What Time Do Options Expire? A Trader's Guide

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

What Is Risk Adjusted Return? A Practical Guide

What is risk adjusted return? This guide explains how to measure it with the Sharpe Ratio, how to interpret the numbers, and why it's key to smarter investing.

For most standard US equity options, the final bell for trading rings at 4:00 PM Eastern Time on expiration day. But if you think that's the end of the story, you might be in for a surprise. Knowing what happens after that bell is what separates novice traders from seasoned pros.

The Final Bell: Understanding Options Expiration

Think of an options expiration day like a football game. The final whistle blows at 4:00 PM ET, signaling the end of play—no more trades can be made on the open market. This is the official close of regular trading hours, and for most of the public, the game is over.

But in the locker room, the work isn't done. For a short period after the market closes, brokers and clearinghouses are still busy, processing the final results and settling the day's events. This is where the crucial exercise cutoff comes into play. While you can no longer sell your option, a final decision on whether to exercise it still needs to be made.

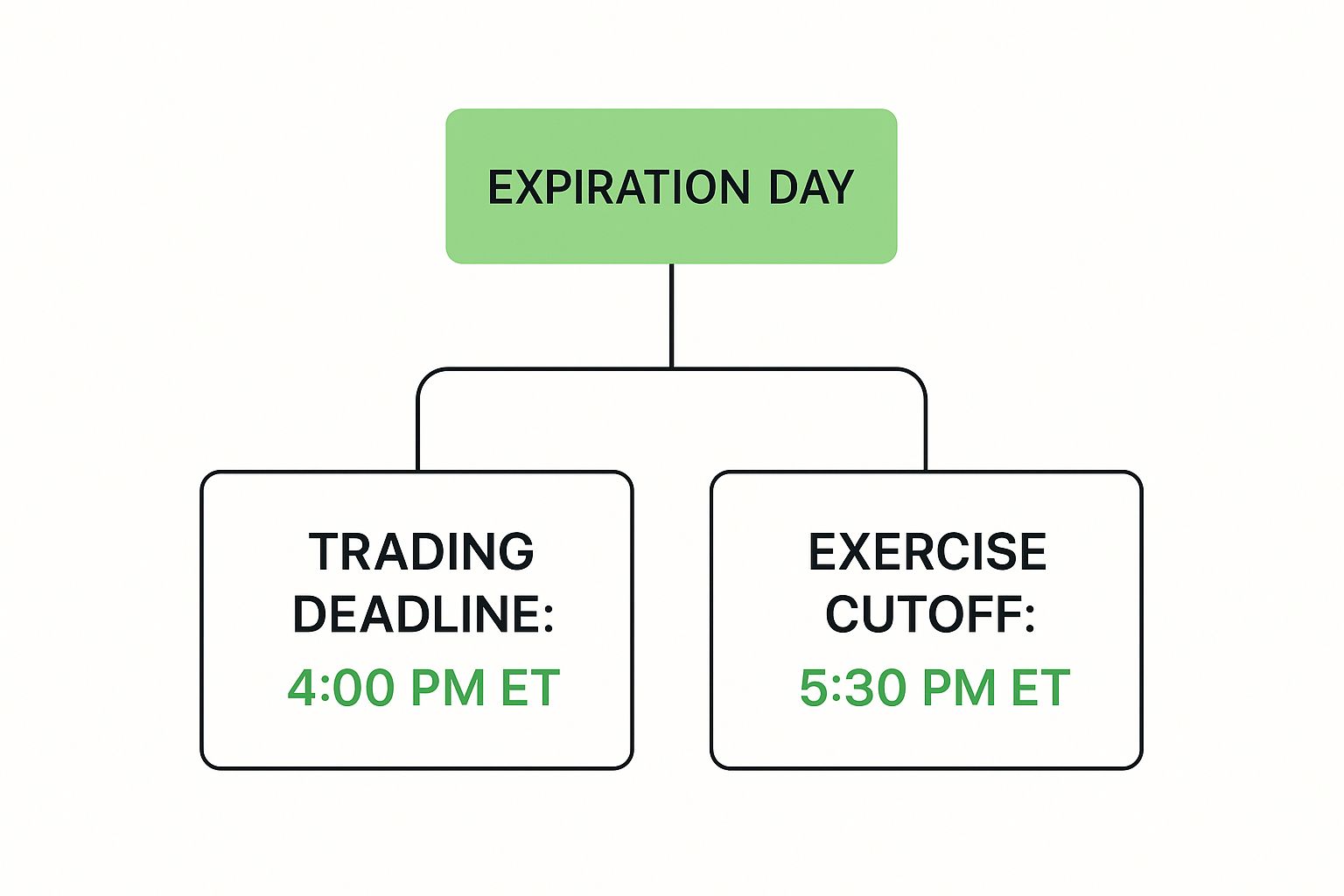

Trading Deadline vs. Exercise Cutoff

Getting these two times straight is the first step to mastering expiration day. They might seem similar, but they serve very different purposes.

- Trading Deadline (4:00 PM ET): This is your absolute last chance to sell an option you own or to buy-to-close a short position. Once 4:00 PM hits, that contract is locked in your account, and its fate is out of your hands—at least in terms of trading it.

- Exercise Cutoff (~5:30 PM ET): This is the internal deadline for you or your broker to formally submit instructions to exercise a contract. For options that are in-the-money, this usually happens automatically, but it's a critical cutoff for any manual decisions.

This timeline gives you a simple visual breakdown of the two key deadlines on expiration day.

As you can see, there's a clear separation between when public trading stops and when the final, behind-the-scenes processing happens. Managing these deadlines is becoming easier as technology evolves; for example, new developments in AI in options trading are helping traders automate and fine-tune their strategies around critical events like expiration.

To make it even clearer, here’s a quick rundown of the key moments every options trader should have burned into their memory for expiration day.

Key Deadlines for US Equity Options

| Event | Typical Time (ET) | What It Means for Traders |

|---|---|---|

| End of Trading | 4:00 PM | Your last opportunity to sell-to-close a long option or buy-to-close a short one. The market is now closed for options. |

| Exercise Cutoff | ~5:30 PM | The final moment for brokers to submit exercise notices. This is mostly an internal deadline, but it finalizes your position. |

| Assignment Notices | Varies (Evening/Night) | Brokers receive notices of which short options were assigned. This happens after hours, and you'll typically see it the next day. |

Remembering these times ensures you won't get caught off guard. That 4:00 PM deadline is firm, but the day's activity doesn't truly wrap up until long after the closing bell.

Not All Options Follow the Same Clock

The old "third Friday of the month" rule for options expiration used to be the gold standard. But if you’re still relying on that alone, it's like using a paper map in the age of GPS. The options market has exploded with variety, offering a whole menu of expiration schedules for different strategies.

Today’s market gives traders incredible flexibility to target specific events—whether it’s an earnings report next Tuesday or a long-term portfolio hedge. It's no longer a one-size-fits-all game.

A World Beyond Monthly Expirations

The most popular alternatives to the traditional monthly cycle are all about timing. Each one serves a different purpose, so the key is to match the option's lifespan to what you’re trying to achieve.

You'll most commonly run into two types:

- Weekly Options (Weeklys): These are the sprinters of the options world, expiring at the close of trading every single Friday. They’re perfect for traders who want to capitalize on short-term news, like a big announcement or an economic report. But be warned: their short life means they lose value incredibly fast.

- Quarterly Options (Quarterlys): Think of these as the marathon runners. They align with the fiscal calendar, expiring on the last business day of each quarter. Big-money traders and long-term investors often use them to hedge large positions over several months.

And it doesn't stop there. Just look at the daily options available on the Eurex exchange. This shows just how specialized these schedules have become.

This push toward more frequent, even daily, expirations is a global trend. It gives traders more precision than ever before.

This brings us to a critical principle in options trading: the less time an option has until it expires, the faster its extrinsic value evaporates. This is the infamous theta decay, and it’s something every trader needs to master.

This accelerated decay is exactly why a deep understanding of time decay in options is non-negotiable, especially when you're playing with short-term contracts like Weeklys. The bottom line? Always, always double-check the exact expiration date and time for any contract you trade. Assumptions can be incredibly expensive.

American vs European Options: The When Matters

It’s not enough to just know the expiration date. The when of an option trade is also defined by its “exercise style,” a detail that dictates your flexibility and can completely change how you approach a position. The two styles you'll constantly see are American and European.

Think of an American-style option like a flexible plane ticket. You can cash it in (exercise the option) any time you want before your flight takes off. This gives you incredible freedom. If the market makes a huge move in your favor long before expiration, you have the power to lock in your gains right then and there.

On the other hand, a European-style option is like a movie ticket for a specific showtime. You can only use it right at the end, on the expiration date. There’s no early entry. Your chance to exercise is limited to that one specific moment.

How Exercise Style Impacts Your Strategy

This difference isn't just a technicality; it has a direct impact on how you manage your trades.

- Flexibility: American options are the clear winner here. If a stock you bought a call on suddenly skyrockets a month before it expires, you can exercise early and grab those shares. No need to wait and see what happens next.

- Risk Management: This flexibility is also a powerful risk management tool. With an American option, you can get out of a position early if you see the market turning against you as expiration gets closer.

Most options on individual stocks and ETFs in the U.S. are American-style, which is great for traders who value that flexibility. But be aware that many of the big index options, like those for the S&P 500 (SPX), are European-style.

Always double-check the exercise style before you even think about placing a trade. It defines your rights as an option holder and will shape your entire plan for managing that position from start to finish.

The Global Market and the Rise of Daily Expirations

The options market isn't a walled garden; it's a global arena. Rules and products are always evolving, and while US markets have set plenty of standards, international exchanges are pushing the envelope. They’re forcing traders to look beyond the old, familiar timelines.

Nowhere is this shift more obvious than in the explosion of daily expiring options, better known as Zero Days to Expiry (0DTE) options. These aren't your typical monthly or weekly contracts. They're built for incredibly specific, short-term strategies. Think of them as precision tools for reacting to breaking news or hedging risk overnight.

The Innovation of 0DTE Options

Exchanges outside the US were the real pioneers here. Take the Eurex exchange in Europe—they’ve been offering daily expiring options on major indices like the EURO STOXX 50® and DAX® for a while now. These contracts expire at the close of each trading day, giving traders a way to react instantly to market-moving events like elections or economic reports.

This isn't just a European trend anymore. It has firmly landed in the US markets, with major indices now offering expirations for every single trading day of the week.

This rapid-fire innovation means the old question of "what time do options expire?" now has a much more complicated answer. Staying on top of it requires constant vigilance and access to information that's updated by the second.

Trying to keep up with these fast-moving products demands better tools. To have any chance of managing a 0DTE strategy effectively, traders now lean heavily on platforms that provide real-time options data. In such a compressed timeframe, you simply can't afford to be working with delayed information.

Understanding how the global market is driving these changes is the key to staying ahead and adapting your own strategies to what's happening right now.

Debunking the Myth of Worthless Options

You’ve probably heard one of the oldest and most misleading clichés in trading: "most options expire worthless." This idea makes it sound like buying options is a surefire way to lose money, but it completely misses how experienced traders actually operate.

The reality is that most traders are actively managing their positions, not just waiting around for the final bell. They’re closing out trades—either by selling to lock in a profit or cutting a loss—long before expiration even becomes a factor. Letting a contract expire is just one of many possible outcomes, and it's far from the most common.

The numbers tell a completely different story. Data from the CBOE shows that only about 30% of options contracts actually expire with no value. The vast majority—around 60%—are closed out before they ever reach their expiration date. The remaining 10% are exercised.

That’s a huge distinction. It shows that most traders are proactive, not passive.

A Proactive Mindset Is Key

This should completely reframe how you think about trading. Don't view an option's expiration date as some finish line you’re forced to cross. Think of it as a hard deadline by which you need to have made a decision.

The most successful traders don’t just let their options ride into the sunset. They have a plan for taking profits, minimizing losses, and adjusting their strategy as market conditions change throughout the life of the contract.

This active management is what separates disciplined traders from gamblers. It shifts you from being a passive participant hoping for the best into an active manager making smart, data-driven decisions. Once you understand the real statistics, you can see why managing your positions as that final deadline approaches is so critical.

To dive deeper into the mechanics of what happens at the end of the line, check out our full guide on what happens when options expire, which breaks down the specifics of assignment and exercise.

Frequently Asked Questions About Options Expiration

Even after you've got the rules down, expiration day can feel like a mad dash. Let's clear up some of the most common questions that pop up in those final, critical hours so you can make your moves with confidence.

What if I Can't Sell My Option Before It Expires?

It happens. Sometimes an option's value craters, dropping to just a penny or two with no buyers in sight.

If you can't unload your long option and it’s out-of-the-money, you just let it expire worthless. The contract vanishes from your account, and your loss is capped at whatever premium you paid to open it.

For short options, the game is a little different. If there's even a slim chance it could slip into-the-money, it’s often smart to buy it back—even for a few cents—just to kill any lingering assignment risk.

Will My Broker Automatically Exercise My In-the-Money Option?

Yep, almost always. This is called automatic exercise, and most brokers will trigger it for any option that's in-the-money by as little as $0.01. It’s a safety net to make sure traders don't accidentally leave money on the table.

But what if you don't have the cash to buy the underlying shares (for a call) or simply don't want them? You have to proactively tell your broker with a "do not exercise" instruction before their deadline.

Important Takeaway: Never assume you can just let an in-the-money option ride into the sunset. If you don't want the stock, you must either sell the option before the 4:00 PM ET trading deadline or instruct your broker not to exercise it.

Do Index Options Like SPX Expire Differently?

Absolutely. Big-time index options, like the S&P 500 Index (SPX), operate on a different set of rules. Here are the two key distinctions:

- Exercise Style: They're typically European-style. That means they can only be exercised right at expiration, not a moment sooner.

- Settlement: Instead of getting shares of a stock, these options are cash-settled. The option's intrinsic value is simply deposited into (or debited from) your account. No stock changes hands, which neatly sidesteps the risk of holding shares over a weekend.

Understanding these differences is crucial. The expiration process for index products is much cleaner and avoids the whole headache of stock assignment. Knowing what time do options expire for these specific products is key to preventing costly surprises.

Stop guessing and start selling with confidence. Strike Price provides real-time probability metrics to help you find the safest and most profitable covered call and secured put opportunities. Turn your portfolio into a consistent income engine. Discover your next winning trade at Strike Price.