10 Essential Investment Diversification Strategies for 2025

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

True financial resilience isn't just about owning a few different stocks. It's about building a portfolio designed to withstand market turbulence, economic shifts, and unforeseen global events. Effective investment diversification strategies are the bedrock of sophisticated portfolio management, transforming a simple collection of assets into a strategic, all-weather financial engine. The old adage about not putting all your eggs in one basket is a starting point, but genuine portfolio protection requires a much more nuanced and multi-layered approach.

This guide moves beyond the surface-level advice to provide a deep dive into 10 proven strategies that institutional and savvy individual investors use to manage risk and capture opportunities. We will explore how to intelligently spread investments not just across different companies, but across asset classes, geographic regions, market capitalizations, and even investment philosophies. Each section is designed to provide clear, actionable insights, demystifying complex concepts and offering practical steps for implementation.

You will learn precisely how to apply these techniques to your own holdings, with a focus on building a robust framework that aligns with your financial goals. From foundational asset allocation to advanced factor-based investing and income stream diversification, we will unpack how each strategy works, its specific pros and cons, and provide concrete examples. The goal is to equip you with the knowledge to build a truly diversified portfolio that can navigate market uncertainty with greater stability and confidence, moving you from a passive investor to a strategic architect of your financial future.

1. Asset Class Diversification

Asset class diversification is the cornerstone of modern portfolio construction and one of the most fundamental investment diversification strategies. The core principle is simple: spread your investments across different categories of assets, such as stocks (equities), bonds (fixed income), real estate, and commodities. Since each class reacts differently to economic events, a downturn in one area may be offset by gains in another, creating a more stable and resilient portfolio.

This strategy, popularized by Nobel laureate Harry Markowitz’s Modern Portfolio Theory, aims to maximize returns for a given level of risk. For instance, during economic expansion, stocks tend to perform well, while in a recession, government bonds are often seen as a safe haven. By holding both, you smooth out your portfolio's performance over time.

How to Implement Asset Class Diversification

Implementing this strategy starts with assessing your personal risk tolerance, financial goals, and investment timeline. A younger investor with a long time horizon might allocate a higher percentage to growth-oriented stocks, while someone nearing retirement may prefer the stability and income of bonds.

- The 60/40 Portfolio: A classic example where 60% of the portfolio is invested in stocks for growth and 40% in bonds for stability.

- The Yale Model: Pioneered by David Swensen, this approach allocates a significant portion to alternative investments like real estate and private equity alongside traditional stocks and bonds.

- Target-Date Funds: These funds automatically adjust their asset allocation, becoming more conservative as the target retirement date approaches.

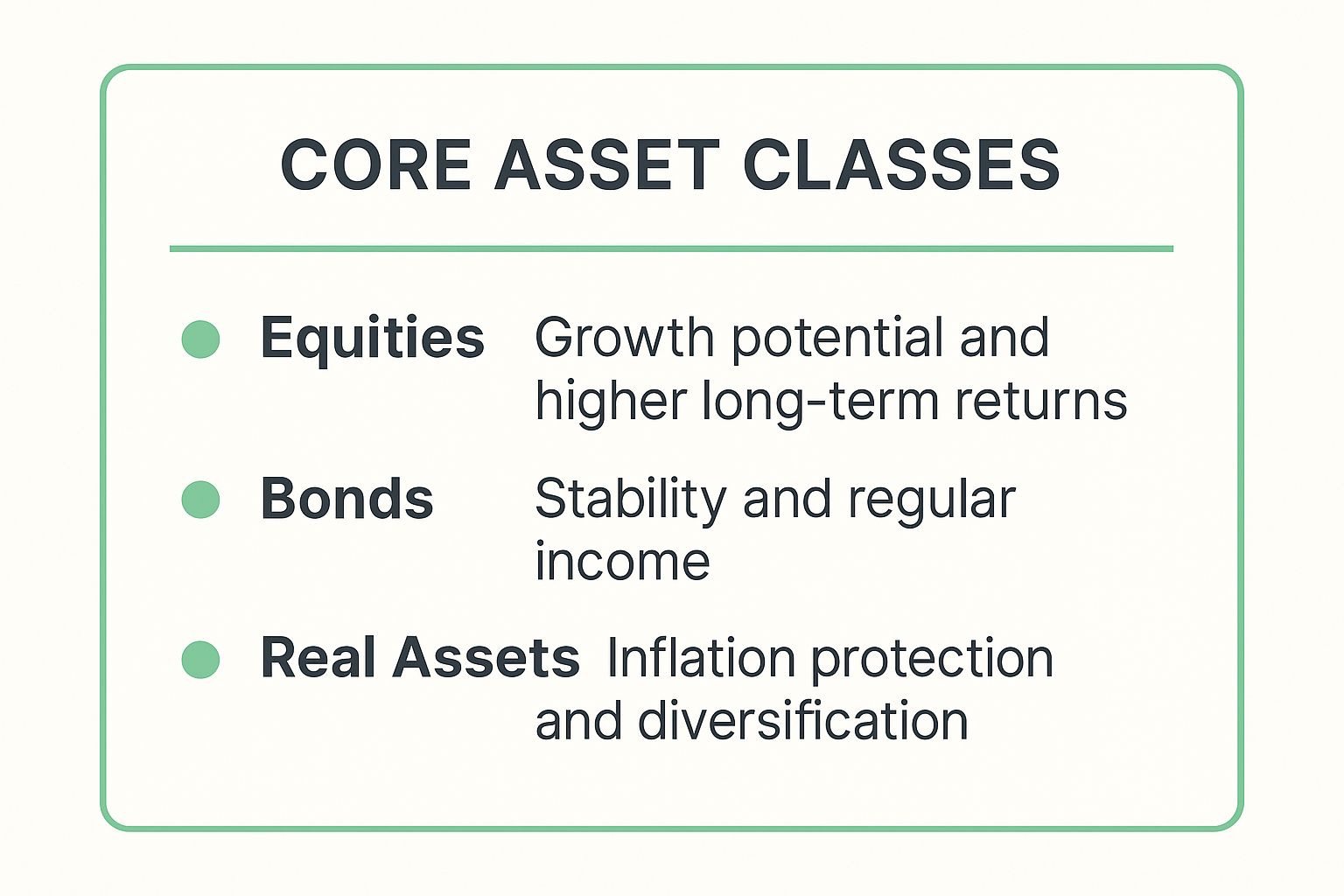

This infographic provides a quick reference on the primary roles of core asset classes.

As the summary shows, each asset class plays a distinct, complementary role, from driving growth to providing stability and hedging against inflation. For more in-depth guidance, exploring best practices in portfolio management can provide a structured approach to building your allocation.

To maintain your desired mix, it's crucial to rebalance periodically, perhaps annually or quarterly. This involves selling some of the assets that have performed well and buying more of those that have underperformed to return to your target allocation.

2. Geographic Diversification

Geographic diversification is a crucial investment diversification strategy that involves spreading investments across different countries and regions. The primary goal is to protect a portfolio from localized risks, such as political instability, currency fluctuations, or a regional economic recession. By looking beyond domestic borders, investors can mitigate the impact of a downturn in their home market and tap into growth opportunities in other parts of the world.

This approach, championed by global investing pioneers like John Templeton, acknowledges that no single country's economy can outperform all others indefinitely. Investing internationally allows you to benefit from different economic cycles and growth drivers, from the established stability of developed markets to the high-growth potential of emerging economies.

How to Implement Geographic Diversification

Executing a global strategy involves allocating a portion of your portfolio to international assets. A common rule of thumb suggests dedicating 20% to 40% of your equity holdings to markets outside your home country. For those considering real estate as part of their geographic diversification strategy, exploring the best rental property markets for investors can provide valuable insights.

- Global Index Funds: An ETF tracking an index like the MSCI ACWI (All Country World Index) offers instant exposure to thousands of companies across both developed and emerging markets.

- Targeted Regional ETFs: Investors can gain specific exposure by using ETFs that focus on particular regions, such as Europe (e.g., Vanguard FTSE Europe ETF) or Asia (e.g., iShares MSCI All Country Asia ex Japan ETF).

- Real Estate Investment Trusts (REITs): International REITs allow you to invest in a portfolio of income-producing properties abroad without the complexities of direct ownership.

When investing internationally, it's important to consider currency risk, as fluctuations can impact your returns. Some funds offer currency-hedged versions to minimize this volatility. Additionally, be aware of the tax implications of foreign investments, such as withholding taxes on dividends.

3. Sector and Industry Diversification

Going a level deeper than asset classes, sector and industry diversification involves spreading investments across different economic sectors. This includes areas like technology, healthcare, financials, consumer staples, and energy. The core principle is that different sectors react uniquely to business cycles, technological shifts, and regulatory changes, making this one of the most practical investment diversification strategies.

By avoiding over-concentration in a single industry, you protect your portfolio from sector-specific downturns. For example, during the dot-com bubble burst of 2000-2002, investors who were diversified into defensive sectors like healthcare and consumer staples experienced less volatility than those heavily invested in technology. Similarly, the COVID-19 pandemic highlighted this principle, as technology and healthcare stocks thrived while travel and hospitality sectors suffered major losses.

This strategy was championed by legendary investors like Peter Lynch, who emphasized the importance of understanding the distinct dynamics of various industries. Modern frameworks like the Global Industry Classification Standard (GICS) provide a clear system for categorizing companies, helping investors implement this approach effectively.

How to Implement Sector and Industry Diversification

Implementing this strategy requires looking inside your equity allocation to ensure no single sector dominates. A common pitfall for investors is unintentionally concentrating in a hot sector, which can lead to outsized gains followed by significant losses when sentiment shifts.

- Benchmark Against an Index: Use the sector weightings of a broad market index, like the S&P 500, as a neutral starting point for your own portfolio allocation.

- Balance Cyclical and Defensive Sectors: Hold a mix of cyclical sectors (like technology and consumer discretionary) that do well in a growing economy, and defensive sectors (like utilities and consumer staples) that tend to be more stable during downturns.

- Consider Sector-Specific ETFs: Exchange-Traded Funds (ETFs) offer an easy and low-cost way to gain exposure to an entire sector without having to buy individual stocks.

- Review and Rebalance: Check your sector exposures quarterly or semi-annually. If a particular sector has performed exceptionally well, its weighting may have grown, and you may need to rebalance to avoid unintentional concentration.

4. Time Diversification (Dollar-Cost Averaging)

Time diversification is an investment diversification strategy focused on mitigating the risk of market timing. Instead of investing a large sum of money at a single point in time, this approach involves spreading investments out over various periods. The most popular method for implementing this is dollar-cost averaging (DCA), where you invest a fixed amount of money at regular intervals, regardless of market fluctuations. This disciplined approach helps smooth out the average purchase price over time.

This strategy, advocated by investment legends like Benjamin Graham and John Bogle, removes emotion from the investment process. By committing to a regular investment schedule, you naturally buy more shares when prices are low and fewer shares when prices are high. This can lower your average cost per share and reduce the anxiety associated with trying to perfectly time the market's peaks and troughs.

How to Implement Time Diversification

Implementing dollar-cost averaging is straightforward and accessible to most investors, making it a cornerstone of long-term wealth building. Many employer-sponsored retirement plans, like 401(k)s, automatically use this strategy by deducting contributions from each paycheck. For individual investors, setting up automatic transfers from a bank account to a brokerage account is a common and effective method.

- Automate Your Investments: Set up a recurring investment schedule (e.g., weekly, bi-weekly, or monthly) to transfer a fixed amount into your chosen funds or stocks.

- Stay Consistent: The power of DCA lies in consistency. Continue investing your fixed amount through market highs and lows to benefit from price averaging. Investors who continued this during the 2008-2009 crisis, for example, were well-positioned for the subsequent recovery.

- Minimize Transaction Costs: Use commission-free ETFs or mutual funds to ensure that trading fees do not erode the benefits of making frequent, smaller investments.

While historical data, such as a well-known Vanguard study, shows that lump-sum investing has often outperformed DCA over the long run (roughly two-thirds of the time), DCA remains a powerful tool for risk management. It is an excellent strategy for those investing periodically, like with a salary, or for those who have a large sum of cash but are hesitant to invest it all at once due to market volatility. Combining DCA with other investment diversification strategies creates a robust framework for achieving financial goals.

5. Market Capitalization Diversification

Market capitalization diversification is a powerful investment diversification strategy that involves spreading investments across companies of different sizes. This means allocating funds to large-cap (over $10 billion), mid-cap ($2-$10 billion), and small-cap (under $2 billion) stocks. Each category exhibits distinct risk-return characteristics and reacts differently to market cycles, allowing for a more balanced portfolio that captures growth across the entire market spectrum.

This approach is heavily influenced by the work of Eugene Fama and Kenneth French, whose Three-Factor Model identified company size as a key driver of stock returns. Historically, small-cap stocks have offered higher growth potential, though with greater volatility. For instance, from 1926 to 2020, small-caps returned an average of 11.9% annually versus 10.2% for large-caps. Conversely, during downturns like the 2008 financial crisis, large-caps often proved more resilient, falling less than their smaller counterparts.

How to Implement Market Capitalization Diversification

To implement this strategy, you should define a target allocation based on your risk tolerance and investment horizon. A longer timeline may justify a higher allocation to small-caps for their growth potential, while a more conservative investor might favor the stability of large-cap companies.

- Baseline Allocation: A common starting point is a portfolio with 70-80% in large-cap stocks, 15-20% in mid-cap, and 5-10% in small-cap.

- Index Funds and ETFs: The simplest way to achieve this diversification is by using low-cost index funds or ETFs that track specific market-cap segments, like the S&P 500 (large-cap), S&P MidCap 400, and Russell 2000 (small-cap).

- Factor Tilting: More advanced investors might "tilt" their portfolio by overweighting small-cap or value stocks within each size category to potentially capture higher returns.

Since smaller, high-growth companies can significantly alter your portfolio's balance as they expand, regular rebalancing is essential. For further details on maintaining your desired asset mix, discover valuable insights on how to rebalance a portfolio to keep your strategy on track.

6. Investment Style Diversification (Value vs. Growth)

Beyond diversifying across sectors or asset classes, another powerful strategy is diversifying by investment style, primarily between value and growth investing. This approach acknowledges that different types of stocks perform better during different phases of the economic cycle. By holding both, you can achieve more consistent returns and reduce the volatility associated with leaning too heavily on one style.

Value investing, championed by figures like Benjamin Graham, focuses on stocks trading below their intrinsic worth, often identified by low price-to-earnings (P/E) ratios. Growth investing, popularized by Philip Fisher, targets companies with above-average growth potential, even if their current valuation seems high. History shows these styles often perform in a cyclical pattern; for instance, value stocks significantly outperformed after the tech bubble burst in the early 2000s, while growth stocks, led by tech giants, dominated the 2010s.

How to Implement Investment Style Diversification

Implementing this strategy involves intentionally allocating capital to funds or stocks that explicitly follow a value or growth mandate. Instead of relying on a "blend" fund, which mixes both, you gain more control by holding separate value and growth investments. This is a key tactic within broader investment diversification strategies.

- Equal Weighting: A simple approach is to allocate 50% of your equity portfolio to a value-focused fund and 50% to a growth-focused fund for a neutral style exposure.

- Factor Tilting: Based on historical data from academics like Fama and French showing a long-term "value premium," some investors tilt their portfolio slightly more toward value to capture potentially higher risk-adjusted returns.

- Using Specific ETFs: Utilize exchange-traded funds (ETFs) that track specific value or growth indices, such as the Vanguard Value ETF (VTV) and the Vanguard Growth ETF (VUG).

- Annual Rebalancing: Rebalance between your value and growth allocations annually. This forces you to sell the style that has performed well and buy the underperforming one, capturing gains from mean reversion.

Combining these two opposing yet complementary styles ensures your portfolio is well-positioned to perform regardless of which methodology is currently in favor with the market.

7. Alternative Investment Diversification

Alternative investment diversification involves expanding your portfolio beyond traditional stocks and bonds into non-traditional asset classes. These can include private equity, hedge funds, commodities, real estate, infrastructure, and cryptocurrency. The primary benefit is their typically low correlation with public markets, which means they often move independently of stocks and bonds, providing powerful diversification benefits and potentially enhancing returns.

Pioneered by institutional investors like David Swensen at the Yale Endowment, this approach seeks to build a more robust portfolio that can perform well across various economic scenarios. For example, commodities like gold can act as an inflation hedge, while private equity offers exposure to long-term growth opportunities not available on public exchanges. Including these assets is a key component of many advanced investment diversification strategies.

How to Implement Alternative Investment Diversification

Accessing alternatives has become easier for retail investors, though they still require careful due diligence due to their complexity and potential for lower liquidity. A measured approach is essential, focusing first on more accessible options before venturing into more complex, illiquid investments.

- Start with Liquid Alternatives: Begin with publicly traded vehicles like Real Estate Investment Trusts (REITs) or commodity-tracking ETFs. For tangible assets, a practical guide to buying Gold American Eagles can be a helpful starting point.

- Set a Portfolio Allocation Limit: Most financial advisors recommend allocating between 10% and 30% of a portfolio to alternatives, depending on your risk tolerance and financial goals.

- Understand the Purpose: Use alternatives to serve a specific function. For instance, use infrastructure funds for stable income and inflation protection, or venture capital for high-growth potential.

- Vet Managers and Fees: For private funds, thoroughly research the fund manager's track record, strategy, and fee structure, as these can significantly impact returns.

8. Fixed Income Duration and Credit Diversification

Beyond simply owning bonds, sophisticated investment diversification strategies require a deeper look within your fixed income allocation. Fixed income duration and credit diversification is a method of managing risk by investing across different bond maturities and credit qualities. Duration measures a bond's sensitivity to interest rate changes, while credit quality reflects the issuer's likelihood of default.

The core principle is that different types of bonds perform differently under various economic conditions. For instance, long-term government bonds may rally when interest rates fall, but high-yield corporate bonds might perform better during economic growth. Pioneered by legendary managers like PIMCO's Bill Gross, this strategy creates a more resilient bond portfolio that can weather shifts in both interest rates and the broader economy. The sharp rate hikes of 2022 highlighted the critical importance of managing duration risk effectively.

How to Implement Duration and Credit Diversification

Implementing this strategy involves intentionally selecting bonds with varied characteristics rather than just buying a single type. Your approach will depend on your income needs, risk tolerance, and outlook on interest rates.

- The Barbell Strategy: This involves concentrating your portfolio in short-term and long-term bonds, while avoiding intermediate-term ones. The short-term bonds provide liquidity and stability, while the long-term bonds offer higher yields.

- The Laddered Portfolio: This strategy involves purchasing bonds with staggered maturity dates, such as one, two, three, four, and five years. As each bond matures, the principal is reinvested into a new long-term bond, ensuring consistent cash flow and mitigating reinvestment risk.

- Total Return Approach: Popularized by PIMCO, this is an active management style that dynamically shifts allocations across the entire duration and credit spectrum to capitalize on market opportunities and manage risk.

To start, you can use total bond market index funds for instant, broad diversification. For more control, consider building a bond ladder to create predictable income streams. A good rule of thumb is to limit high-yield (junk) bonds to a smaller portion, perhaps 10-20%, of your fixed income allocation due to their higher risk profile. Adjusting your portfolio's average duration based on your time horizon and interest rate expectations is also a key component of this advanced diversification technique.

9. Factor-Based Diversification (Smart Beta)

Factor-based diversification, often called "smart beta," moves beyond traditional market-cap weighting to target specific, persistent drivers of long-term returns. This strategy involves building a portfolio by tilting it toward securities with certain characteristics or "factors" that academic research has shown can lead to higher risk-adjusted performance. Key factors include value, size, momentum, quality, and low volatility.

Pioneered by researchers like Eugene Fama and Kenneth French, this evidence-based approach challenges the idea that market-cap-weighted indexes are the most efficient way to invest. Instead, it systematically overweights stocks with desirable factor characteristics. For example, a value factor strategy would invest more in companies that appear cheap relative to their fundamentals, while a momentum strategy would favor stocks that have been performing well recently.

How to Implement Factor-Based Diversification

Implementing this strategy means moving a portion of your equity allocation from broad market index funds to funds that are specifically designed to capture factor premiums. This can be an effective way to enhance returns or reduce volatility, making it a powerful tool among investment diversification strategies. It is crucial, however, to remain disciplined, as factors can go through long periods of underperformance.

- Start with Multi-Factor Funds: For beginners, a multi-factor ETF that combines several factors (like value, momentum, and quality) offers built-in diversification and prevents over-reliance on a single factor.

- Tilt, Don't Concentrate: A prudent approach is to allocate a portion, perhaps 20-40%, of your total equity holdings to factor-based strategies, keeping the core in traditional index funds.

- Combine Negatively Correlated Factors: To smooth returns, consider combining factors that historically perform differently in various market cycles. For instance, value and momentum often have a low or negative correlation.

- Understand the Rationale: Before investing, ensure you understand the economic reason why a factor is expected to deliver a premium over the long term.

Companies like AQR Capital Management and Dimensional Fund Advisors have built their entire businesses around factor investing, and major providers like Vanguard and BlackRock now offer a wide range of smart beta ETFs. By systematically harvesting these risk premiums, you can add another layer of sophisticated diversification to your portfolio, potentially outperforming the market over time.

10. Income Stream Diversification

Income stream diversification is a powerful strategy focused on creating cash flow from multiple sources rather than relying on a single one. The principle is to build a portfolio that generates income from dividends, interest, rental income, and other distributions. Because different income sources react uniquely to market cycles and economic shifts, this approach provides a more stable and resilient cash flow, which is especially crucial for retirees or income-focused investors.

This method, championed by figures like John Bogle through his advocacy for dividend-focused funds, creates a buffer against volatility. For instance, if a company cuts its dividend (affecting stock income), the interest payments from bonds or rent from a real estate property continue to provide cash. This diversification of income sources, not just assets, adds a critical layer of security to your financial plan.

How to Implement Income Stream Diversification

To effectively implement this strategy, you must combine various income-producing assets that align with your financial goals and risk tolerance. The goal is to build a "portfolio of paychecks" that can weather different economic climates.

- The Multi-Asset Income Model: A retiree might combine Social Security benefits, pension payments, dividend-paying stocks, bond interest, and rental income from a property to create a robust income stream.

- Balanced Income Funds: Funds like the Vanguard Wellesley or Wellington Funds offer a professionally managed mix of dividend stocks and interest-bearing bonds, simplifying the process for investors.

- Dividend Growth Investing: This involves focusing on "Dividend Aristocrats" or other companies with long histories of consistently increasing their dividend payments, providing a growing income stream over time.

For those interested in building a reliable income flow, understanding the nuances of how to generate passive income from stocks can provide valuable insights into selecting the right dividend-paying assets.

To maintain a healthy and sustainable income portfolio, focus on quality over high-yield temptations. Building a bond ladder can provide predictable interest payments at various maturity dates, while holding these assets in tax-advantaged accounts can optimize your after-tax returns. A sustainable withdrawal rate, often targeted around 3-4%, ensures the portfolio's longevity.

Diversification Strategies Comparison Matrix

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Asset Class Diversification | Moderate – requires ongoing monitoring and rebalancing | Moderate – access to multiple asset categories | Balanced risk and return, reduces volatility | Core portfolio construction, broad risk management | Proven long-term effectiveness; reduces volatility |

| Geographic Diversification | High – involves understanding foreign markets and regulations | Moderate to High – international funds and tax considerations | Reduces country-specific risks, captures global growth | Investors seeking global exposure and political risk reduction | Access to growth markets; currency diversification |

| Sector and Industry Diversification | Moderate – knowledge of sector dynamics needed | Moderate – sector ETFs or funds available | Mitigates sector-specific downturns, balances growth and stability | Mitigating industry risk; sector rotation strategies | Protects against industry disruption; balanced exposure |

| Time Diversification (Dollar-Cost Averaging) | Low – simple automation of regular investments | Low – requires regular funding source | Reduces timing risk, smooths purchase prices | Investors with regular income preferring disciplined investing | Removes emotional decision-making; lowers average cost |

| Market Capitalization Diversification | Moderate – requires allocation across cap sizes | Moderate – diverse market cap funds or ETFs | Balances growth and stability, captures size premiums | Investors seeking full market spectrum exposure | Access to small-cap premium; diversified growth risk |

| Investment Style Diversification (Value vs. Growth) | Moderate – monitoring style cycles | Moderate – style-specific funds or ETFs | More consistent returns via exposure to different styles | Balancing value and growth for risk-adjusted returns | Captures style premiums; reduces portfolio volatility |

| Alternative Investment Diversification | High – complex, high minimums, illiquid assets | High – requires significant capital and due diligence | Access to unique returns, low correlation with traditional assets | Sophisticated investors seeking diversification beyond stocks/bonds | True diversification; inflation protection |

| Fixed Income Duration and Credit Diversification | Moderate to High – managing duration and credit risk | Moderate – bond funds or individual bonds | Income with controlled interest rate and credit risk | Fixed income portfolio stability and income optimization | Reduces interest rate and credit risks; stable income |

| Factor-Based Diversification (Smart Beta) | High – complex factor analysis and rebalancing | Moderate – factor ETFs/funds requiring monitoring | Potential for enhanced risk-adjusted returns | Investors seeking systematic, evidence-based factor exposure | Transparency; removes emotional bias; academic backing |

| Income Stream Diversification | Moderate – managing multiple income sources | Moderate – requires access to dividend, bond, real estate income | Stable and predictable cash flow, inflation protection | Income-focused portfolios or retirees | Stable cash flow; tax and income source diversification |

Implementing Your Diversification Blueprint

Navigating the world of investment diversification strategies can feel like assembling a complex puzzle. We've explored ten distinct yet interconnected pieces, from the foundational principle of Asset Class Diversification to the nuanced approaches of Factor-Based Investing and Income Stream Diversification. Each strategy represents a powerful tool for constructing a portfolio designed not just for growth, but for resilience. The core lesson is clear: true financial fortitude isn't achieved by chasing the single best-performing asset, but by skillfully weaving together a variety of non-correlated or low-correlated investments.

The journey from theory to practice is where many investors falter. Understanding geographic, sector, and market-cap diversification is one thing; implementing them in a cohesive, disciplined manner is another. The goal is to move beyond a haphazard collection of stocks and bonds and architect a portfolio with intention, where every component serves a specific purpose in mitigating risk and capturing opportunity across different economic environments.

From Knowledge to Action: Your Next Steps

The strategies detailed in this article provide a comprehensive framework. Now, it's time to put that framework to use. Your immediate task is to transform these concepts into a personalized, actionable plan.

- Conduct a Portfolio Audit: Start by assessing your current holdings. Where are you overly concentrated? Are you unknowingly exposed to a single country, industry, or investment style? Use the ten strategies as a checklist to identify gaps and vulnerabilities in your existing portfolio.

- Define Your Target Allocation: Based on your audit, your financial goals, and your personal risk tolerance, create a target asset allocation. This is your "blueprint." It should specify your desired percentages for different asset classes (e.g., 60% equities, 30% fixed income, 10% alternatives), regions, and market caps.

- Implement Gradually: You don't need to overhaul your entire portfolio overnight. Use new capital contributions to buy into under-allocated areas. Consider rebalancing periodically-perhaps quarterly or annually-by trimming overperforming assets and reinvesting the proceeds into underperforming ones. This disciplined process forces you to buy low and sell high.

Remember, the most effective investment diversification strategies are not static. Your blueprint requires regular review and occasional adjustments as your life circumstances, time horizon, and the market landscape evolve. A "set it and forget it" approach can lead to unintended risks over time.

The Strategic Advantage of Sophisticated Income

For investors looking to elevate their diversification, particularly in generating consistent income, consider the strategic role of options. Far from being purely speculative instruments, options can be used conservatively to enhance returns and manage risk.

A prime example is selling covered calls on stocks you already own. This strategy allows you to generate a steady stream of premium income, effectively creating an additional, diversified income source from your equity holdings. The key is making data-driven decisions. Instead of guessing, you can use probability analysis to select strike prices that align perfectly with your risk tolerance and income goals.

Key Insight: Mastering a variety of investment diversification strategies transforms you from a passive market participant into an active architect of your financial future. It's the difference between being a passenger on a turbulent flight and being a pilot with the controls to navigate through storms.

Ultimately, building a resilient portfolio is a testament to discipline, foresight, and continuous learning. By layering these diverse strategies, you create a financial structure capable of weathering market volatility and compounding wealth steadily over the long term. This proactive approach is your greatest defense against uncertainty and your most reliable path toward achieving your financial objectives.

Ready to add a sophisticated layer of income generation to your diversified portfolio? Strike Price provides the probability-based tools and real-time alerts you need to confidently sell covered calls and secured puts. Take the guesswork out of options trading and start optimizing your premium income by visiting Strike Price today.