Options Trading for Income: Top Strategies to Boost Your Earnings

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

When people hear "options trading," they often think of high-stakes gambling on wild market swings. And while that's one way to play the game, there's a completely different approach—one focused on generating a steady, predictable cash flow.

This strategy isn't about hitting home runs. It’s about consistently getting on base by selling options contracts and collecting what’s known as the premium. You’re essentially using the assets you already have, whether that’s stocks or cash, to create a regular revenue stream.

How to Generate Consistent Income with Options

The secret is shifting your mindset from being an options buyer to an options seller.

When you buy an option, you're usually making a bet that a stock will move sharply in one direction. When you sell an option, you get paid an immediate cash premium. That cash is yours to keep, no matter what the stock does later. Think of yourself as an insurance company for the stock market. You sell a policy (the option contract) and collect a fee for taking on a very specific, calculated risk.

The Landlord Analogy for Options Income

The easiest way to wrap your head around this is to think like a real estate investor.

- Covered Calls: You own a house (100 shares of a stock). You decide to rent it out to a tenant (sell a call option) and collect monthly rent (the premium). You still own the property, but now you're earning money from it.

- Cash-Secured Puts: You want to buy a house, but only if you can get it at a great price. You can agree to buy it if the price drops to your target (sell a put option) and get paid a fee (the premium) just for making that offer.

This approach is all about generating yield from assets you either already own or are happy to own at a lower price. It turns market volatility, something most investors fear, into a source of reliable cash flow. You can dive deeper into these and other powerful tactics by exploring more advanced options income strategies.

The goal of income-focused options trading isn't to get rich on one trade. It's about consistently hitting singles and doubles to build a reliable monthly income that compounds over time.

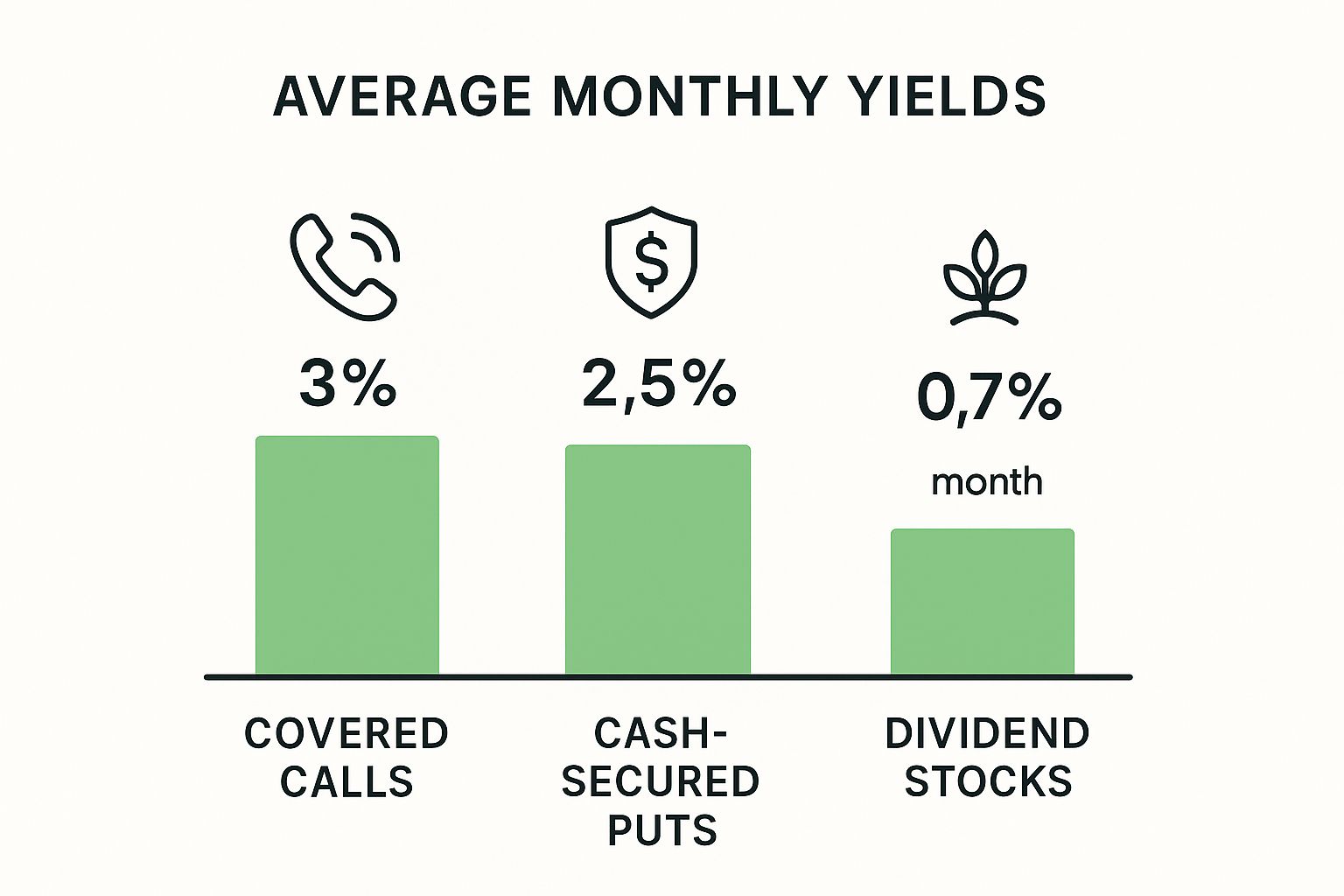

Comparing Potential Yields

Dividend stocks have long been the go-to for investment income, but certain options strategies can offer significantly higher potential monthly yields—though they come with a different set of risks.

This chart breaks down the average potential monthly yield you might see from covered calls and cash-secured puts versus what you'd get from typical dividend stocks.

The numbers speak for themselves. The potential income from selling options can dwarf the yield from traditional dividend investing, which is why so many people are drawn to these methods.

But this isn't free money. It demands a clear understanding of the risks and a disciplined plan. The two foundational strategies that make this possible are covered calls and cash-secured puts. They are the workhorses for turning your portfolio into an income-generating machine.

Core Income Strategies at a Glance

To make it even clearer, let's compare the two primary income strategies side-by-side. Think of this as your quick-reference guide.

| Strategy | Objective | When You Use It | Main Risk |

|---|---|---|---|

| Covered Call | Generate income from stocks you already own. | You're neutral to slightly bullish on a stock you hold and want to earn extra cash from it. | Your shares might get "called away" (sold) at the strike price, capping your potential profit if the stock soars. |

| Cash-Secured Put | Generate income while waiting to buy a stock you want at a lower price. | You're neutral to bullish on a stock and want to buy it, but only if the price drops to your target. | You might be forced to buy the stock at your strike price, even if the market price has fallen further below it. |

As you can see, each strategy serves a distinct purpose. Covered calls help you monetize the stocks in your portfolio, while cash-secured puts pay you for your patience in acquiring new ones. Mastering both gives you a flexible toolkit for generating income in different market conditions.

The Reality of Trading Success and Failure

Before we jump into the nuts and bolts of using options for income, we need a serious reality check. It’s easy to get drawn in by the promise of fast money, but the truth is, the path to trading success is paved with challenges that sideline unprepared traders. It’s absolutely possible to win, but wins are built on knowledge and discipline, not just a lucky guess.

Think about it this way: Trading without a plan is like trying to perform surgery without ever going to medical school. You might have the best tools and a lot of capital, but without understanding how the market works and how to execute a strategy, you’re just gambling. And that rarely ends well.

The Retail and Professional Divide

There’s a massive gap between how professional traders and the average retail trader experience the options market. For the pros, it’s a career built on deep analysis, sophisticated tools, and ironclad risk management. For many retail traders, it can quickly become an expensive, frustrating hobby.

The stats tell a stark story. Research shows that from 2019 to 2021, retail traders as a group lost over $2 billion on options premiums alone. This isn't to scare you off—it's to underscore a critical point. While the potential is real, most people who jump in without a plan lose money.

This doesn't mean you can't be successful. It just means you have to approach trading with the seriousness of a professional, even if you’re doing it from your kitchen table. The biggest difference? Having a repeatable process.

Key Takeaway: The pros who make a living from trading aren't just smarter. They have a defined edge built on strategy, risk control, and emotional discipline—and anyone can learn to build their own.

Building Your Edge Through Discipline

The shift from a struggling trader to a consistently profitable one almost always comes down to a change in mindset. Instead of chasing lottery-ticket trades, the goal becomes creating high-probability setups that generate steady, predictable gains. You have to treat it like a business.

Running your trading like a business rests on a few key pillars:

- Continuous Education: The markets never stop changing, and neither should you. A commitment to learning is non-negotiable.

- A Written Trading Plan: This is your business plan. It outlines your goals, strategies, entry/exit rules, and—most importantly—how you'll manage risk.

- Rigorous Risk Management: Never risk more than a small, set percentage of your capital on any single trade. This is how you survive the inevitable losses.

- Emotional Neutrality: The real secret is following your plan, even when fear or greed is screaming at you to do the opposite.

Discipline goes beyond just understanding the charts. Sticking to your plan day in and day out is tough, which is why a financial accountability partner can be a game-changer. Having someone in your corner can be the difference between a small, manageable loss and a devastating one. Your edge isn't a magic indicator; it’s your unwavering discipline.

Using Covered Calls for Monthly Income

The covered call is easily one of the most reliable and widely used strategies for generating consistent income from options. It's popular for a good reason—it’s straightforward and turns stocks you already own into income-producing assets.

Think of it like being a landlord. You own a valuable asset (your shares), and you decide to rent out the potential upside of that asset for a set period. The "rent" you collect is the option premium, which lands in your account immediately. You still own the stock, but now it’s working a little harder for you.

How a Covered Call Works

Executing a covered call is a simple, two-step process that builds on an existing stock position. You aren't buying anything new to get started; you’re just monetizing what’s already in your portfolio.

First, you need to own at least 100 shares of a stock. This is non-negotiable because one standard options contract represents exactly 100 shares. Owning the underlying stock is what makes the call "covered," which dramatically reduces your risk compared to selling a "naked" call.

Once you have the shares, you sell one call option against them. By doing this, you're selling someone the right—but not the obligation—to buy your 100 shares at a specific price (the strike price) on or before a specific date (the expiration date). For making this deal, you get paid an instant cash payment known as the premium.

The Core Concept: By selling a covered call, you agree to cap your potential stock gains in exchange for immediate, guaranteed income. You keep the premium no matter what happens, making it a powerful income-generation tool.

Selecting the Right Stocks and Strikes

The best stocks for covered calls are typically stable, blue-chip companies you wouldn't mind holding for the long haul. It's usually best to avoid highly volatile or speculative stocks, since a sudden price explosion could force you to sell your shares and miss out on huge gains.

Choosing the right strike price is all about balancing income with risk.

- Higher Strike Prices: These are further from the current stock price, making them "safer" (less likely to get assigned). The trade-off? They also come with lower premium income.

- Lower Strike Prices: These are closer to the current stock price. They offer much juicier premiums but also increase the odds that your shares will be sold.

The expiration date also plays a huge role. Selling options with 30-45 days left until they expire often hits the sweet spot. This timeframe captures the best rate of time decay (theta), maximizing your income relative to the time you're in the trade. For a more detailed breakdown, check out our complete guide to the covered call income strategy.

The Three Possible Outcomes

When you sell a covered call, only three things can happen by the expiration date. Let’s walk through a quick example. Imagine you own 100 shares of XYZ Corp, which is currently trading at $48 per share. You decide to sell one call option with a $50 strike price and collect a $1 premium, for a total of $100.

- The Stock Stays Below the Strike Price: If XYZ closes below $50 on expiration day, the option expires worthless. You keep your 100 shares, and the $100 premium is pure profit. This is the ideal outcome for pure income generation.

- The Stock Rises Above the Strike Price: If XYZ closes at, say, $52, the option gets exercised. You have to sell your 100 shares at the agreed-upon $50 strike price. You still keep the $100 premium, and you also pocket the gains from the stock's move from $48 to $50. Your profit is simply capped at the strike price.

- The Stock Price Falls: If XYZ drops to $45, the option still expires worthless. You keep the $100 premium, which helps offset some of the paper loss on your shares. In effect, it lowers your cost basis on the stock.

Notice a pattern? In every scenario, you keep the premium. This is what makes covered calls so powerful for generating a steady cash flow stream from the stocks you already own.

Using Cash-Secured Puts to Generate Income

While covered calls are great for earning income on stocks you already have, the cash-secured put flips the script. It’s a powerful way to get paid for stocks you want to own, but at a better price. This is a foundational strategy for any serious income trader.

Instead of just setting a price alert and waiting for a stock to drop, you can sell a cash-secured put and collect cash for your patience. Think of it like placing a standing offer to buy a stock at a discount—and getting paid a fee whether your offer gets accepted or not. It's a core tactic for any solid options trading for income plan.

The Mechanics of Getting Paid to Wait

The cash-secured put is a straightforward, defined-risk strategy. The "cash-secured" part is the most important piece of the puzzle. It simply means you have enough cash set aside in your account to purchase the shares if you're required to. This is what separates it from the massive risk of selling "naked" puts.

Here’s how it works in a nutshell:

- Identify a Stock: You find a quality company you’d like to own, but you think its current price is a little rich. Let's say you want to buy 100 shares of ABC Corp, currently trading at $105, but you'd be much happier buying it at $100.

- Set Aside the Cash: You need to have the money ready to go. In this case, you'd secure $10,000 (100 shares x $100 strike price) in your brokerage account.

- Sell a Put Option: You then sell one put option contract with a $100 strike price. For selling this contract, you immediately collect a premium—let's say it's $2 per share, for a total of $200.

That $200 is yours to keep, no matter what happens next. You’ve literally just been paid to agree to buy a stock you wanted anyway, but at a lower price.

Choosing Your Strike and Expiration

Picking the right strike price and expiration date is where the art comes in. It's all about balancing the income you want to generate with your goal of maybe, just maybe, getting to buy the stock.

- Strike Price Selection: A strike price closer to the current stock price will always pay a higher premium. The tradeoff? It has a much greater chance of being assigned, meaning you'll have to buy the shares. A strike price further away is "safer" and less likely to be assigned, but it will generate less income.

- Expiration Date: Just like with covered calls, options with 30 to 45 days left until they expire often hit the sweet spot. This window gives you enough time to collect a meaningful premium while letting accelerated time decay (theta) work in your favor.

A cash-secured put really is a win-win scenario. Either the option expires worthless and you pocket the premium as pure profit, or you get assigned the shares of a company you wanted to own from the start—but at an effective price that's even lower than the one you originally targeted.

For anyone who wants to go deeper, our detailed guide on how to sell cash-secured puts breaks down the entire process with more advanced examples.

The Two Win-Win Outcomes

Let's get back to our ABC Corp example. You sold a put with a $100 strike and collected a $200 premium. As the expiration date gets closer, one of two things is going to happen.

| Scenario | Stock Price at Expiration | Outcome |

|---|---|---|

| Pure Income | Closes above $100 (e.g., at $102) | The put option expires worthless. You keep the $200 premium, and your initial $10,000 in cash is freed up. You just made a 2% return on your secured cash in about a month without ever touching the stock. |

| Acquiring the Stock | Closes below $100 (e.g., at $98) | The put is assigned. You're now obligated to buy 100 shares of ABC at your $100 strike price, and you use your set-aside cash to do it. |

In that second scenario, you now own a stock you wanted. But here’s the kicker: your effective purchase price isn't really $100. Because you received that $200 premium upfront, your net cost is only $9,800 for 100 shares, or $98 per share. You successfully bought the stock at a discount to your target price, all while the market price was also $98. It’s a smarter way to build positions in great companies.

Why Market Liquidity and Volume Matter

A great options trading for income strategy is only as good as the market you're trading in. Imagine you've spotted the perfect covered call, but when you go to sell the contract... crickets. No buyers. Or worse, you try to close out a position and find yourself completely stuck.

A great options trading for income strategy is only as good as the market you're trading in. Imagine you've spotted the perfect covered call, but when you go to sell the contract... crickets. No buyers. Or worse, you try to close out a position and find yourself completely stuck.

This is where market liquidity and volume become your best friends.

Think of liquidity like the water level in a busy harbor. A highly liquid market is a deep harbor, where you can easily get your boat in (enter a trade) and just as easily get it out (exit a trade). An illiquid market? That’s more like a shallow, muddy pond. Getting in and out is a struggle, and you'll kick up a lot of muck that costs you money.

That "cost" usually shows up as slippage—the frustrating difference between the price you thought you’d get and the price you actually got. In markets with low trading volume, slippage can silently eat away at your hard-earned premiums, turning a solid trade into a mediocre one.

The Importance of a Tight Bid-Ask Spread

The most direct way liquidity hits your wallet is through the bid-ask spread. This is simply the tiny gap between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). When you sell an option to open a position, you're almost always getting a price at or very near the bid.

In a market buzzing with high trading volume, the competition between buyers and sellers is intense. This pressure forces the bid-ask spread to be razor-thin—often just a penny or two. A tight spread means you’re getting a fair price and not giving up a chunk of your profit just for the privilege of entering the trade.

On the other hand, options on stocks with low volume have ridiculously wide spreads. You might see a bid of $0.90 and an ask of $1.10. That $0.20 gap represents an instant 20% haircut if you were to enter and exit that trade back-to-back. For income traders who rely on stringing together small, consistent wins, wide spreads are a deal-breaker.

Reading Market Sentiment with Volume Data

Beyond just making your trades smoother, volume data gives you a window into the market's collective mindset. High trading volume is a big, flashing sign that a lot of people are paying attention, confirming that a stock is on the radar of serious investors.

The U.S. options market shows this on a massive scale. For instance, on a single day in July 2025, the Cboe reported that index options volume swelled from around 433,000 contracts in the morning to over 2.53 million by the afternoon. You can dive deeper into these dynamics and see how data reflects trader sentiment on Cboe.com.

This beehive of activity is exactly what income strategies need for clean, efficient execution. Another powerful tool we can pull from volume data is the Put/Call Ratio (P/C Ratio).

The Put/Call Ratio is calculated by dividing the total number of traded put options by the number of traded call options. It acts as a contrarian indicator, helping you gauge whether the market is overly bullish or bearish.

A high P/C ratio (above 1.0) suggests traders are snapping up more puts than calls, signaling a bearish or fearful mood. A low P/C ratio (below 0.7) points to bullishness. By keeping an eye on this ratio, you can get a better feel for the market's mood and position your trades to swim with the current, not against it.

Using Historical Data to Refine Your Strategy

Guesswork is a recipe for disaster in options trading. While solid strategies like covered calls and cash-secured puts give you a great starting point, the real secret to consistency is refining your approach with cold, hard data. This is how you go from just following a recipe to becoming a master chef.

The best traders I know have one thing in common: they look backward to sharpen their view forward. They lean on historical data to test, validate, and tweak their strategies before a single dollar is ever on the line. It’s what turns trading from a gut-feeling gamble into a calculated, data-backed discipline.

The Power of Backtesting Your Strategy

The engine of this data-driven approach is backtesting. Think of it as a time machine for your trading plan. You take your exact rules—which stocks you trade, what strike prices you pick, your exit criteria—and run them against past market data to see how you would have fared.

The goal isn't to find some mythical "perfect" strategy that never has a losing trade. It's about finding the cracks in your plan and building unshakeable confidence in it.

- Pinpoint Strengths: Does your strategy crush it in bull markets? Or is it a steady earner when things are choppy and going nowhere?

- Uncover Weaknesses: Where does your plan fall apart? Does it get hammered during a market nosedive or when volatility dries up?

- Optimize Your Rules: Maybe you run the numbers and find that selling puts with a .20 delta consistently works better for your risk appetite than a .30 delta.

By stress-testing your plan against how the market actually behaved, you can make smart adjustments, learn to trust your process, and avoid paying for those lessons with your hard-earned capital.

Finding and Using the Right Data

To get anything meaningful out of your analysis, you need the right ingredients. For backtesting options, that means historical stock prices, option contract prices, and implied volatility levels. Professional-grade historical options data is a game-changer here, offering deep datasets with daily prices, implied volatility, and the "Greeks" (critical risk metrics). Top providers offer data across global markets, letting you test your income strategies through all kinds of market cycles.

Backtesting isn't about predicting the future. It’s about understanding how your strategy behaves under pressure, so you can trade with a calm, statistical edge instead of gut feelings.

To really dial in your strategy, learning how to analyze data in Excel is a foundational skill. Even with a simple spreadsheet, you can track your simulated trades, crunch the numbers on performance, and see your results visually. This hands-on work builds a deep, intuitive feel for your strategy’s personality that you just can’t get from reading a book. The goal is simple: use the past to make smarter, more profitable decisions in the future.

Frequently Asked Questions About Options Income

As you get your feet wet with options income, you’ll find the same questions tend to pop up. Getting straight answers is the fastest way to build confidence and sidestep those early, preventable mistakes. Let's tackle some of the most common ones I hear from new income traders.

How Much Capital Do I Need to Start?

There’s no magic number here. The real answer is: have enough capital to run your strategy safely.

If you're selling cash-secured puts, that means having enough cash on hand to actually buy 100 shares of the stock you're targeting. For covered calls, you need to own those 100 shares outright.

As a general rule of thumb, most experienced traders find $10,000 to $25,000 is a solid starting point. This gives you enough breathing room to diversify your trades and size your positions properly, so you aren't betting the farm on a single outcome.

What Is the Biggest Risk with Covered Calls?

The single biggest risk is opportunity cost. Plain and simple.

Imagine you sell a covered call and the stock suddenly rips higher, blowing way past your strike price. You're still obligated to sell your shares at that lower agreed-upon price.

Sure, you keep the premium you collected—that's yours no matter what. But you'll have to watch from the sidelines as the stock keeps climbing, missing out on all that extra profit. This is exactly why covered calls work best on stable, steady stocks you don't expect to go to the moon overnight.

Can I Lose More Than My Secured Cash on a Put?

Nope. With a properly executed cash-secured put, your risk is locked in from the start. Since your trade is fully backed by cash you've already set aside, it's impossible to lose more than that amount.

Your maximum potential loss is the strike price minus the premium you received. This only happens if you're forced to buy the stock and its value then plummets to zero. This defined-risk nature is a key reason it’s a foundational options trading for income strategy.

How Often Should I Place Income Trades?

How often you trade really comes down to your personal strategy and how much risk you're comfortable with.

Many income traders have found a sweet spot selling options with 30 to 45 days left until they expire. This window tends to offer a great balance between collecting a decent premium upfront and benefiting from accelerating time decay (theta).

Of course, some traders build entire systems around weekly options for more frequent paydays, while others prefer playing the long game with longer-term contracts. It's all about what works for you. Just remember that navigating your profitability also means having a firm grasp on the tax side of things, including understanding capital gains tax.

Stop gambling and start building a real income stream. With Strike Price, you get the data-driven probabilities you need to sell options with confidence. Our platform shows you the real risk and reward for every trade, so you can hit your income targets consistently. Transform your trading strategy with a free trial of Strike Price today!