What Is Slippage in Trading and How to Avoid It

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Definitive Guide to Short Call Options Strategies

Master short call options, from covered calls to naked calls. Learn proven strategies to manage risk, generate income, and analyze payoffs like a pro.

What Is a Strangle An Options Trading Guide

Uncover what is a strangle in options trading. This guide explains how to use this powerful volatility strategy for both big market moves and stability.

Credit Spread Vs Debit Spread A Trader's Decisive Guide

Dive into the credit spread vs debit spread debate. Learn which options strategy fits your goals with real-world scenarios and risk-reward analysis.

Slippage is that frustrating little gap between the price you think you’re going to get and the price you actually get when your trade goes through. It can work for you, against you, or not at all, but understanding it is a non-negotiable for managing your risk.

So, What Exactly Is Slippage in Trading?

Ever tried to book a flight online, only to see the price jump the moment you click "buy"? That’s slippage in the real world. In trading, it’s the exact same concept—a price shift that happens in the split second between when you place your order and when it’s actually filled.

The Core Idea

Slippage is simply the difference between the expected price of a trade and the price at which the trade is actually executed.

It’s not always a bad thing. Sometimes the market moves in your favor.

- Positive slippage is when you get a better price than you expected. You might buy an asset for slightly less or sell it for slightly more. It’s a nice little bonus.

- Negative slippage is the one that stings. It’s when you end up paying more for an asset or selling it for less than you intended.

- Zero slippage means your order was filled at the exact price you saw when you clicked the button.

Why You Can’t Ignore It

Slippage isn't just a minor annoyance; it can slowly eat away at your profits or make your losses sting even more. It’s a direct hit to your trading costs and a big, flashing sign of high volatility in the market. Knowing when to expect it helps you make smarter choices about the types of orders you place.

Markets that move fast or don't have a lot of buyers and sellers are prime territory for slippage. Back in March 2020, when the COVID-19 news sent markets into a tailspin, a lot of traders saw slippage rates that were two to three times higher than normal. You can read more about those findings over at HedgeNordic.

Understanding slippage also goes hand-in-hand with the bid-ask spread, another key factor that impacts your final execution price.

This is where platforms like Strike Price come in, giving options sellers the data they need to get ahead of slippage.

- You get real-time alerts on assignment probability.

- Probability metrics for each strike help you balance safety and yield.

- A clean dashboard lets you track your execution performance.

- Continuous monitoring of probabilities means fewer execution surprises.

Certain situations are magnets for slippage risk. Be extra cautious around:

- News-driven events like earnings reports.

- Low-volume securities like penny stocks.

- Illiquid contracts like exotic options.

Getting a handle on slippage means you’ll get tighter fills and, ultimately, better results.

In the next sections, we’ll dive into the specific order types and strategies you can use to keep slippage under control. The goal? Improve your fills and boost your bottom line.

The Real Causes of Trading Slippage

To get a handle on slippage, you first need to know where it comes from. Slippage isn’t just random bad luck; it’s a direct response to what’s happening in the market right now. Two main culprits are behind that gap between the price you expect and the price you get: high volatility and low liquidity.

Think of volatility as a sudden squall hitting the open ocean. One minute, the water’s glass, and the next, massive waves are tossing everything around. In trading, those waves are lightning-fast price swings, usually kicked off by big economic news or a surprise announcement from a company. When you drop a market order into the middle of that storm, the price can jump dramatically in the fraction of a second it takes for your trade to go through.

Periods of increased market volatility are a huge driver of slippage because prices are just moving too fast for the system to keep up. Staying on top of these conditions means you need the best information possible, which is why using real-time options data is so critical for making sharp decisions.

Low Liquidity: The Other Side of the Coin

Now, picture trying to sell a rare painting in a tiny town. You might only find one or two people who are even interested, forcing you to take a lower offer than you’d hoped. That’s low liquidity in a nutshell — not enough buyers and sellers hanging around at a specific price.

This is common in the wilder corners of the market, like with penny stocks or obscure cryptocurrencies. If you try to place a big order, there just might not be enough shares or coins available at your target price to fill it.

So what happens? Your order has to "slip" down to find the next available buyers, grabbing shares at progressively worse prices until it's complete. It's a classic cause of negative slippage.

In markets like futures, for instance, slippage can pop up during quiet trading hours when there isn't much depth, or when a news event causes a sudden flood of traders to jump in at once.

Once you learn to spot these two forces—volatility and liquidity—you'll get much better at anticipating when slippage is a real threat and know when to adjust your game plan.

When Slippage Can Actually Help You

The word "slippage" usually sounds like something went wrong. But it isn't always the enemy of your trade. In fact, sometimes it can work in your favor, giving you an unexpected—and welcome—boost. This happy accident is known as positive slippage.

Positive slippage happens when the market moves to your advantage in the split second between placing your order and when it actually gets filled. If you’re buying, it means the price dropped, and you got the asset for less than you expected. If you’re selling, the price ticked up, and you walked away with more cash.

Of course, the opposite is also true. Negative slippage is the costly version we all dread, where the market moves against you. You end up buying higher or selling lower than you planned, which can chip away at your profits or make a loss even worse.

Slippage Scenarios in Action

Let's make this crystal clear. Imagine you want to buy 100 shares of a stock that’s currently trading at $50 per share.

- Negative Slippage: Your order fills at $50.10. You just paid an extra $10 for your position.

- Positive Slippage: Your order fills at $49.90. You just saved $10 on the trade. A pleasant surprise!

- Zero Slippage: Your order fills at exactly $50.00. No surprises here.

This is especially common in fast-moving, volatile markets where prices are jumping around. Getting a handle on different volatility trading strategies is key to navigating these kinds of conditions.

The key takeaway is that slippage is a two-way street. While you should always work to minimize the negative kind, it helps to remember that positive slippage is also part of the game. It provides a more balanced view of how markets really work.

To put it all together, here's a quick table breaking down how these scenarios play out for a buy order.

Slippage Outcomes at a Glance

| Slippage Type | Expected Price | Execution Price | Impact on Your Trade |

|---|---|---|---|

| Negative Slippage | $50.00 | $50.10 | You paid more than you intended. |

| Positive Slippage | $50.00 | $49.90 | You got a better deal than expected. |

| Zero Slippage | $50.00 | $50.00 | The trade executed at the exact price. |

As you can see, while zero slippage is the goal for predictability, not all slippage is created equal—and sometimes, it can be a nice little bonus.

Using Order Types to Control Slippage

When it comes to fighting slippage, the type of order you place is your first and best line of defense. It's the most direct tool you have. By understanding the core difference between your options, you can deliberately choose whether you want speed or price certainty for any given trade.

The two most fundamental choices are market orders and limit orders. They represent opposite ends of the trading spectrum.

A market order is all about speed. It basically tells your broker, "Get me in right now at the best price available." This guarantees you'll get into the trade almost instantly, but it leaves you completely exposed to negative slippage, especially when the market is moving fast.

A limit order is all about control. It tells your broker, "Only fill my order at this exact price or a better one." This is your strongest shield against getting a worse price, but there's a trade-off. If the market price never reaches your limit, your order might not get filled at all.

Balancing Speed and Certainty

So, which one should you use? It comes down to your goal for that specific trade.

Are you trying to jump on a freight train—a fast-moving trend where getting in immediately matters more than the exact cent? A market order could be the right call. But if you're patiently waiting for a precise entry point that lines up with your analysis, a limit order is the much safer bet.

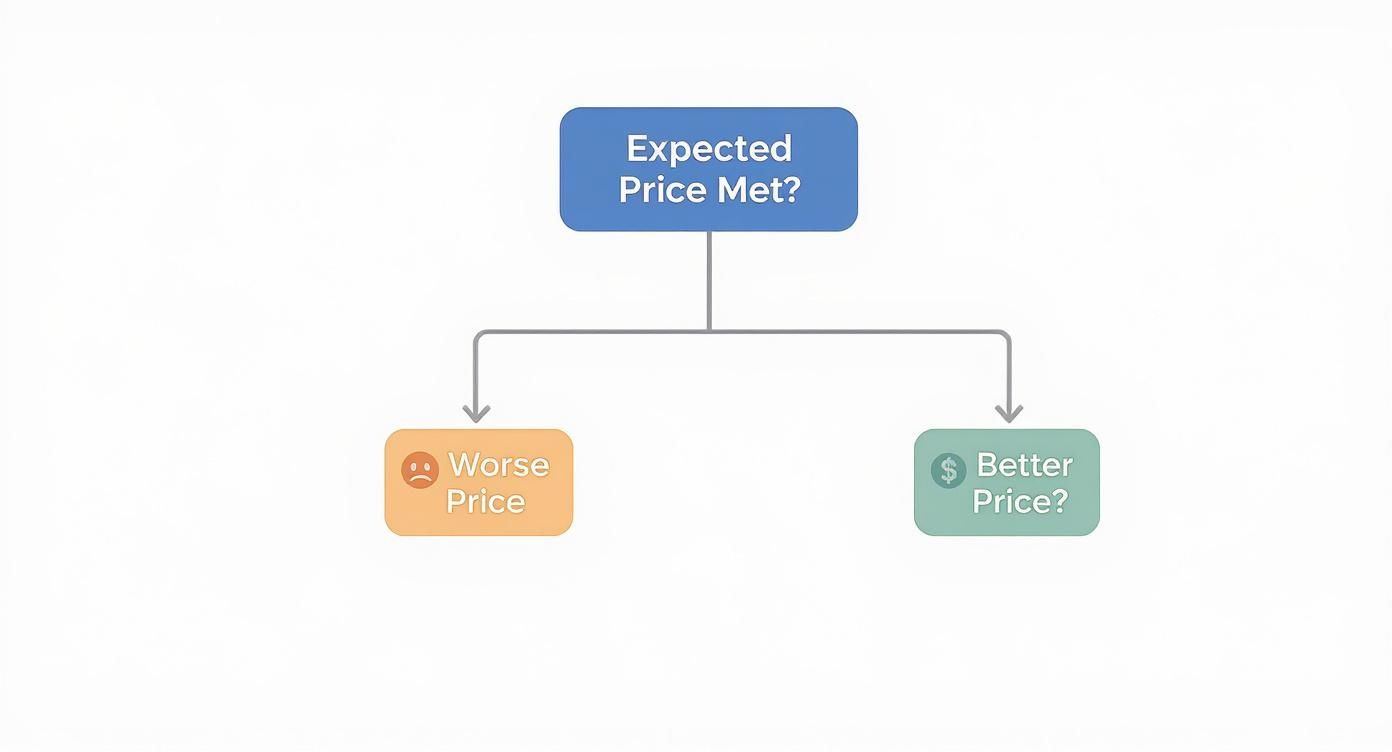

This infographic breaks down the simple reality of what happens after you click "buy" or "sell."

As the chart shows, every trade diverges down one of three paths: you get the price you wanted, a better one, or a worse one. Using the right order type gives you more say in which direction your trade goes.

Interestingly, while most traders dread getting a bad price, positive slippage happens more often than you might think. Recent data shows that across all order types, 25.64% of trades actually experienced positive slippage, while only 12.18% were hit with the negative kind.

The same data showed limit orders were overwhelmingly likely to get a better price, with a whopping 70.80% resulting in positive slippage. You can dig into the numbers yourself with these slippage statistics from FXCM.

Beyond these two basics, you'll find hybrid orders like stop-limit orders. These give you a middle ground, combining the features of a stop order (which triggers a market order at a certain price) and a limit order to give you more refined control over your execution.

At the end of the day, mastering your order types is what turns you from a passive price-taker into a strategic trader. You stop reacting to the market's whims and start dictating the terms on which you're willing to trade.

Proven Strategies to Minimize Slippage

While you can never completely get rid of slippage, you can absolutely tighten up your executions and reduce its impact on your account. Moving from theory to practice is all about adopting a toolkit of smart, proven strategies designed to protect your capital.

The most effective game plan comes down to a mix of timing, market selection, and how you manage your orders. By being deliberate about when and how you trade, you can sidestep the most common slippage traps and give yourself a real edge.

Choose Your Trading Times Wisely

One of the simplest yet most powerful tactics is to just avoid trading when the market goes haywire. Big news events, earnings reports, or Federal Reserve announcements almost always trigger chaotic price swings where slippage is a given.

A savvy trader knows that sometimes the best move is no move at all. Staying on the sidelines during these predictable market storms protects your capital from the wild price gaps that cause nasty surprises.

Instead, try to trade when the market is calmer and liquidity is high. You’ll often find the best conditions in the middle of the trading day, far away from the turbulence of the opening and closing bells.

Stick to High-Liquidity Markets

Just like you’d avoid trading at a chaotic time, you should also avoid chaotic markets. Highly liquid markets, like major stock indices or popular forex pairs, are packed with buyers and sellers. That depth means your orders can get absorbed easily without moving the price against you.

On the flip side, trying to push a large order through a low-liquidity market—think a penny stock or an obscure crypto coin—is a recipe for disaster. There just aren’t enough people on the other side to fill your order at a stable price.

Use the Right Tools for the Job

The type of order you use is your direct control lever for managing slippage. As we've covered, your best defense is the limit order. It lets you set the absolute worst price you're willing to accept, putting a hard cap on any potential negative slippage.

You should also think about breaking up your big trades. Instead of dropping one massive order that could rattle the market, split it into several smaller chunks. This technique, often called order splitting, makes your activity less noticeable and allows each piece to get filled with minimal impact. It takes a bit more effort, but it can save you a surprising amount on your execution costs, helping you avoid the classic pitfalls of what is slippage in trading.

Your Questions, Answered

Let's clear up some of the most common questions traders ask about slippage. Getting these answers down will help you handle this market reality with a lot more confidence.

Is Slippage Worse in Crypto or Forex?

Slippage shows up in both markets, but it definitely feels louder in the crypto world. Why? Crypto is famous for its wild volatility and spotty liquidity. Prices can go vertical or fall off a cliff in minutes, and order books on smaller exchanges can be dangerously thin.

The forex market, on the other hand, is the most liquid market on the planet—especially for major pairs like EUR/USD. All that liquidity usually means tighter spreads and less slippage. But don't get too comfortable; when major news hits, even forex can slip and slide.

Can You Get Rid of Slippage Entirely?

The short answer? Nope. Slippage is just part of how markets work. As long as there's a tiny delay—even milliseconds—between when you click "buy" and when your order actually gets filled, the potential for slippage is there.

But you can massively reduce its impact. Using limit orders, sticking to highly liquid assets, and sitting on the sidelines during chaotic news events will protect you from the worst of it. The goal isn't to eliminate it, but to manage it.

A pro trader doesn't try to make slippage disappear. They build a strategy that expects it and accounts for it. It becomes a calculated cost of business, not a nasty surprise.

How Do Top Traders Deal With It?

Great traders bake slippage right into their risk management. They aren't just crossing their fingers for a perfect entry; they're planning for an imperfect one. Here's a look inside their playbook:

- They factor it into position sizing. They might trade slightly smaller, knowing their entry price could be a few ticks off from what they see on screen.

- They set smarter stop-losses. In choppy markets, they might give their stop-loss a little more breathing room to avoid getting kicked out of a good trade by a sudden, slippage-fueled price spike.

- They audit their broker. They constantly review their trade history to see how much slippage is costing them. If the execution is consistently sloppy, they'll find a broker who can do better.

At the end of the day, they understand exactly what slippage is: just another variable that needs to be controlled.

Stop guessing and start trading with data-driven confidence. Strike Price provides real-time probability metrics and smart alerts to help you master options selling and manage your risk effectively. Get the insights you need to turn market variables like slippage into a manageable part of your strategy. Join thousands of traders earning consistent income with Strike Price today.