- Choose a Strike Price: You select a $155 strike price. This is slightly "out-of-the-money," so it's cheaper than an in-the-money option but still has a realistic shot.

- Analyze the Bid-Ask Spread: You see the bid is $3.45 and the ask is $3.55. The bid is what buyers are offering; the ask is what sellers are demanding.

- Place the Order: You place a limit order to "Buy to Open" one $155 call contract at a price of $3.50 (right in the middle), costing your account $350 in virtual funds.

The goal here isn't to get rich with fake money. It's to execute the trade cleanly and watch how its value changes as the stock moves and time ticks by.

Key Insight: Your paper trading account is a laboratory. Use it to experiment with different strike prices and expirations to see firsthand how they change an option's risk and reward. It’s also the perfect place to test out strategies before risking real capital. You could run dozens of simulated trades to backtest option strategies and see how they would have performed in the past.

Buying a Protective Put

Now for a different scenario. Let's say your paper portfolio also holds 100 shares of "Stable Co" (ticker: STBL), which you "bought" at $50. You’re worried about a potential dip in the market but want to hold the stock for the long haul.

You can buy a protective put to hedge this position.

- Find the Options Chain: Pull up the options chain for STBL.

- Select an Expiration: Choose an expiration about 60 days out to give yourself plenty of protection time.

- Choose a Strike Price: You pick a $48 strike put. This essentially guarantees you can sell your 100 shares for at least $48 each, no matter how low the stock price falls.

- Execute the Trade: You see the $48 put is trading for $1.20. You "Buy to Open" one contract, which costs $120 in virtual cash.

That $120 is your insurance premium. You've now capped your downside risk on the stock for the next two months. By successfully placing these two basic orders—a speculative call and a protective put—you'll build the fundamental muscle memory needed for any strategy that comes next.

Exploring Your First Options Strategies

Now that you’ve gotten your feet wet with a paper trading account, it’s time to look at some real-world strategies. We’re not diving into the deep end with complex, multi-leg trades just yet. Instead, we’ll focus on a few foundational plays that give you a clear, defined risk from the start.

Think of these as the building blocks of your options trading journey. They aren't about hitting grand slams; they're about learning to hit consistent singles. Each one serves a specific purpose, whether you want to generate some income from stocks you already own or buy shares at a discount.

The Covered Call: Your First Income Strategy

The covered call is a classic for a reason—it’s a favorite for both newcomers and seasoned traders. It’s a straightforward way to make the stocks in your portfolio work for you. If you own at least 100 shares of a stock, you can put this strategy into action.

Here's the setup: you sell one call option for every 100 shares you own. The moment you sell that call, you collect a premium. That cash is yours to keep, no matter what happens next.

Your ideal scenario is for the stock price to stay below the call's strike price. If it does, the option expires worthless, you keep your shares, and you pocket the full premium. It’s like getting your stocks to pay you rent.

Ideal Market Condition: You're neutral to slightly bullish on the stock. You don’t see it rocketing up in the short term, but you’re perfectly happy holding on to your shares.

Let’s run through a quick example:

- You own 100 shares of Apple (AAPL), currently trading around $190.

- You decide to sell one AAPL call option with a $200 strike price that expires in 30 days.

- For selling it, you immediately collect a premium of $2.50 per share, which is $250 total.

What could happen next?

- AAPL stays below $200: The call option expires worthless. You keep your 100 shares of Apple and the $250 premium. Win-win.

- AAPL rises above $200: The option gets exercised. You have to sell your 100 shares at the $200 strike price. You still keep the $250 premium, and you've locked in a nice gain on the stock itself. Your upside is simply capped at that $200 price.

The Cash-Secured Put: Acquiring Stock at a Discount

Ever look at a stock you want to own but think the price is just a little too high? The cash-secured put was made for exactly this situation. It lets you either buy a stock you like at a lower price or get paid while you wait.

To pull it off, you sell a put option on a stock you're willing to own. The "cash-secured" part is key: you must have enough cash set aside to buy 100 shares at the option's strike price if the trade goes that way.

When you sell the put, you collect a premium upfront. If the stock price drops below your chosen strike price by expiration, you’ll be assigned the shares—meaning you buy them at your desired lower price. If the stock stays above the strike, the option expires worthless, and you just keep the premium. It's a fantastic strategy for patient investors.

Vertical Spreads: Directional Bets with Capped Risk

Ready for the next step? Vertical spreads are a great way to learn about combining options because they let you define your exact risk upfront. They are directional bets—either bullish or bearish—with a fixed maximum profit and loss.

Spreads involve buying one option and selling another at the same time.

There are two main types you'll encounter:

- Bull Call Spread (Debit Spread): You buy a call at a lower strike price and sell a call at a higher strike price. You pay a small amount (a "net debit") to enter the trade and profit if the stock price goes up.

- Bear Put Spread (Debit Spread): You buy a put at a higher strike price and sell a put at a lower strike price. This also costs a net debit and profits if the stock price falls.

What makes spreads so powerful is that they lower your cost to enter a trade compared to just buying a single call or put. The option you sell helps pay for the option you buy, which immediately reduces your risk. This defined-risk setup makes them an excellent tool for learning the ropes of directional trading. You can see how popular these are by looking at daily trading volumes on major exchanges. For instance, the Nasdaq options volume summary shows millions of contracts traded daily, giving you a real sense of market activity.

Mastering Risk and Trading Psychology

This is where the real work begins. Seriously. Understanding charts and strategies is one thing, but this is the stuff that separates traders who make it from those who flame out in a few months.

Long-term success isn't about landing a few massive wins. It's about protecting what you have so you can show up and trade tomorrow, and the day after that. Technical skills get your foot in the door, but mastering risk and your own head is what keeps you in the game.

The Non-Negotiable Rules of Risk Management

Before you even think about the potential profit of a trade, your first job is to manage the potential loss. Hope is not a strategy. Real risk management comes down to a set of hard rules you follow on every single trade, no exceptions.

The absolute cornerstone of this is position sizing. No single trade should ever have the power to blow up your account or send you into an emotional tailspin. A solid rule of thumb is to risk no more than 1-2% of your entire portfolio on one idea.

Got a $10,000 account? That means your maximum loss on any given trade should be capped at $100 to $200. This one simple rule forces you to play defense first and keeps any single mistake from taking you out of the game entirely.

Define Your Exit Before You Enter

Every single trade needs a complete plan before you hit the buy button. Knowing your exit points ahead of time is how you remove panic and greed from the equation when prices are flying around.

- Your Entry Point: The exact price or setup that triggers you to get into the trade.

- Your Profit Target: A realistic price where you’ll take the win. Don't let greed turn a good trade into a bad one.

- Your Stop-Loss: The price where you admit the trade isn't working, cut your small loss, and move on.

This simple framework transforms trading from a reactive gamble into a proactive business. You've already planned for every outcome before risking a single dollar.

Trader's Insight: The best traders aren't defined by how much they make when they're right. They're defined by how little they lose when they're wrong. A stop-loss isn't failure; it's your best tool for preserving capital.

Conquering the Mental Game

Let's be honest: the psychological side of trading is often way harder than the technical side. The market is a battlefield of fear and greed, and how you handle those emotions will show up directly in your account balance.

One of the biggest account-killers is revenge trading. This is what happens after a loss when you immediately jump back in, determined to "make your money back." It's a recipe for disaster, leading to bigger, angrier, and more irrational trades.

The best defense against emotional decisions is a written trading plan. This is your rulebook. It should spell out your strategies, risk limits, and exact criteria for entering and exiting. When you feel that emotional pull, you don't guess—you consult the plan. It’s your anchor in a chaotic market.

Another incredibly powerful tool is a trading journal. Log every single trade, win or lose.

- What was the setup?

- Why did I take this trade?

- How did I manage it?

- What was the result?

- What's the one thing I learned?

Reviewing your journal is like watching game film. You'll quickly spot your bad habits, see what strategies are actually working, and build the discipline needed to trade like a professional.

Common Questions About Learning Options Trading

As you get your feet wet with options, a few questions always seem to pop up. Getting straight answers is the best way to build the confidence you need to keep moving forward. Let's tackle some of the most common ones I hear.

How Much Money Do I Really Need to Start?

You’ll see brokers letting you open an account with next to nothing, but let's be realistic. To trade options without immediately blowing up your account, you should aim for a starting capital of around $2,000.

Why that number? It gives you just enough room to keep your trade sizes small. More importantly, it helps you mentally absorb the losses that are an inevitable part of learning.

Trying to start with less than $1,000 is incredibly difficult. A single bad trade can wipe out a huge chunk of your account, making it psychologically tough to recover and stick with it.

What Is the Biggest Mistake New Traders Make?

Hands down, the single biggest mistake is buying cheap, far out-of-the-money options that are about to expire. I get it. They look like lottery tickets—a tiny investment for a potentially massive payout.

The hard truth is that these options have an extremely high probability of expiring worthless. Successful traders don't gamble. They focus on high-probability strategies, grinding out consistent, smaller gains that compound over time.

How Long Does It Take to Get Good at This?

There’s no magic number here. It all comes down to how much time you put in. Realistically, you should expect to spend a solid 6 to 12 months just learning the ropes and practicing in a paper trading account before you even start to feel comfortable.

But becoming consistently profitable? That’s a marathon, not a sprint. For most people, that journey takes several years of active trading, continuous learning, and tweaking strategies as the market changes.

The key is to treat this as a skill you build over time, not a get-rich-quick scheme. Your greatest assets are patience and discipline. Don't fall into the trap of thinking you can master something this complex in a few weeks. True competence is built trade by trade, by reviewing what went wrong (and right), and committing to being a lifelong student of the markets.

Ready to stop guessing and start trading with a statistical edge? Strike Price gives you real-time probability metrics for every covered call and cash-secured put. Turn theory into action and find your next trade with data-driven confidence. See the numbers at https://strikeprice.app.