7 Proven Options Income Strategies for Steady Gains in 2025

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

Welcome to the world of strategic income generation through options. If you're looking for an alternative to the traditional buy-and-hold approach, the financial markets offer powerful tools for creating regular cash flow, and some of the most effective are options income strategies.

These methods aren't about wild speculation or hitting a home run on a volatile stock. Instead, they focus on a simple, powerful concept: selling time value. By selling options contracts, you collect premium income upfront, much like a landlord collects rent from a tenant. This article serves as your comprehensive roundup, demystifying the most effective options income strategies used by seasoned traders.

We will break down seven distinct approaches, moving beyond generic advice to provide actionable steps, detailed risk/reward analysis, and a clear-eyed view of what it takes to succeed. A key theme throughout this guide is the shift from gambling to data-driven decision-making. We will explore how using probability-focused tools can transform your trading by helping you select strikes that align with your specific income goals and risk tolerance.

Whether you're aiming to supplement your salary, fund your retirement, or simply make your portfolio work harder, mastering these strategies can unlock a new dimension of financial empowerment. Let’s dive into the mechanics of turning market probabilities into predictable income.

1. Covered Call Strategy

The covered call is arguably the most foundational of all options income strategies, making it an excellent starting point for investors looking to generate consistent cash flow from their stock holdings. The strategy involves two simple components: owning at least 100 shares of an underlying stock and selling (or "writing") one call option contract against those shares. By selling the call option, you receive an immediate cash payment known as a premium.

This premium is yours to keep, regardless of what the stock price does. In exchange, you grant the option buyer the right, but not the obligation, to purchase your 100 shares at a predetermined price (the strike price) on or before the option's expiration date. This creates a scenario where you either keep your shares and the premium, or you sell your shares at a price you pre-selected while also keeping the premium.

How It Works: Risk vs. Reward

The primary benefit of a covered call is income generation. The premium you collect enhances your overall return on the stock, providing a small cushion if the stock price declines. The trade-off, however, is that you cap your potential upside. If the stock price skyrockets past your strike price, you miss out on those additional gains because you are obligated to sell your shares at the agreed-upon strike price.

- Maximum Profit: (Strike Price - Stock Purchase Price) + Premium Received

- Maximum Loss: (Stock Purchase Price - Premium Received) * 100. This occurs if the stock goes to zero, but the loss is less than simply holding the stock due to the premium collected.

When and Why to Use a Covered Call

This strategy is ideal for investors who have a neutral to slightly bullish outlook on a stock they already own. If you believe a stock will trade sideways, rise modestly, or even dip slightly, a covered call allows you to monetize that expectation. It's particularly effective for investors holding blue-chip, dividend-paying stocks, as the option premium can supplement the dividend income.

Key Insight: Think of a covered call as setting a target selling price for your stock. You are essentially saying, "I am happy to sell my shares at this strike price and will accept a cash payment today for that commitment."

Actionable Tips for Implementation

To optimize your covered call strategy, focus on data-driven decisions:

- Select the Right Expiration: Target options with 30-45 days to expiration (DTE). This window offers the best balance, capturing the accelerated time decay (theta) that benefits option sellers without taking on the risks of very short-term options.

- Choose an Optimal Delta: A delta around 0.20 to 0.30 is often considered a sweet spot. This translates to a 20-30% probability of the option expiring in-the-money. It provides a healthy premium while reducing the likelihood of your shares being called away.

- Plan Your Exit: Don't wait until expiration day. If you want to continue generating income, consider "rolling" the position. This involves buying back your current short call and selling a new one with a later expiration date, often collecting another net credit in the process.

2. Cash-Secured Put Strategy

The cash-secured put is a cornerstone of conservative options income strategies, allowing investors to generate income while potentially acquiring quality stocks at a discount. This strategy involves selling (or "writing") a put option and simultaneously setting aside enough cash to buy 100 shares of the underlying stock at the option's strike price. For selling this put option, you receive an immediate premium.

This premium is your profit to keep, no matter the outcome. In exchange for this payment, you agree to buy 100 shares of the stock at the strike price if the stock's market price drops below it and the option holder exercises their right. This creates a win-win scenario: either you keep the premium as pure profit if the stock stays above the strike price, or you purchase a stock you wanted anyway at a lower effective price.

How It Works: Risk vs. Reward

The core benefit of the cash-secured put is twofold: income generation and disciplined stock acquisition. The premium collected provides an immediate return, and if assigned, your cost basis for the stock is reduced by the amount of the premium. The primary risk is that the stock price could fall significantly below your strike price, obligating you to buy shares that are worth less than your purchase price, though still at a discount to when you sold the put.

- Maximum Profit: The premium received. This is achieved if the stock price closes at or above the strike price at expiration.

- Maximum Loss: (Strike Price * 100) - Premium Received. This occurs if the stock price goes to zero, which is the same risk profile as buying the stock at the strike price, but lessened by the premium.

When and Why to Use a Cash-Secured Put

This strategy is ideal for investors with a neutral to bullish outlook on a specific stock. It’s perfect if you are waiting for a stock to pull back to a more attractive price point. Selling a cash-secured put allows you to get paid while you wait. It's a powerful tool for value investors looking to systematically enter positions in high-quality companies or for those executing the "Wheel Strategy" by acquiring shares through puts and then selling covered calls against them.

Key Insight: Think of a cash-secured put as setting a limit order to buy a stock, but you get paid for placing the order. You are stating, "I am happy to buy 100 shares at this strike price and will accept a cash payment today for making that commitment."

Actionable Tips for Implementation

To implement cash-secured puts effectively, a data-driven approach is crucial:

- Choose Stocks You Want to Own: This is the golden rule. Never sell a put on a company you wouldn't be comfortable holding for the long term, as assignment is a real possibility.

- Select a High-Probability Strike: Target out-of-the-money puts with a delta between 0.20 and 0.30. This provides a 70-80% probability of the option expiring worthless, allowing you to keep the premium while still collecting a meaningful amount.

- Manage Your Exit: Be proactive. If the position has profited by 50% of the maximum premium well before expiration, consider buying back the put to close the trade and lock in your gains. You can then redeploy the capital into a new opportunity.

3. Iron Condor Strategy

The iron condor is a sophisticated yet highly popular choice among options income strategies, designed for investors who anticipate low volatility in a particular stock or index. This four-legged, defined-risk strategy involves selling both an out-of-the-money (OTM) put spread and an OTM call spread on the same underlying asset with the same expiration date. By doing so, you collect a net premium upfront.

Your goal is for the underlying stock price to remain between the two short strike prices of your spreads until expiration. If the stock stays within this "profit range," both spreads expire worthless, and you keep the entire premium as profit. This makes it an ideal strategy for generating income from sideways-moving or range-bound markets.

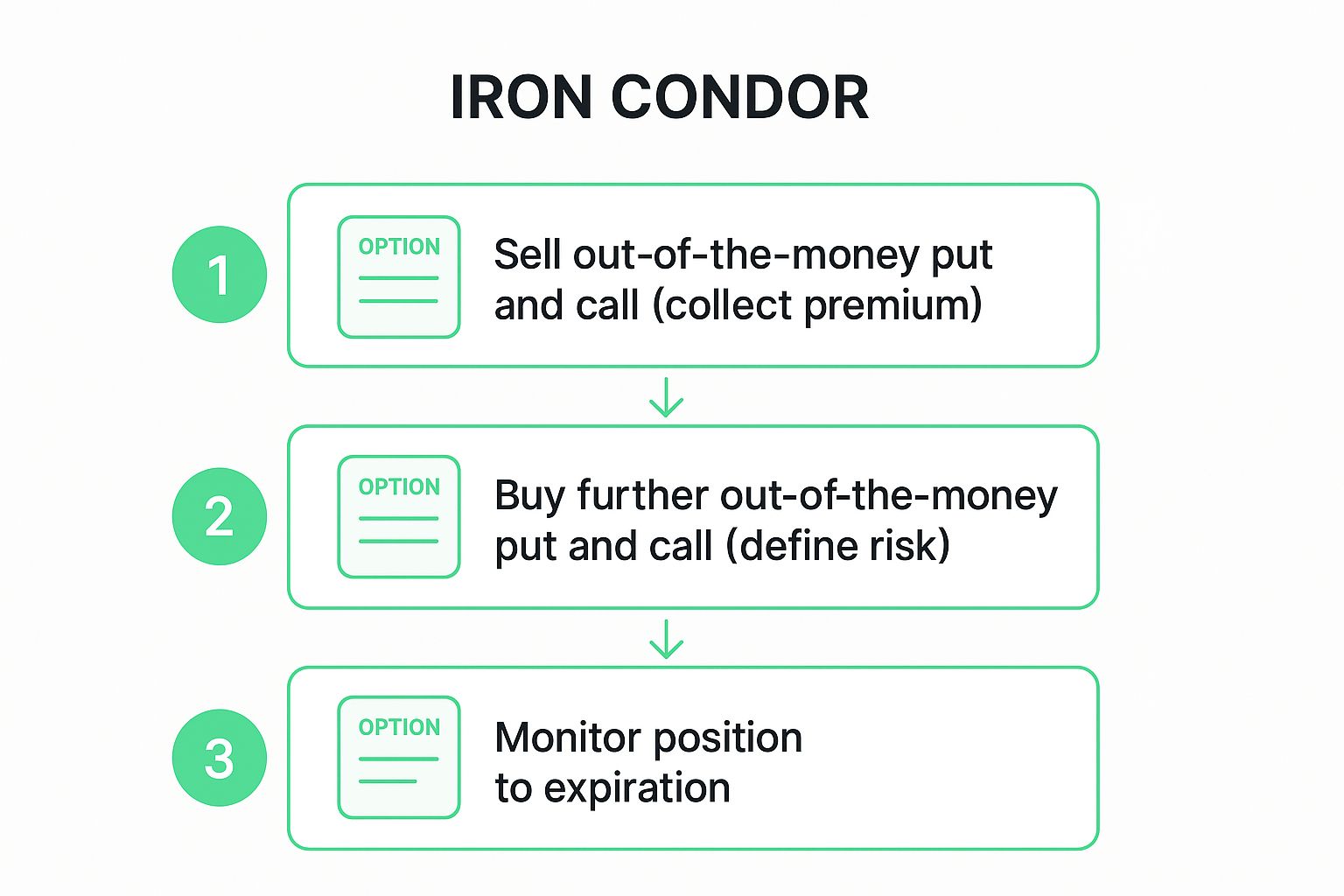

The infographic below illustrates the simple three-step workflow for setting up an iron condor position.

This process flow highlights how selling the inner strikes generates the initial income, while buying the outer strikes establishes a clear, defined risk limit for the trade.

How It Works: Risk vs. Reward

The beauty of the iron condor is its defined risk and reward profile. You know your maximum potential profit and maximum potential loss before you even enter the trade. The profit is capped at the net premium received, while the loss is limited to the difference between the strike prices of either spread, minus the premium collected.

- Maximum Profit: Net Premium Received. This is achieved if the stock price closes between the short call and short put strikes at expiration.

- Maximum Loss: (Width of the Spread - Net Premium Received) * 100. This occurs if the stock price moves significantly above the long call strike or below the long put strike.

When and Why to Use an Iron Condor

This strategy is perfect for traders with a neutral outlook who believe an underlying asset will not make a large move in either direction. It's particularly effective on high-volume, liquid ETFs like SPY, QQQ, or IWM, especially during periods of low implied volatility. Many traders implement this strategy to profit from time decay (theta), as the value of the options erodes each day the stock price stays within the range.

Key Insight: Think of an iron condor as building a "house" for the stock price to live in. As long as the price stays comfortably inside the walls (your short strikes) until expiration, you collect rent (the premium).

Actionable Tips for Implementation

To successfully manage an iron condor, a data-driven approach is critical:

- Select the Right Expiration: Just like with covered calls, target options with 30-45 days to expiration (DTE). This window provides a sweet spot for premium collection and accelerated time decay, which is the primary driver of profit for this strategy.

- Define Your Risk-Reward: A common guideline is to structure the trade so the potential reward (the premium) is at least one-third of the maximum risk. For example, if the strikes are $5 wide ($500 max risk), aim to collect at least $125 in premium.

- Plan Your Profit-Taking Exit: Don't be greedy and hold until expiration. A disciplined approach is to set a profit target of 25-50% of the maximum profit. Closing the trade early locks in gains and frees up capital for new opportunities.

For those looking to explore similar range-bound strategies, you can learn more about the differences between an iron condor and its cousin, the iron butterfly. Read more about the Iron Condor Strategy vs. Iron Butterfly on strikeprice.app.

4. Wheel Strategy

The Wheel Strategy is a systematic, cyclical approach that combines two foundational options income strategies: the cash-secured put and the covered call. Popularized by online communities like Reddit's r/thetagang and platforms such as Tastytrade, it provides a structured method for continuously generating premium income by either acquiring a stock at a discount or selling it at a profit.

The process begins by selling a cash-secured put on a stock you are willing to own long-term. If the put expires worthless, you keep the premium and repeat the process. If the stock price drops below the strike price and you are assigned the shares, you then transition to the second phase: selling covered calls against your newly acquired stock. You continue selling covered calls until the shares are eventually called away, at which point the "wheel" starts over again with a new cash-secured put.

How It Works: Risk vs. Reward

The beauty of the Wheel Strategy lies in its methodical nature. You are always in an income-generating position, either collecting premium from puts or from calls. The primary risk is bag-holding, which occurs if you are assigned a stock that continues to fall significantly in price, making it difficult to sell covered calls above your cost basis. However, because the strategy is predicated on choosing high-quality stocks you want to own anyway, this risk is mitigated compared to speculative trading.

- Maximum Profit: The profit potential is not strictly capped but is realized through the continuous collection of premiums from both puts and calls over time.

- Maximum Loss: (Stock Purchase Price - Total Premiums Received) * 100. This is the same as owning the stock outright, but your break-even point is lowered by the premiums collected.

When and Why to Use the Wheel Strategy

This strategy is ideal for patient, long-term investors who want to build positions in quality companies at a discount or generate consistent income. It works best in neutral-to-bullish market conditions. If you have a list of blue-chip dividend stocks or stable ETFs like SPY or QQQ that you'd be happy to hold, the wheel provides a framework for monetizing your willingness to buy them. It transforms the act of waiting to buy a stock into an income-producing activity.

Key Insight: The Wheel Strategy is not just about collecting premium; it's a disciplined stock acquisition and income generation system. Every outcome is productive: you either get paid to wait to buy a stock, or you get paid while you own it.

Actionable Tips for Implementation

A successful wheel strategy depends on discipline and careful stock selection:

- Select High-Quality Stocks: This is the most critical rule. Only run the wheel on stocks or ETFs you are genuinely comfortable owning for the long term. This prevents panic-selling if you get assigned during a market downturn.

- Target the 20-30 Delta: For both your cash-secured puts and covered calls, aim for a delta between 0.20 and 0.30. This provides a high probability (70-80%) of the options expiring worthless, maximizing your premium income while managing the frequency of assignment.

- Maintain Consistent Position Sizing: Determine a standard amount of capital to allocate to each wheel trade and stick with it. This prevents over-exposure to a single stock and ensures you always have the required cash to secure your puts.

- Manage Around Dividends: Be aware of ex-dividend dates. When selling covered calls, deep in-the-money calls are often exercised early by buyers looking to capture the dividend. You may want to close your position before the ex-dividend date to avoid this.

5. Credit Spread Strategy

For traders seeking more defined risk and capital efficiency, the credit spread is a cornerstone of advanced options income strategies. This strategy involves simultaneously selling a high-premium option and buying a lower-premium option of the same type (both calls or both puts) and with the same expiration date. The difference between the premium collected from the sold option and the premium paid for the purchased option results in a net credit, which is the maximum potential profit on the trade.

The purchased option acts as a form of insurance, defining your maximum potential loss from the very beginning. This structure allows traders to generate income with significantly less capital and risk compared to selling a naked option. There are two primary types: a bull put spread (betting the stock stays above a certain price) and a bear call spread (betting the stock stays below a certain price).

How It Works: Risk vs. Reward

The beauty of a credit spread lies in its defined-risk nature. Unlike a naked put or call, your maximum loss is capped and known before you enter the trade. This makes it a highly popular strategy for managing risk while still benefiting from time decay (theta) and the stock price moving in your favor (or simply not moving against you). The trade profits if the options expire worthless, allowing you to keep the entire initial premium.

- Maximum Profit: Net Premium Received. This is realized if the options expire out-of-the-money.

- Maximum Loss: (Width of the Strikes - Net Premium Received) * 100. This loss is fully defined at the trade's inception.

When and Why to Use a Credit Spread

Credit spreads are incredibly versatile. A bull put spread is ideal when you have a neutral to bullish outlook on a stock or ETF, believing it will stay above your short put strike price. Conversely, a bear call spread is perfect for a neutral to bearish outlook on an asset you believe is overextended and will stay below your short call strike. They are excellent for generating consistent income with limited capital and precisely managed risk. For those looking to delve deeper, you can explore detailed guides on the bull put credit spread.

Key Insight: Think of a credit spread as making a directional bet with built-in protection. You are defining a price zone where the stock needs to stay (or stay away from) for you to profit, and your loss is capped if you're wrong.

Actionable Tips for Implementation

To implement credit spreads effectively, focus on probabilities and risk management:

- Aim for High Probability: Target spreads with a 70-80% probability of profit (POP). This usually means selling the short leg of the spread at a delta around 0.20 to 0.30, giving you a high statistical chance of success.

- Manage Your Risk-Reward: A common guideline is to seek a risk-to-reward ratio of at least 1:3, meaning for every $1 of potential profit, you should risk no more than $3. However, be flexible; higher probability trades often come with wider risk-reward ratios.

- Take Profits Early: Don't hold the trade until expiration to squeeze out the last few pennies. A standard best practice is to set a profit target to close the trade at 25-50% of the maximum potential profit. This frees up capital and reduces the risk of the trade moving against you.

- Avoid High-Impact Events: Do not place credit spreads on individual stocks right before major known events like earnings reports or FDA announcements. The unpredictable volatility can easily wipe out a high-probability trade. Stick to broad market ETFs or wait until after the event.

6. Naked Put Strategy

The naked put, also known as an uncovered put, is a high-risk, high-reward strategy that stands in contrast to its cash-secured counterpart. As one of the more advanced options income strategies, it involves selling a put option without setting aside the cash required to purchase the underlying stock if assigned. Instead, the trader uses their portfolio's margin buying power to secure the position, freeing up capital for other investments.

By selling the put option, you collect an immediate premium and take on the obligation to buy the underlying stock at the strike price if the stock's price falls below it by expiration. Because you are not holding a corresponding short position in the stock, the potential loss is substantial if the stock price drops dramatically. This strategy is exclusively for experienced traders who are comfortable with the risks and have a firm grasp of margin mechanics.

How It Works: Risk vs. Reward

The primary benefit of a naked put is capital efficiency. Since you don't tie up a large amount of cash, you can potentially generate a higher return on capital. The premium received is your maximum profit. However, the risk is the key differentiator. Unlike a cash-secured put where your loss is limited to the strike price minus the premium, a naked put's risk is technically close to the same but feels more significant as it can lead to a margin call and forced liquidation of other assets.

- Maximum Profit: The premium received when the put is sold. This is achieved if the stock price closes at or above the strike price at expiration.

- Maximum Loss: (Strike Price * 100) - Premium Received. The maximum loss occurs if the stock price goes to zero, which is identical to the cash-secured put, but the impact on a margin account can be far more severe.

When and Why to Use a Naked Put

This strategy is best suited for sophisticated investors with a strongly bullish to neutral outlook on a high-quality stock they wouldn't mind owning. It's often employed during market corrections when implied volatility is high, leading to inflated option premiums. The goal is pure income generation, leveraging margin to amplify returns, or to acquire shares at a discount if assignment occurs. Professional traders and hedge funds may use naked puts as part of broader portfolio strategies.

Key Insight: A naked put is a statement of confidence. You are essentially being paid to make a commitment: "I am so confident this stock will not fall below the strike price that I will use my account's leverage to back that belief."

Actionable Tips for Implementation

Success with naked puts requires discipline and strict risk management. For a comprehensive look into the mechanics, consider reviewing a detailed guide on the put selling strategy on strikeprice.app.

- Only Sell Puts on Quality Stocks: Never use this strategy on a speculative stock. Only sell naked puts on companies you are genuinely willing to own long-term if you are assigned the shares.

- Monitor Margin Requirements: Margin requirements can change based on the stock's volatility. Keep a close watch on your buying power and ensure you have a significant buffer to avoid a margin call.

- Define Your Exit Plan: Do not just wait for expiration. Plan your defensive adjustments in advance. This could involve setting a stop-loss on the option's price or rolling the position down and out if the trade moves against you.

- Use Low Delta Strikes: To increase your probability of success, stick to selling out-of-the-money puts with a low delta, such as 0.15 to 0.25. This reduces the chance of assignment while still providing a reasonable premium.

7. Strangle Strategy

The short strangle is a more advanced, undefined-risk strategy that builds on the principles of selling individual puts and calls. It is one of the classic options income strategies favored by professional traders looking to profit from low volatility and significant time decay. The strategy involves selling an out-of-the-money (OTM) call option and an out-of-the-money (OTM) put option simultaneously on the same underlying asset with the same expiration date.

By selling both options, the trader collects two premiums, creating a wide profit range between the two strike prices. The goal is for the underlying stock price to remain between the short put strike and the short call strike through expiration. If it does, both options expire worthless, and the trader keeps the entire premium received as profit. This strategy is effectively a bet that the stock will not make a large move in either direction.

How It Works: Risk vs. Reward

The primary benefit of a short strangle is its potential for a high probability of profit and a significant premium collection, especially when implied volatility is high. The trade-off is substantial: the strategy comes with undefined risk. If the stock price makes a massive move up or down, well past one of the strike prices, the potential losses are theoretically unlimited.

- Maximum Profit: The total premium received from selling both the call and the put. This is achieved if the stock price closes between the two strike prices at expiration.

- Maximum Loss: Unlimited. Significant losses occur if the stock price moves dramatically beyond either the call strike (to the upside) or the put strike (to the downside).

When and Why to Use a Strangle

This strategy is best suited for experienced traders who are confident that a stock will exhibit low volatility and trade within a well-defined range. It's often used on broad market ETFs like SPY or QQQ during periods of expected market calm. Traders also implement strangles to capitalize on "volatility crush," selling options when implied volatility is high (e.g., before a known event like an earnings announcement) with the expectation that volatility will drop afterward, decreasing the options' prices.

Key Insight: A short strangle is a pure volatility play. You are essentially betting that the market's fear (implied volatility) is overstated and the stock's actual movement will be much tamer than expected.

Actionable Tips for Implementation

To manage the significant risks of a strangle, a disciplined and data-driven approach is critical:

- Sell into High Volatility: The best time to enter a strangle is when the implied volatility rank (IV Rank) of an asset is high, typically above 50. This ensures you are selling expensive options, maximizing your premium and widening your break-even points.

- Choose Strikes by Delta: A common approach is to select strikes with a delta around 0.15 to 0.20 for both the call and the put. This creates a statistically high probability (60-70%) of the stock price remaining between your strikes.

- Define Your Exit Early: Do not hold strangles to expiration. A standard best practice is to set a profit target of 25-50% of the maximum profit. Once this target is hit, close the position to lock in the gain and eliminate the risk of a sudden adverse move.

Options Income Strategies Comparison Overview

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Covered Call Strategy | Medium - requires stock ownership and option selling | High - needs owning 100 shares per contract | Moderate income, capped upside | Sideways to slightly bullish markets | Consistent premium income, some downside protection |

| Cash-Secured Put Strategy | Medium - involves selling puts with cash backup | High - cash to cover potential stock purchase | Income with possible stock acquisition | Neutral to bullish markets | Income generation plus buying stocks at discount |

| Iron Condor Strategy | High - complex multi-leg spreads | Moderate - margin varies by broker | Limited profits, defined max risk | Low volatility, range-bound markets | High probability of profit, defined risk/reward |

| Wheel Strategy | Medium - systematic combo of puts and calls | High - requires stock ownership and cash | Consistent income, cycle of selling | Various markets, income-focused investors | Continuous income, capitalizes on stock assignment |

| Credit Spread Strategy | Medium - single type spreads with defined risk | Moderate - margin based on spread width | Limited profit, defined max loss | Bullish or bearish directional setups | Limited risk, high probability of consistent income |

| Naked Put Strategy | Medium to High - selling puts without collateral | Moderate - margin-based, flexible sizing | Higher return but unlimited downside | Speculation or income in bullish/neutral | High capital efficiency, flexible sizing |

| Strangle Strategy | High - selling both puts and calls separately | High - significant margin requirements | Income from time decay, high risk | Range-bound stocks with low volatility | Income from dual premiums, flexible strikes |

From Strategy to Action: Building Your Income Engine

You have now journeyed through seven of the market's most potent options income strategies. From the foundational stability of the covered call and cash-secured put to the more complex, direction-neutral setups like the iron condor and strangle, each strategy presents a unique toolkit for generating consistent cash flow from your portfolio.

The central theme connecting these approaches is a fundamental shift in perspective. Instead of solely relying on capital appreciation, you are now equipped to proactively collect premium, transforming your stock holdings and cash reserves into active income-generating assets. This is the core of what makes options income strategies so powerful for retail investors seeking control over their financial outcomes.

However, theory without execution is just a blueprint. The true key to unlocking long-term, sustainable success lies in disciplined implementation, rigorous risk management, and, most importantly, data-driven decision-making.

Bridging the Gap from Knowledge to Profit

The biggest hurdle for many traders is moving from understanding a strategy to confidently applying it. It’s one thing to know what a credit spread is; it's another to select the right underlying asset, strike prices, and expiration date in a volatile market. This is where modern analytics tools become a game-changer.

Instead of relying on gut feelings or outdated rules of thumb, data-driven platforms empower you to operate with statistical precision. Imagine these scenarios:

- Automated Opportunity Scanning: Instead of manually searching for high-probability setups, you set your criteria, for example, "Find all cash-secured puts on S&P 100 stocks with a >90% probability of profit and at least 15% annualized return." The system delivers a curated list in seconds.

- Risk-Defined Trade Construction: You decide on a maximum acceptable loss and a target income for an iron condor. The platform can then help you construct the trade by suggesting strike prices that align perfectly with your predefined risk-reward parameters.

- Probabilistic Decision-Making: For a covered call, you can instantly see the probability of the stock price finishing above your chosen strike. This allows you to intelligently balance the premium received against the likelihood of having your shares called away.

This is the evolution of options trading: replacing guesswork with quantifiable probabilities.

Your Actionable Next Steps

Mastering options income strategies is a marathon, not a sprint. The journey is built on incremental progress and continuous learning. Here is a practical roadmap to get started:

- Select Your Starting Strategy: Revisit the strategies we've discussed. Choose one that aligns with your current capital, risk tolerance, and market outlook. For most beginners, the cash-secured put or the covered call are excellent starting points due to their defined risk and simpler mechanics.

- Paper Trade First: Before risking a single dollar, open a paper trading account. Execute your chosen strategy multiple times. Get a feel for placing orders, managing positions, and closing trades. This is your no-risk sandbox for building muscle memory.

- Start Small, Win Small: Once you are comfortable, deploy a small, manageable amount of real capital. The goal isn't to hit a home run on your first trade; it's to successfully execute the strategy from start to finish and build confidence.

- Track and Analyze Everything: Keep a detailed trading journal. Record your entry and exit points, the premium collected, your reasoning for the trade, and the final outcome. This feedback loop is your single most valuable learning tool.

As your skills grow, you can begin exploring how different derivatives and market approaches complement each other. Um Ihr Wissen über Derivate und erweiterte Handelsansätze zu vertiefen, könnte auch eine Einführung in das Future Trading hilfreich sein. Ultimately, the goal is to build a diversified portfolio of strategies you can deploy as market conditions change. With patience, discipline, and the right analytical tools, you are fully equipped to start building a powerful and reliable income engine.

Ready to move from theory to action with data-driven confidence? Strike Price provides the real-time probability tools and trade scanners you need to find and manage high-probability options income strategies. Stop guessing and start trading with a statistical edge by visiting Strike Price to see how our platform can revolutionize your approach.